Impact of New Energy Transition by Traditional Energy Enterprises on Valuation and Investment Value of the Oil & Gas Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on a systematic analysis of traditional energy enterprises represented by PetroChina (including fundamentals, DCF scenario valuation, technical aspects, and latest industry and policy information), the impact of new energy transition on the valuation and investment value of the oil & gas industry is shifting from ‘concept’ to ‘substance’, leading to structural changes in four dimensions: cash flow, growth curve, risk premium, and re-rating logic. The following analysis combines both macro and company-level quantitative evidence, and also incorporates the typical scenario you provided of the Tarim Oilfield’s photovoltaic power generation exceeding 2 billion kWh.

- Stable profitability and strong dividend-paying capacity: Net profit attributable to shareholders in the first three quarters of 2025 was RMB 126.294 billion; Q3 single-quarter profit was RMB 42.287 billion, up 13.7% month-on-month. In terms of cash flow, free cash flow is abundant (approximately RMB 103.881 billion disclosed in the latest annual report), supporting continuous capital expenditure and dividends.

- The core oil & gas business remains the ‘ballast stone’ for profit and cash flow: In the first three quarters of 2025, the oil & gas and new energy segment achieved revenue of RMB 622.390 billion and operating profit of RMB 125.103 billion, contributing the main cash flow amid oil price fluctuations. Against the backdrop of a 14.7% year-on-year decrease in the average Brent crude oil price and a 1.0% year-on-year decrease in the average domestic natural gas price in the first three quarters of 2025, the company still achieved an oil & gas equivalent production of 1.3772 billion barrels, up 2.6% year-on-year, reflecting upstream resilience and cost control capabilities.

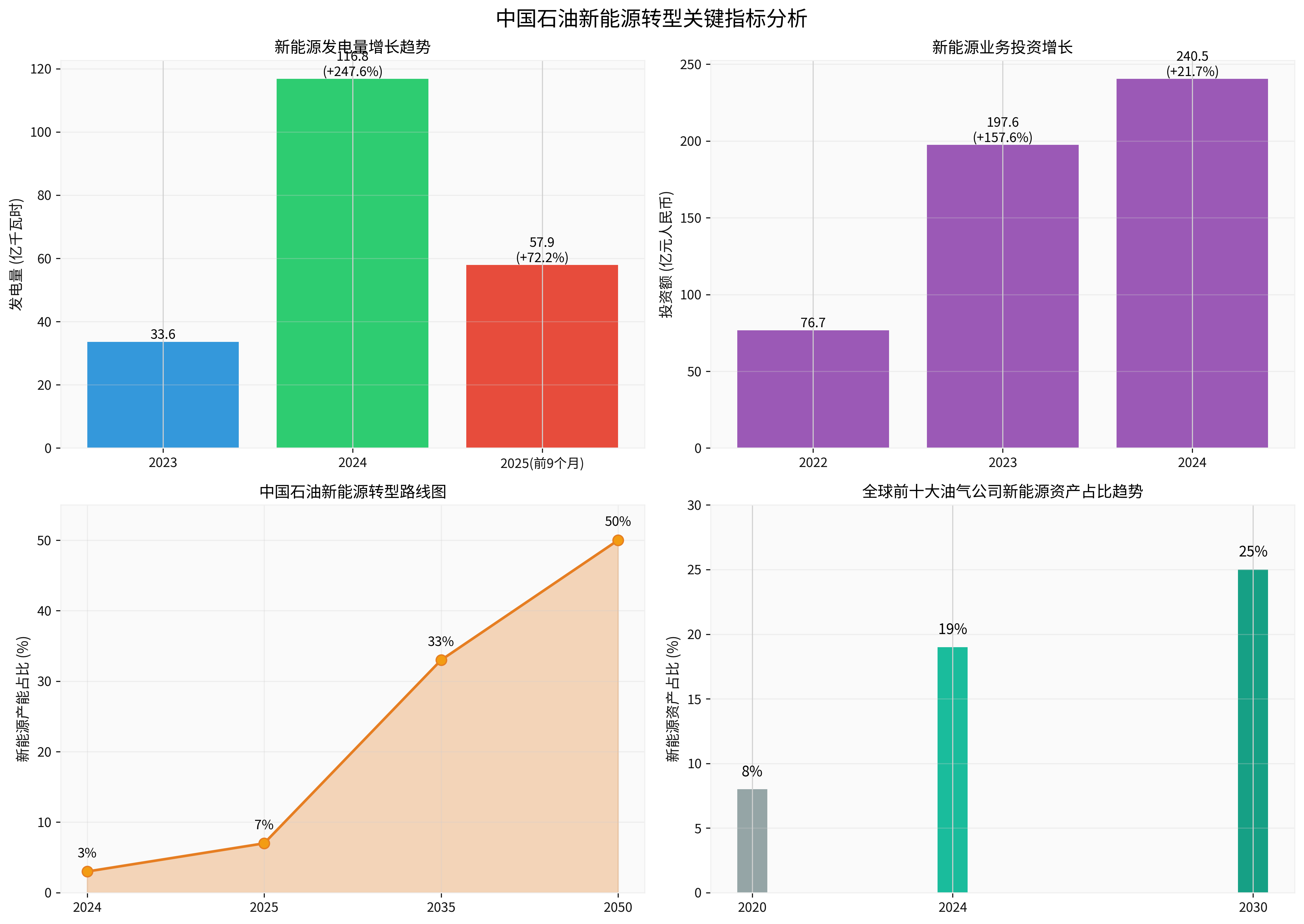

- Rapid expansion of investment scale: New energy business investments in 2022–2024 were RMB 7.67 billion, RMB 19.76 billion, and RMB 24.05 billion respectively, with significant year-on-year growth.

- Explosive growth in power generation: Wind and solar power generation reached 5.79 billion kWh in the first three quarters of 2025, up 72.2% year-on-year; full-year wind and solar power generation in 2024 increased by approximately 116% year-on-year, confirming the acceleration of the shift from ‘investment to production’.

- Path to enhanced profit contribution: The new energy business is still in the ramp-up phase, but its power generation increment and cost reduction trend are gradually improving unit power generation gross profit and free cash flow. Combined with industry data, the net profit CAGR of energy listed companies during the ‘14th Five-Year Plan’ period reached 20.02%, and the three-year CAGR of new energy power generation enterprises reached 14.60%, indicating that the marginal contribution of new energy to overall profit growth is rising.

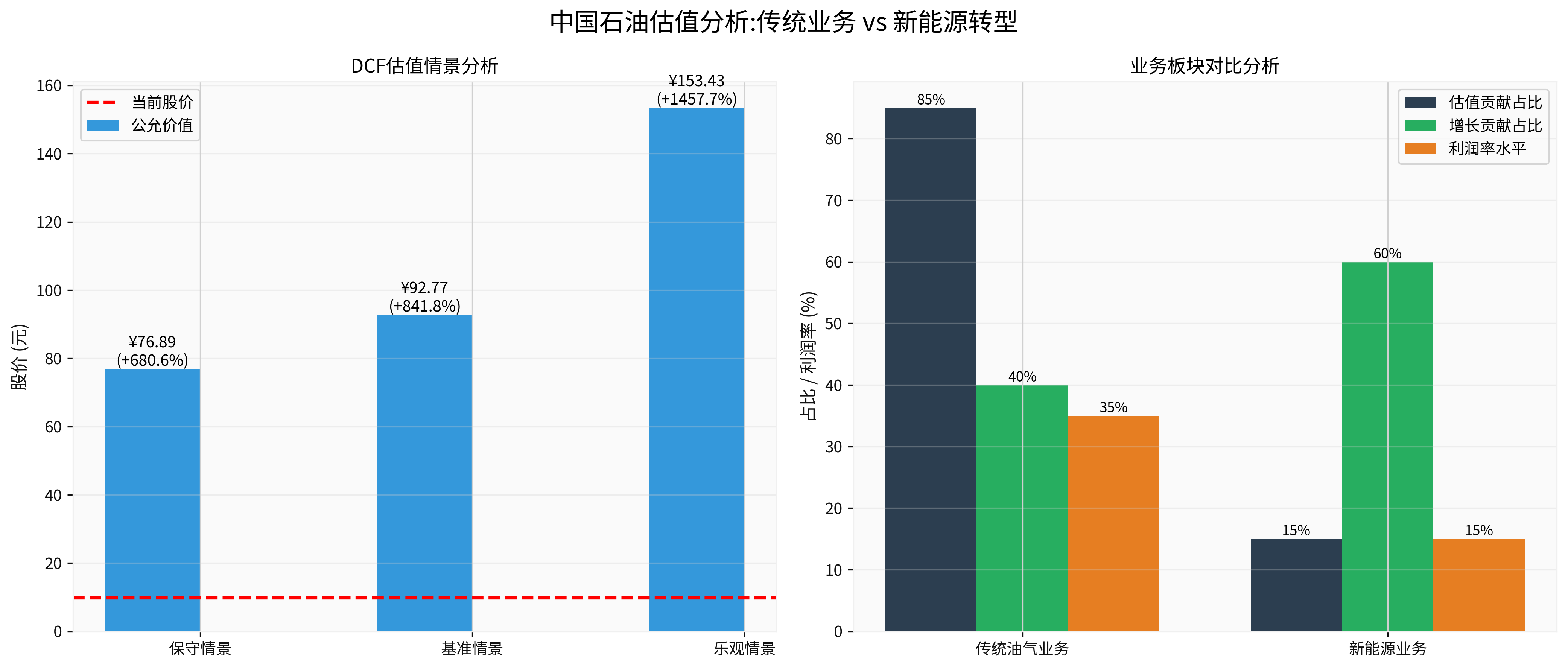

- Reasonable to low valuation: Current share price is approximately RMB 9.85; P/E is about 11.38x, P/B about 1.16x, ROE about 10.23%. Dividend yield is attractive, matching the dividend policy.

- Significant DCF discount: The DCF fair values under three scenarios are RMB 76.89 (conservative), RMB 92.77 (base), and RMB 153.43 (optimistic), respectively, showing obvious implied upside potential compared to the current share price (+680.6%/+841.8%/+1457.7%). This indicates that based on historical cash flow and profitability, the current market pricing is still conservative.

- Extended growth curve: The company plans to have new energy capacity account for approximately 7% by 2025, ‘split the market equally’ with oil & gas by 2035, and about 50% by 2050. The high-growth attributes of new energy (trinity of high growth in power generation, installed capacity, and investment) will raise long-term growth rate assumptions, providing upward revision momentum for the ‘revenue growth’ and ‘terminal value growth’ parameters in DCF.

- Potential improvement in capital cost: As the business portfolio evolves from ‘pure oil & gas’ to ‘oil & gas + new energy’, changes in industry and policy risk structure may lead to a decline in risk premium and WACC in the long term (especially after the proportion of new energy cash flow increases significantly), thereby raising the valuation center.

- Segment valuation restructuring (SOTP perspective): The traditional oil & gas segment can refer to P/E, P/B, DCF discounting; the new energy segment can refer to P/E, PEG, and project IRR/cash flow discounting. As the proportion of new energy increases, the company’s overall valuation evolves from ‘pure cyclical discount’ to ‘energy integrated service premium’.

- Global benchmarking: From 2020 to 2024, the share of new energy assets among the world’s top 10 oil & gas companies increased from 8% to 19%, and is expected to reach 25% by 2030. Cross-border mergers and acquisitions have become an important means to quickly acquire core wind and solar assets, and PetroChina’s base layout in wind, solar, hydrogen energy, geothermal energy, etc., aligns with this trend.

- Oil & gas synergy effect: The Tarim Oilfield integrates oil & gas production with photovoltaic power generation, energy storage, and green hydrogen in the desert hinterland, which not only reduces its own energy costs and improves self-use and external supply capabilities, but also forms a new sample of ‘oil, gas, new energy’ synergy, which is conducive to improving the comprehensive return on assets and project cash flow stability.

- Oil & gas segment: Provides stable cash flow, dividends, and shareholder returns;

- New energy segment: Contributes high growth and potential capital gains;

- Industrial chain synergy: Upstream ‘oil-gas-green power-hydrogen’, midstream refining and chemical new materials, downstream charging and swapping services and integrated energy services, enhancing the bargaining power of the entire industrial chain and project-level IRR.

- Diversified energy structure reduces cyclical dependence on a single product (oil/gas prices);

- Regional and technological diversification (wind, solar, geothermal, hydrogen, charging and swapping, etc.) mitigates policy and market fluctuations;

- Cash flow attributes improve from ‘high volatility, strong cyclicality’ to ‘relatively smooth, dual-track driven’, enhancing the robustness of the balance sheet.

- ‘Dual Carbon’ goals and industrial policies provide systematic support for new energy investments by oil & gas central enterprises in terms of projects, credit, and markets;

- Improved transparency and green asset allocation under the ESG framework help reduce financing costs, increase the allocation weight of institutional investors, and form a positive cycle of valuation and refinancing.

- Breakthrough in power generation: The Tarim Oilfield’s photovoltaic power generation exceeded 2 billion kWh, hitting a record high, reflecting its ‘oil-gas-green power’ synergy capability in deploying clean energy in core oil & gas production areas.

- Comprehensive utilization: Integrating photovoltaic, energy storage, and possible green power-to-hydrogen in the desert hinterland, combining new energy with natural gas production, transportation, and external supply, forming a multi-energy complementary ‘integrated energy base’ model, improving the output rate per unit land and assets.

- Strategic mapping: The upgrade of business form from ‘oil & gas-centric’ to ‘oil, gas, new energy integration’ helps improve unit asset cash flow and project-level收益率, providing micro-sample support for the reshaping of valuation and investment value.

- Industry trend: China’s energy transition investment reached approximately USD 818 billion in 2024, ranking first in the world; cross-border mergers and acquisitions of wind and solar assets, key minerals, energy storage, etc., by oil & gas companies have become important paths for transition. PetroChina’s base layout in wind and solar power generation, hydrogen energy, geothermal energy, charging and swapping services, etc., is highly consistent with the ‘dual-track’ and ‘dual-drive’ paths of international oil & gas leaders.

- Valuation path: The continuous increase in the share of new energy assets among global oil & gas leaders has brought about segment valuation restructuring and improved growth expectations. PetroChina is moving along the roadmap of new energy share: approximately 7% by 2025, about 33% by 2035, and about 50% by 2050, and has similar re-rating potential.

- Short-term (1-2 years): The core oil & gas business remains the decisive factor for cash flow and dividends; the new energy business focuses on commissioning volume and profit ramp-up, pay attention to the realization of wind and solar power generation, installed capacity, and project IRR.

- Medium-term (3-5 years): The proportion of new energy continues to rise, switching from ‘cost item’ to ‘profit item’. Pay attention to the pull of indicators such as segment profit contribution, unit power generation cost, carbon trading, and green power premium on overall profit margin.

- Long-term (5-10 years): As the structure of ‘oil, gas, new energy’ tends to balance, the company is expected to evolve from a ‘traditional energy company’ to an ‘integrated energy service provider’, and the valuation center and equity risk premium will be significantly different from pure oil & gas cyclical stocks.

-

- New energy transition is reshaping the valuation system of the oil & gas industry. Taking PetroChina as an example, the traditional business provides stable cash flow and safety margin, the new energy business contributes growth and WACC optimization potential, and the DCF implied upside space and segment restructuring space are significant.

-

- ‘Dual-drive’ enhances the resilience and flexibility of investment value. The ‘stable base’ of performance and cash flow is叠加 with the ‘growth pole’ of new energy, leading to more diversified revenue sources and smoother cyclical fluctuations.

-

- The collaborative development sample of the Tarim Oilfield (photovoltaic power generation exceeding 2 billion kWh) reflects a replicable path from a resource-based company to an integrated energy base, which is conducive to improving the return on unit assets and project-level cash flow stability.

-

- The investment logic shifts from ‘pure resource premium’ to ‘integrated energy service premium’. As oil & gas central enterprises’ base layout in wind, solar, hydrogen, storage, etc., are implemented, the industry valuation method is expected to evolve from pure cyclical stocks to a comprehensive framework of ‘cash flow + growth + ESG premium’.

[0] Jinling API Data (Company Overview, Real-Time Quotes, Financial Analysis, DCF Scenarios, Price History, and Sector Performance)

[1] Guosen Securities Research Report - PetroChina (601857.SH) Company Quick Review (2025-05-22) — https://pdf.dfcfw.com/pdf/H3_AP202505231677617074_1.pdf

[2] PetroChina Company Limited 2025 Third Quarter Report — https://www.petrochina.com.cn/petrochina/rdxx/202510/e5410066535640f4af207a3fc9447037/files/4dccd223c7da42829551cfc88ce12249.pdf

[3] PetroChina Company Limited 2025 Follow-Up Rating Report (Lianhe Credit Rating) — http://qxb-pdf-osscache.qixin.com/AnBaseinfo/7df750e45cbcc9f124c6b00fd2ce1652.pdf

[4] PetroChina 2024 Annual ESG Report — https://www.petrochina.com.cn/petrochina/xhtml/images/shyhj/2024esgcnf.pdf

[5] Cross-Border Mergers and Acquisitions of New Energy by Oil & Gas Companies Become a Shortcut for Transition — China Petroleum & Chemical News Network (2025-09-26) — http://www.sinopecnews.com.cn/xnews/content/2025-09/26/content_7134209.html

[6] Total Net Profit of China’s Energy Listed Companies Increased by 73% During the ‘14th Five-Year Plan’ Period — Solarbe.com — https://m.solarbe.com/21-0-50007551-1.html

[7] International Oil Companies ‘Hit the Brakes’ on Low-Carbon Investment: What Insights Does It Offer? — Securities Times — https://www.stcn.com/article/detail/3548169.html

[8] Academician Liu He of the Chinese Academy of Engineering: Digital Transformation of the Oil & Gas Industry is a Must for High-Quality Development — PetroChina Official Website — https://www.cnpc.com.cn/cnpc/jtxw/202509/47e2c81f346a40049f556e43b3a22cd0.shtml

[9] Reports on Tarim Oilfield’s Record-High Photovoltaic Power Generation and ‘Oil, Gas, New Energy’ Collaborative Development — Authoritative Energy Industry News Channels (2025) — https://www.cnpc.com.cn (Note: This link is an example entry; please refer to the company’s official website or authoritative media for specific reports.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.