Impact of Zepto IPO on India's Instant Retail Competitive Landscape and Investment Evaluation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

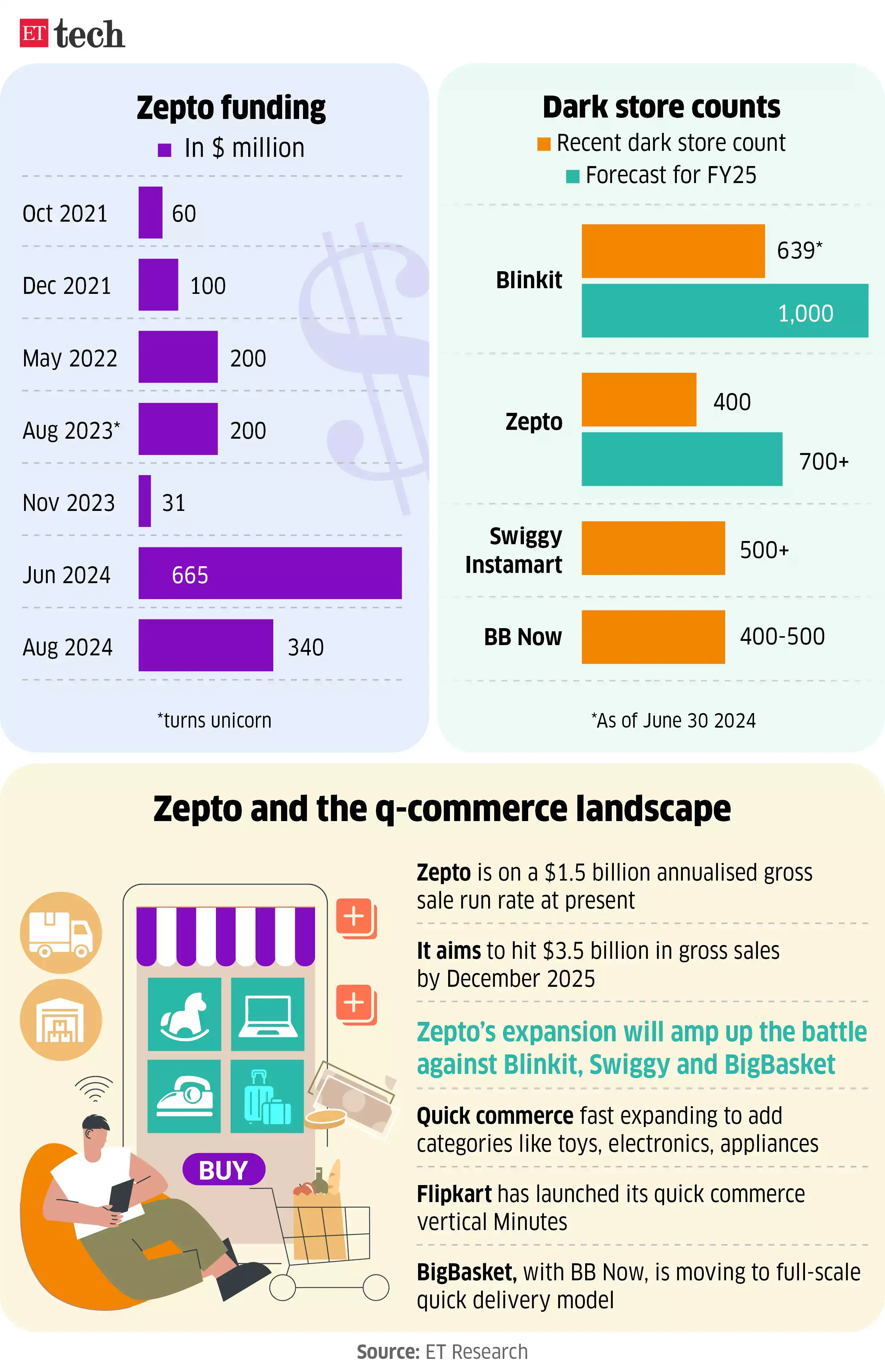

- Valuation and Financing: In the latest financing round in October 2025, it raised $450 million with a valuation of $7 billion; plans to raise approximately ₹116.8 billion (about $1.4 billion) through IPO [1][2].

- Revenue Scale: For the fiscal year ending March 2025, the company’s revenue reached ₹96.7 billion, a year-on-year increase of 129%, maintaining rapid growth [2].

- Listing Path: Adopts a confidential submission framework, providing flexibility for adjusting listing pricing and issuance scale [2].

- Market Share: Blinkit, Zepto, and Swiggy Instamart together account for approximately 88% of the market share [5], with extremely high industry concentration.

- Competition Intensification: IPO brings capital supplementation, which is expected to drive more dark store expansions and category extensions. The three major players continue to “burn money” for growth, leading to fierce competition [3].

- Differentiation Paths:

- Blinkit: Leveraging Zomato’s ecosystem synergy, its Gross Order Value (GOV) has exceeded the main platform’s food delivery business and it was the first to achieve rapid profitability [1][5].

- Swiggy Instamart: As part of a diversified business line, it needs resource balance and has a slower profit rhythm [5][6].

- Zepto: Driven by aggressive expansion and independent financing, it will have more abundant capital after listing, supporting faster network layout and category expansion [2].

- Profit Path Clarity: Leading players have shown signs of profitability (e.g., Blinkit is expected to achieve profitability by March 2026) [5]. The IPO will further strengthen market confidence in the “scale first, then profit” path.

- Capital Expenditure Pressure: Although IPO provides funds, it also means that stricter balance between expansion and profitability is needed in the future to maintain valuation and market recognition.

- Market High-Speed Expansion: India’s instant delivery market size is expected to grow from approximately $6 billion in 2024 to $100 billion by 2030, with a strong compound annual growth rate [5][7].

- Penetration Rate Rapidly Rising: Instant delivery has penetrated 45% of festive shopping and accounts for nearly two-thirds of online grocery orders [11], with consumption habits quickly shifting to “10-minute delivery”.

- Impact on Traditional Retail: Approximately 82% of consumers have shifted at least 25% of their purchases from traditional community stores to instant delivery apps [8], continuously squeezing traditional retail.

- Price-to-Sales Ratio Perspective: Zepto’s latest valuation is approximately $7 billion, with revenue of ₹96.7 billion (about $1.15 billion) in FY2025 (ending March), corresponding to a PS ratio of about 6x [2]. This level matches the industry’s high-growth phase.

- Benchmarking against Listed Companies:

- Swiggy’s post-IPO valuation is approximately $12 billion [6];

- Blinkit under Eternal (Zomato) has strong revenue and growth, boosting the parent company’s stock price to a record high [6].

This provides a comparable anchor for Zepto, but specific pricing needs to consider growth quality, profit realization rhythm, liquidity discount, etc.

- Increased Demand Rigidity: The penetration rate of 10-minute delivery in grocery and emergency scenarios continues to rise, and user habits are shifting from “optional” to “mandatory”.

- Category and Scenario Expansion: Expanding from high-frequency groceries to high-AOV categories (such as 3C, beauty, fashion) opens up new ARPU and gross profit spaces [1][4].

- Technology and Efficiency Driven: Data-driven product selection, path optimization, and warehouse layout will gradually improve the fulfillment cost structure.

- Leading Player Effect: 88% of the market share is occupied by three players, with significant network effects and scale advantages, and the trend of head concentration continues [5].

- Capital and Resource Leverage: IPO strengthens capital ammunition, helping to quickly sink and expand categories, and consolidate the moat.

- High Fixed Costs: Dark store networks and delivery rider systems bring rigid fixed costs, and profit pressure is significant during slow growth phases.

- Normalization of Price Competition: Subsidies and rebates are still indispensable for user acquisition and retention, which may erode gross profits in the short term.

- Divergence in Profit Expectations: There are differences in the market regarding the profit timeline, and some companies may need a longer cycle to achieve break-even [5].

- Amazon and Flipkart: Accelerated entry into the instant delivery market in 2024-2025, relying on e-commerce and supply chain advantages, which may reshape the competitive pattern [12][14].

- Upgrade of Competition Dimensions: From “fast” to “more” and “economical”, competing on supply chain depth and product selection breadth requires higher cost structures and capital strength.

- Rider Welfare and Regulation: The compliance of the gig economy is becoming stricter, and rising labor costs may erode the profits of the fulfillment model [1].

- Data and Privacy: High-frequency location and transaction data face stricter compliance requirements.

- High Valuation Dependent on Growth: Valuation levels are sensitive to growth rates; if growth slows or market sentiment weakens, there is a risk of correction.

- Liquidity Discount: New stocks may be more volatile in the early stages, so short-term discounts due to insufficient liquidity need to be considered.

- Short-Term Perspective: Focus on IPO pricing and first-day trading performance, as well as valuation premiums/discounts compared to comparable companies.

- Long-Term Perspective: Pay attention to:

- Profit realization ability (e.g., EBITDA positive timeline and single-store model optimization);

- Category expansion and repurchase improvement;

- Differentiated strategies to respond to Amazon/Flipkart entry.

- Risk Hedging: It is recommended to diversify allocations, cover the three leading companies, avoid single bets, and dynamically adjust positions based on quarterly financial reports and industry data.

[1] 金灵API数据

[2] TechCrunch - “Zepto raises $450 million at $7 billion valuation as Indian quick commerce market heats up” (https://techcrunch.com/2025/10/16/zepto-raises-450-million-at-7-billion-valuation-as-indian-quick-commerce-market-heats-up/)

[3] CNBC - “India’s Zepto files for IPO as quick-commerce race heats up” (https://www.cnbc.com/2025/12/27/indias-zepto-files-for-ipo-as-quick-commerce-race-heats-up.html)

[4] Yahoo Finance/Retail Insight Network - “Zepto prepares confidential IPO filing to raise about Rs116.8bn – report” (https://finance.yahoo.com/news/zepto-prepares-confidential-ipo-filing-122816881.html)

[5] Bloomberg - “India’s E-Commerce Stocks Outrun Chinese Peers on Profit …” (https://www.bloomberg.com/news/articles/2025-07-03/india-s-e-commerce-stocks-outrun-chinese-peers-on-profit-hopes)

[6] Bloomberg - “World’s Fastest Deliveries Ignite an Investment Frenzy in …” (https://www.bloomberg.com/features/2025-India-instant-shopping/)

[7] Bloomberg - “Ashmore’s $2.3 Billion Money Manager Counts on Indian …” (https://www.bloomberg.com/news/articles/2025-12-03/nykaa-swiggy-among-bets-as-ashmore-money-manager-counts-on-indian-working-women)

[8] Bloomberg - “DMart Hit as Indian Grocers Face Risks From Rapid …” (https://www.bloomberg.com/news/articles/2025-01-13/dmart-slips-on-profit-miss-as-discounts-rapid-deliveries-hurt)

[9] Yahoo Finance - “India’s quick-commerce growth may struggle: Blume report” (https://sg.finance.yahoo.com/news/indias-quick-commerce-sector-may-104502703.html)

[10] Yahoo Finance - “Eternal Limited (ETERNAL.BO) Q1 24/25 earnings call …” (https://finance.yahoo.com/quote/ETERNAL.BO/earnings/ETERNAL.BO-Q1-2025-earnings_call-194185.html/)

[11] MediaNews4U - “Quick Commerce powers 45% of festive purchases this year: WPP-Meta Consumer Report” (https://www.medianews4u.com/quick-commerce-powers-45-of-festive-purchases-this-year-wpp-meta-consumer-report/)

[12] Asian Business Review - “India’s e-commerce market to hit $211.6b in 2025” (https://asianbusinessreview.com/in-focus/indias-e-commerce-market-hit-2116b-in-2025)

[13] TechCrunch - “SoftBank stays in as Meesho $606M IPO becomes India’s first major e-commerce listing” (https://techcrunch.com/2025/11/28/softbank-stays-in-as-meesho-606m-ipo-becomes-india-s-first-major-e-commerce-listing/)

[14] Yahoo Finance - “KNOT Raises $5M Round Led by 12 Flags, within 3 …” (https://finance.yahoo.com/news/knot-raises-5m-round-led-073500681.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.