Evaluation of the Performance Boost Effect of Strong Inbound Tourism Growth on A-share Aviation and Tourism Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

In 2025, China’s inbound tourism market showed a strong recovery trend, with multiple indicators hitting historical records:

| Core Indicator | Data Performance | Year-on-Year Growth |

|---|---|---|

| First 8 months inbound tourists | Over 25 million | +50%+ [1] |

| Visa-free inbound tourists | 21 million | +50% [1] |

| Full-year estimated inbound tourists | Over 35 million | Historical record [1] |

| Ctrip inbound tourist volume | - | Doubled (+100%+) [1] |

| US tourists’ consumption growth | - | +50% [1] |

| French tourists’ consumption growth | - | +160% [1] |

China continues to expand its ‘visa-free circle of friends’. As of 2025,

Spanish tourists’ domestic flight bookings reached

- Italian tourists’ bookings reached 4xlast year’s level

- Shanghai received over 6 millioninbound tourists, a significant increase from 2024 [1]

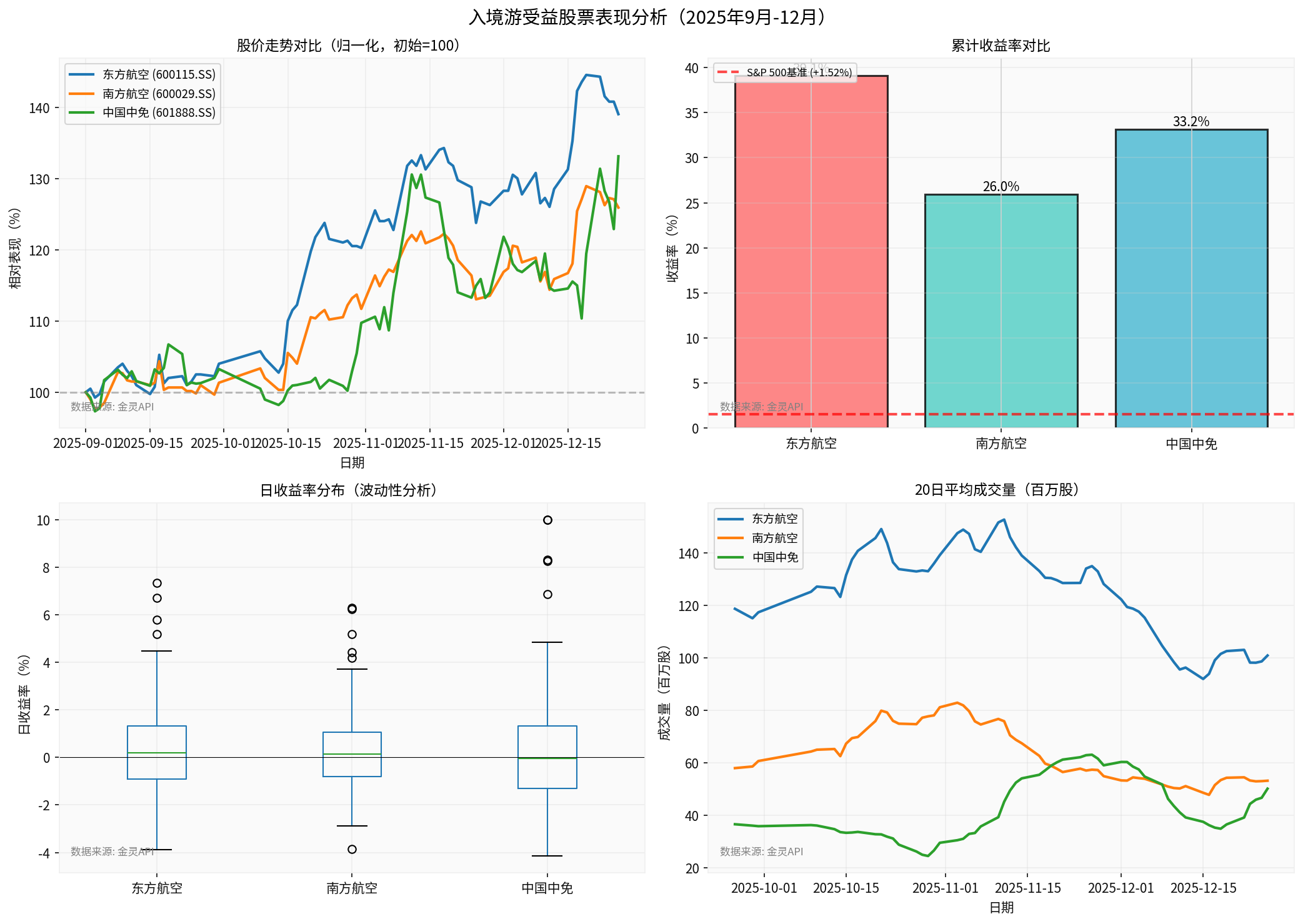

- Top Right: Cumulative return comparison, with China Eastern Airlines leading at +39.1%

- Bottom Left: Box plot of daily return distribution, showing China Duty Free with the highest volatility (2.94% daily average)

- Bottom Right: 20-day average trading volume change, reflecting market capital attention

| Stock Code | Company Name | Period Return | Latest Price | Volatility (Daily Avg) |

|---|---|---|---|---|

| 600115.SS | China Eastern Airlines | +39.10% |

$5.55 | 2.06% [0] |

| 601888.SS | China Duty Free | +33.17% |

$92.30 | 2.94% [0] |

| 600029.SS | China Southern Airlines | +25.96% |

$7.52 | 1.87% [0] |

600138.SS |

China Youth Travel Service | +0.90% | $10.04 | 1.00% [0] |

| UTour Group | -2.43% | $7.23 | 1.42% [0] |

Assume investing 100,000 yuan in early September 2025:-

- China Duty Free: 100,000 yuan →133,200 yuan (profit:33,200 yuan) [0]

- China Southern Airlines:100,000 yuan→126,000 yuan (profit:26,000 yuan) [0]

- Passenger Load Factor Improvement: Inbound tourist growth directly boosts international route load factors, especially Europe-China routes (Spanish/Italian tourists surge)

- Ticket Price Elasticity: Average international route ticket prices are much higher than domestic routes; inbound tourists bring high-end customers that raise overall ticket levels

- Route Network Optimization: Major airlines accelerate recovery and addition of international routes to improve network efficiency

- International Route Revenue Share: China Eastern and China Southern Airlines usually have 20-30% international route revenue share

- Inbound Tourist Spending Power: European tourists (Spanish/Italian) have average unit price 2-3x that of ordinary tourists

- Perfect international route network layout, high share of European routes

-突出 Shanghai hub position, benefiting from Shanghai’s inbound tourist growth (over 6 million) [1] - Flexible capacity deployment strategy, quick response to inbound tourism demand

- Duty Free Consumption Rigidity: Inbound tourists have significant spending power at airport and downtown duty free stores

- Consumption Upgrade Trend: French tourists’ consumption up +160%, US tourists up +50% [1], reflecting high-end consumption recovery

- Strong Free Cash Flow: 2024 free cash flow reached 6.82 billion yuan, healthy finances [0]

- UTour Group (002707.SZ): Down -2.43%; high share of outbound tourism business, weak correlation with inbound tourism

| Evaluation Dimension | Key Indicators | Weight |

|---|---|---|

Inbound Tourism Exposure |

International route revenue share, overseas tourist source share | 30% |

Policy Sensitivity |

Visa-free policy benefit level, hub city layout | 25% |

Financial Elasticity |

Gross margin improvement potential, free cash flow quality | 25% |

Market Performance |

Relative return, volatility, trading volume change | 20% |

- China Eastern Airlines: Highest overall score (high international route share + Shanghai hub + strong policy sensitivity)

- China Duty Free: Largest consumption elasticity (duty free consumption + strong cash flow)

- China Southern Airlines: Steady beneficiary (Guangzhou hub + international route recovery)

- Continued Expansion of Visa-free Policy: More countries join visa-free list

- 2026 Spring Festival Holiday: Performance verification from inbound tourism peak

- International Route Recovery Rate: Currently at 70-80% of pre-pandemic levels, still room for improvement

- International Oil Price Fluctuations: Affect airline costs

- Exchange Rate Fluctuations: RMB exchange rate changes affect inbound tourists’ actual spending power

- Geopolitical Factors: E.g., Sino-Japanese relations tension affected Japanese tourist arrivals (November growth dropped to +3%) [2]

- Stock Price Performance Verification: Major beneficiary stocks rose by 25-39% from September to December 2025, significantly outperforming global markets

- Clear Performance Driver: Inbound tourist count up +50%+ YoY, strong spending power (French/US tourists up +50-160%)

- Strong Policy Continuity: Visa-free policy remains core driver; expected to expand further in 2026

- ✅ Perfect International Route Layout: Dominant European routes, directly benefiting from Spanish/Italian tourist surge

- ✅ Shanghai Hub Advantage: Shanghai received over 6 million inbound tourists, accounting for a significant share of national total

- ✅ Leading Growth: +39.10% period return, verifying market expectations

- ✅ Strongest Consumption Elasticity: Inbound tourists’ spending power increase directly benefits duty free business

- ✅ Healthy Finances: 6.8 billion yuan free cash flow, low debt risk [0]

- ✅ Steady Growth: +33.17% period return, high volatility but attractive returns

- ✅ Steady Beneficiary: Guangzhou hub + international route network

- ⚠️ Relatively Moderate Growth: +25.96% period return, relatively conservative market expectations

- Verification of inbound tourism growth sustainability (track Q1 2026 data)

- Impact of international oil prices and exchange rate fluctuations on airline costs

- Potential impact of global macroeconomic slowdown on international tourism demand

[0] Gilin API Data - Stock Price, Financial Data, Market Index

[1] Tourism-Review - “China’s Inbound Tourism Has Been Booming: Not Just About Money” (https://www.tourism-review.com/chinas-inbound-tourism-has-been-booming-news15224)

[2] Reuters - “Japan Visitor Arrivals Growth Strong in November Despite China Travel Warning” (https://www.reuters.com/world/china/urgent-japan-visitor-arrivals-growth-strong-november-despite-china-travel-2025-12-17/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.