Investment Risk Assessment Analysis of Banu Hot Pot IPO

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected data and market information, I provide you with a comprehensive investment risk assessment analysis of Banu Hot Pot’s IPO:

According to market data, the Hong Kong IPO market from 2024 to 2025 showed an obvious characteristic of

- Yujian Xiaomian(2408.HK) saw a cumulative share price drop of about 30% after listing [1]

- The market generally has low valuation multiples for traditional catering enterprises

From the perspective of peer enterprise valuation, Banu faces the dilemma of choosing a valuation reference system:

| Company | Market Capitalization | P/E | ROE | YTD Share Price Performance |

|---|---|---|---|---|

| Haidilao (6862.HK) | 79.11 billion USD | 16.35x | 44.26% | +4.51%[0] |

| Jiu Mao Jiu (9922.HK) | 2.5 billion USD | 55.42x | 1.40% | -68.49%[0] |

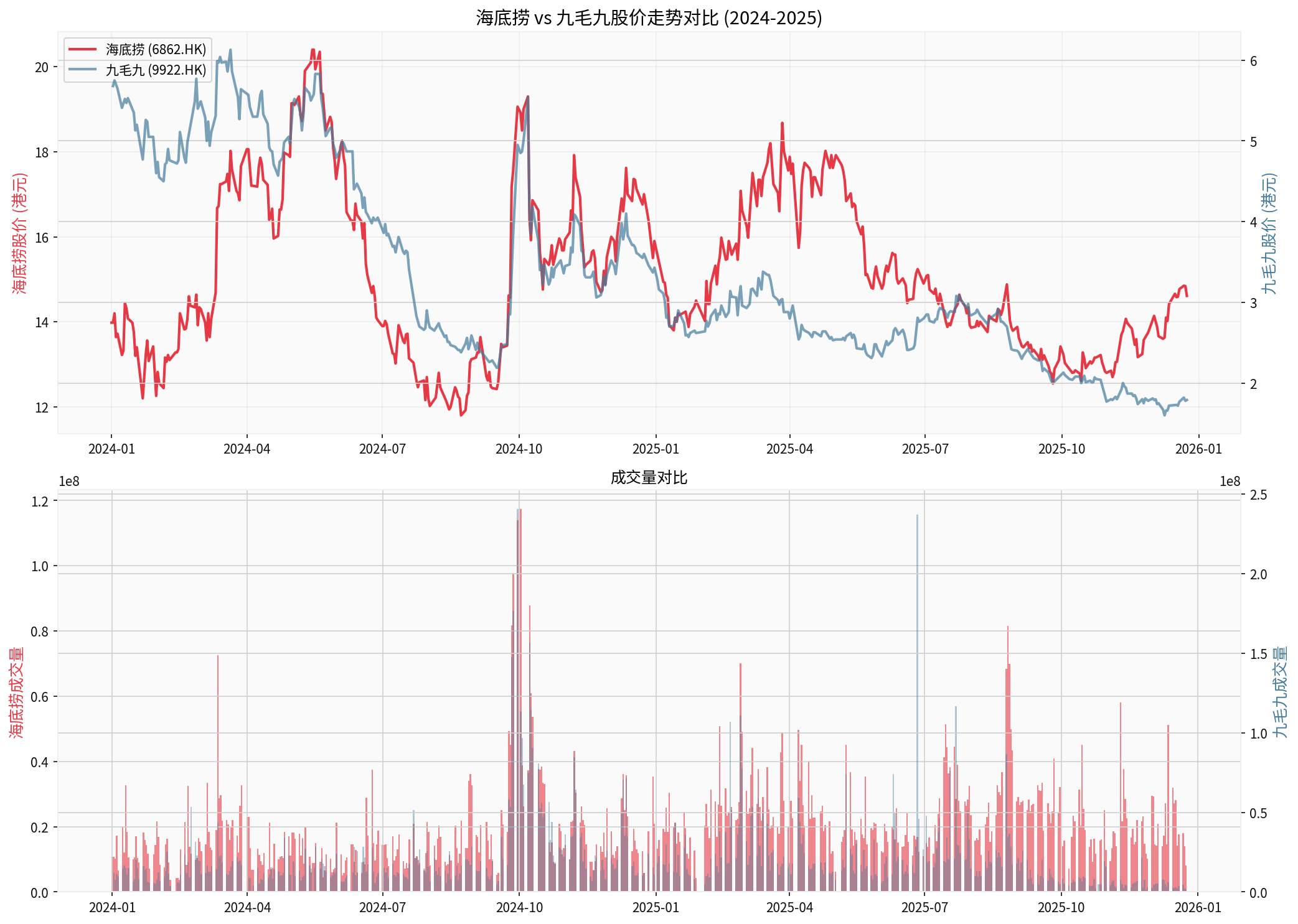

As an industry leader, Haidilao demonstrates stable profitability with a P/E ratio of 16.35x and ROE of 44.26% [0]. Although Jiu Mao Jiu has a high P/E ratio of 55.42x, its ROE is only 1.40%, and its share price plummeted by 68.49% during 2024-2025 [0], reflecting the market’s cautious attitude towards catering enterprises with high valuation but low profitability.

The chart shows: Haidilao (red line) rose from HK$13.98 to HK$14.61 during 2024-2025, an increase of 4.51%; while Jiu Mao Jiu (blue line) plummeted from HK$5.68 to HK$1.79, a drop of up to 68.49%. Jiu Mao Jiu’s volatility (64.90%) is also significantly higher than Haidilao’s (44.76%) [0].

- Social Security Arrears Issue: A common compliance challenge in the catering industry

- Complexity of Equity Structure: May affect the transparency of corporate governance

- Reasonableness of Large Dividends: Need to balance shareholder returns and capital needs for business expansion

Banu has successfully established a differentiated positioning through its signature combination of

- Average customer spend is 138 yuan, about 40% higher than Haidilao’s (about 97.5 yuan) [1]

- The mental perception of “Go to Banu for tripe” has been initially established

However, the high-end positioning faces severe challenges:

- Continuous Decline in Average Customer Spend: Dropped from 142 yuan in the same period last year to 138 yuan (a 2.8% decrease) [1]

- Average customer spend dropped by 5.3% in the first quarter, although it improved later, the trend is still worrying [1]

- In the context of increasingly conservative consumers, extending the price range downward has become an inevitable choice

There is an obvious contradiction between the ambitious expansion plan in the prospectus and actual operations:

- Plan: Open 177 new stores in the next 3 years, with a net increase of over 60 stores per year from 2027 to 2028 [1]

- Reality: Closed multiple stores from the end of 2024 to early 2025, reducing the total number from 156 to 145 [1]

- Current Status: As of September 2025, there are only 162 stores, with a net increase of only 17 stores (3.8% growth) in the past 9 months [1]

This contradiction of

Highlights of data for the first 9 months of 2024:

- Revenue of 2.08 billion yuan, a year-on-year increase of 24.6%

- Table Turnover Rate Increased: From 3.1 times/day to 3.6 times/day

- Same-store Sales Growth of 4.3%(-9.9% for the full year of 2024)

- Restaurant Profit MarginIncreased from 21% to 24.3%

- Net Profit of 156 million yuan, a year-on-year increase of 58% [1]

But the key issues are:

- Revenue growth (24.6%) is far higher than store growth (3.8%), mainly relying on same-store efficiency improvement

- This growth model is unsustainablein the current consumption environment

- Revenue growth in third-tier and lower cities is only 13%, far lower than the 23%+ in first and second-tier cities, indicating difficulties in expanding into the sinking market [1]

- 52 stores are located in Henan, accounting for about 1/3 of the total [1]

- First and second-tier cities contribute 80% of revenue and are the main growth drivers

- Same-store sales growth in third-tier cities is only 2%, with poor expansion results

- Over-reliance on the Henan base, weak risk resistance capability

- Expanding outward faces localized competition challenges

- The acceptance of high-end positioning in the sinking market is questionable

| Risk Category | Risk Level | Key Issues |

|---|---|---|

| Valuation Risk | ⚠️⚠️⚠️ High | Poor peer performance, valuation reference system failure |

| Consumption Downgrade Risk | ⚠️⚠️⚠️ High | Continuous decline in average customer spend, high-end positioning under pressure |

| Expansion Risk | ⚠️⚠️ Medium-High | Contradiction between plan and reality, difficulty in sinking |

| Regional Concentration Risk | ⚠️⚠️ Medium | Over-reliance on Henan market |

| Compliance Risk | ⚠️⚠️ Medium | CSRC concerns to be resolved |

-

Short-term (0-6 months):Recommendcautious wait-and-see

- Hong Kong market has low interest in catering IPOs

- CSRC’s “Nine Questions” need to be properly resolved

- Can pay attention to the risk of breaking on the first day of listing

-

Medium-term (6-12 months):

- Core Observation Indicators:

- Whether the average customer spend can stop falling and rebound

- Whether the 2025 store opening target (52 stores) can be achieved

- Profitability of stores outside Henan Province

- Sustainability of same-store sales growth

-

Long-term Value Assessment:

- If it can maintain a table turnover rate of 3.5+ and average customer spend stable above 135 yuan

- Successfully replicate the model to second and third-tier cities

- Recommend to consider entering after market sentiment warms up

[1] Yahoo Finance - “Market Prioritizes Tech Over Catering, Banu Faces Pressure to List” (December 2025)

[2] Yahoo Finance - “Mainland’s ‘Hermès of Hot Pot’ Banu to List in Hong Kong”

[0] Jinling API Data (Company Overview, Share Price Data)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.