Impact of Tirzepatide Price Reduction and Inclusion in Medical Insurance on China's GLP-1 Market and Investment Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on brokerage API data and market analysis, I will provide a comprehensive analysis of the far-reaching impact of Tirzepatide’s price reduction and inclusion in medical insurance on China’s GLP-1 market.

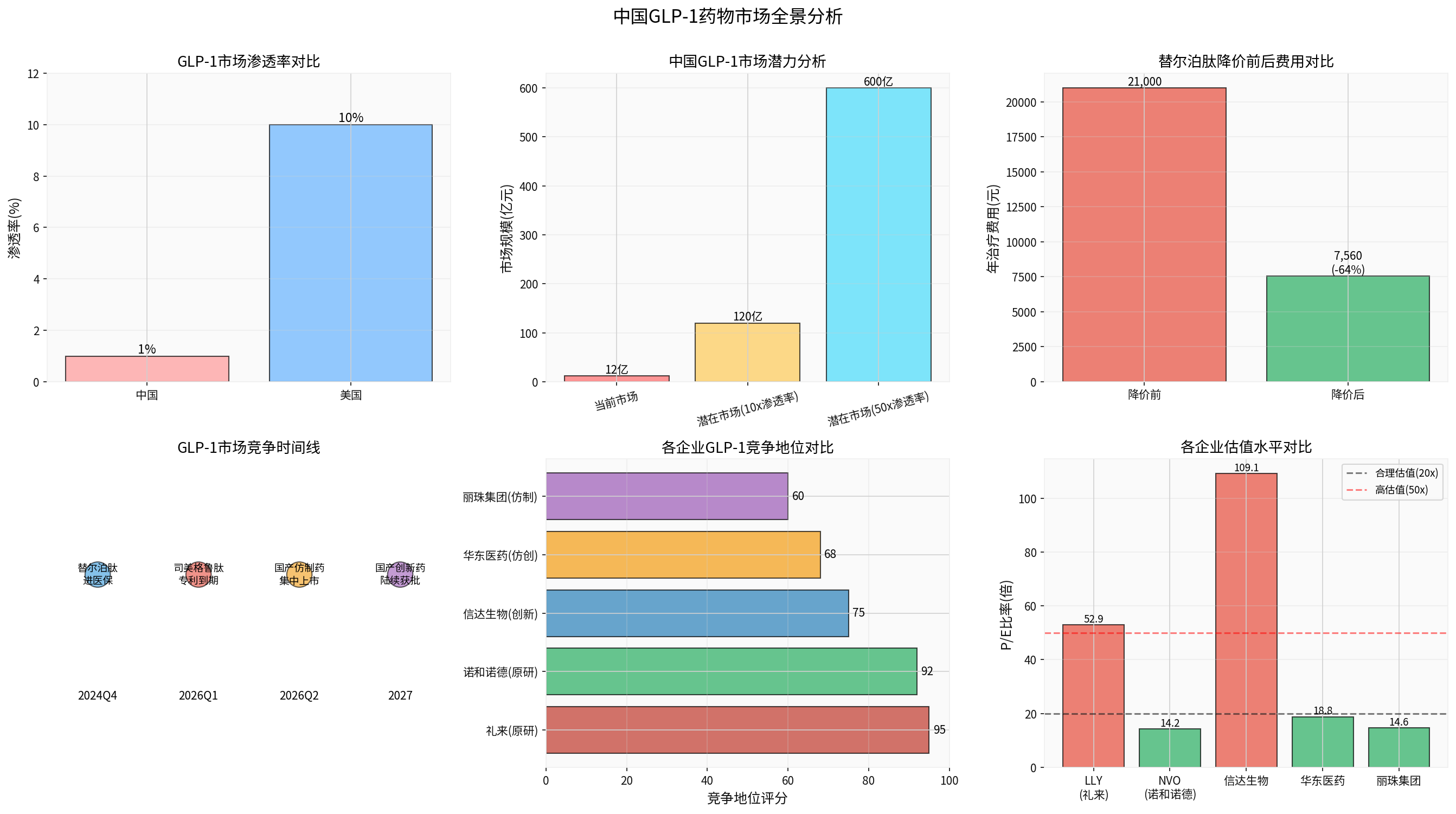

- Before Price Reduction: Tirzepatide’s monthly in-hospital cost was 1,700-1,800 yuan, annual cost about 21,000 yuan, belonging to the high-end self-paid market

- After Price Reduction: Monthly in-hospital cost dropped to 324-936 yuan, annual cost about 3,900-11,200 yuan, with a price reduction range of 64-70%[0]

This price reduction range repositioned GLP-1 drugs from “luxury goods” to “mass medical care”, directly entering the core of China’s medical insurance payment system. From market data, this pricing strategy will greatly enhance accessibility.

- Current Status: China’s GLP-1 market penetration rate is only 1%, with a market size of approximately 1.2 billion yuan

- Benchmarking against the US: The US market penetration rate reaches 10%

- Growth Potential: If the penetration rate increases to 10%, the market size will expand to 12 billion yuan; if it reaches 50% (considering China’s larger base of diabetes and obesity patients), the potential market size can exceed 60 billion yuan

- Chinese diabetes patients: 141 million

- Obese population: about 230 million

- Total target patients: over 370 million

This means that even if the penetration rate only increases to 5%, it will benefit more than 18.5 million patients, and the market size will approach 60 billion yuan.

According to market trend analysis, the competitive situation over the next three years is clear:

- Tirzepatide enters the market through medical insurance negotiations and gains first-mover advantage

- Novo Nordisk’s Semaglutide has not yet entered medical insurance and is at a competitive disadvantage

- The core compound patent of Semaglutide will expire in March 2026

- Domestic generic drug companies (Huadong Medicine, Livzon Group, etc.) are ready to go

- Semaglutide generics from multiple domestic pharmaceutical companies will be approved in batches

- The market enters the price competition stage

- Differentiated products such as long-acting preparations and oral preparations of domestic innovative drugs (Innovent Biologics, etc.) will be launched one after another

- Market stratification: Original research drugs, generic drugs, and innovative drugs stand in a tripartite confrontation

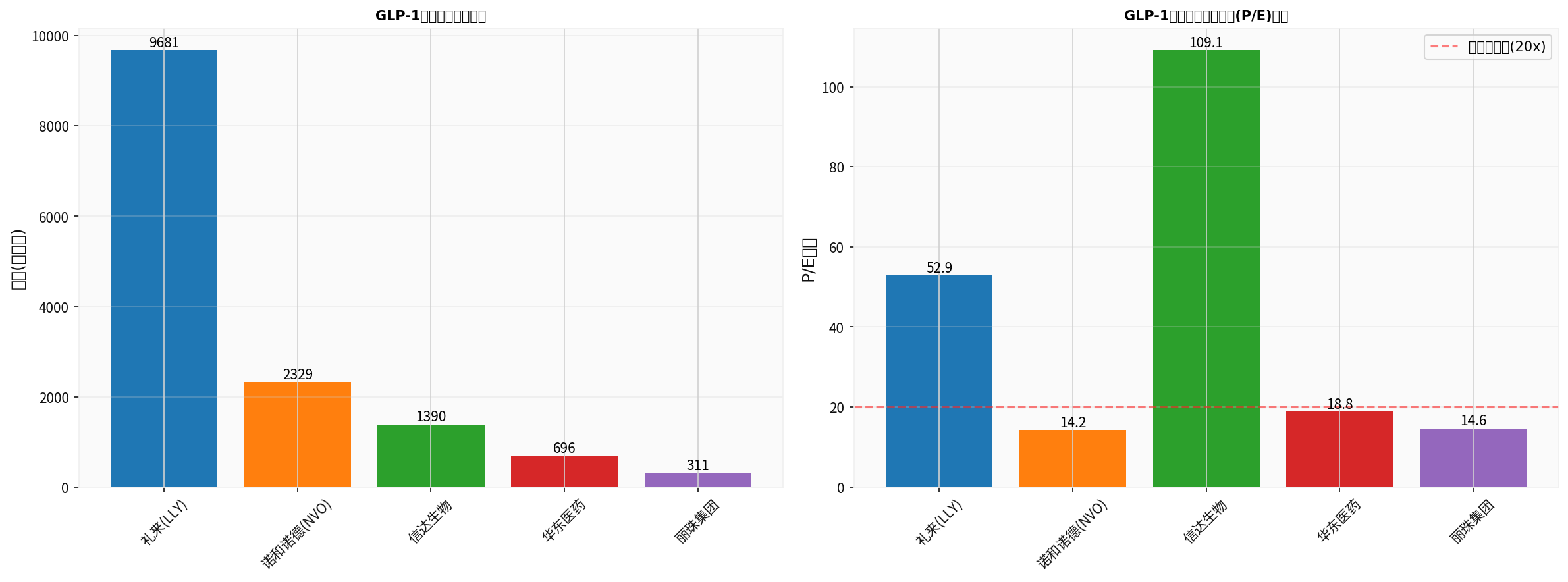

- Current Market Value: 968.1 billion USD (about 6.7 trillion RMB) [0]

- P/E Ratio: 52.91x, at a high level but reflects high growth expectations [0]

- 2025 Performance: Stock price rose by 38.52%, market value increased significantly [0]

- Investment Logic:

- Tirzepatide’s price reduction and inclusion in medical insurance is a classic strategy of “trading price for volume”

- Tirzepatide’s sales in the first three quarters of 2025 were 24.837 billion USD, a year-on-year increase of 125%

- The Chinese market accounts for only 3.7% of Eli Lilly’s total revenue (about 1.66 billion USD), with huge growth space

- Although the price reduction sacrifices short-term profit margins, it will achieve long-term value through market share expansion

- Risk Points: P/E ratio exceeds 50x, valuation has fully reflected growth expectations; Chinese medical insurance negotiation prices significantly lower than expected may compress profit margins

- Current Market Value: 232.9 billion USD (about 1.6 trillion RMB) [0]

- P/E Ratio:14.24x, valuation is significantly lower than Eli Lilly [0]

- 2025 Performance: Stock price fell by 40.13%, under obvious pressure [0]

- Investment Logic:

- Semaglutide’s patent is about to expire, facing the impact of generic drugs

- Price reduction pressure forces Novo Nordisk to accelerate the development of next-generation products

- Current valuation is low, which may have partially reflected negative factors

- Risk Points: After the patent expires in 2026, market share may be eroded by generic drugs; new innovative products are needed to maintain growth

- Current Market Value:138.95 billion HKD (about 126 billion RMB) [0]

- P/E Ratio:109.12x, valuation is at an extremely high level [0]

- Stock Price Range: 52-week range 28.65-109.10 HKD, with large fluctuations [0]

- Rich GLP-1 innovative drug pipeline; Mazdutide (similar mechanism to Tirzepatide), co-developed with Eli Lilly, has entered Phase III clinical trials

- The logic of domestic substitution is clear, and it is expected to seize market share after the patent cliff

- Strong technical platform capabilities; in addition to GLP-1, there are multi-pipeline layouts in oncology, autoimmune diseases, etc.

- P/E ratio exceeds 100x, valuation has fully reflected future growth expectations

- Free cash flow is negative (-418 million HKD), still in the high investment period [0]

- Products have not yet been commercialized, with risks of R&D failure and approval risks

- Current Market Value:69.63 billion RMB [0]

- P/E Ratio:18.82x, valuation is in a reasonable range [0]

- Investment Logic:

- Semaglutide generic drug progress is leading, and listing application has been submitted

- In addition to GLP-1, the company also has layouts in medical aesthetics, oncology and other fields

- Industrial and commercial synergy, obvious channel advantages

- Investment Advice: Medium-low risk stable target. The logic of generic drugs is clear, valuation is reasonable, suitable for allocation by stable investors

- Current Market Value:31.1 billion RMB [0]

- P/E Ratio:14.64x, valuation is at a low level [0]

- Investment Logic:

- Semaglutide generic drug R&D progress is fast

- Traditional businesses such as gonadotropins and digestive tract drugs are stable

- Abundant cash flow, high dividend yield

- Investment Advice: Low-risk stable target. Low valuation, diversified business; GLP-1 generic drug is an additional growth point rather than core dependence

- LLY: Although the valuation is high, the volume growth in the Chinese market and global growth can support the stock price

- Key Indicators: China region sales data, medical insurance volume growth rate, global Tirzepatide sales growth

- Huadong Medicine (000963.SZ): Leading generic drug progress, reasonable valuation

- Livzon Group (000513.SZ): Low valuation stable target

- Risk Tips: Fierce price competition for generic drugs, gross profit margin may be lower than expected

- Innovent Biologics (1801.HK): High-risk high-return, focus on clinical data

- Key Focus Areas: Innovative paths such as GLP-1/GIP dual targets, oral preparations, long-acting preparations

- If the impact of generic drugs in 2026 is smaller than expected, NVO has room for valuation repair

- Need to focus on the R&D progress of next-generation innovative products

- Price Reduction Exceeds Expectations: Future medical insurance negotiations may require further price reductions

- Increased Competition: Price wars after generic drug launches may compress profit margins

- Regulatory Risks: Safety supervision of GLP-1 drugs may become stricter

- Eli Lilly (LLY): Overvalued; if volume growth in China is less than expected, it may face a correction

- Innovent Biologics: Products not commercialized, negative cash flow, with R&D risks

- Generic Drug Enterprises: Risks of price reduction in centralized procurement, approval progress risks

- Technological Substitution: Next-generation weight-loss drugs (such as triple-target drugs) may quickly replace GLP-1

- Over-high Market Expectations: Current valuation has partially reflected future growth; if actual penetration rate is lower than expected, it may trigger valuation regression

Tirzepatide’s 70% price reduction and inclusion in medical insurance marks a strategic turning point for China’s GLP-1 market from “high-end self-paid” to “medical insurance inclusive”. This move will:

- Short-term(2024-2025): Eli Lilly enjoys first-mover advantage, seizes market share through price-for-volume

- Medium-term(2026): Generic drug launches bring price competition, market expands rapidly

- Long-term(2027+): Domestic innovative drugs seize mid-to-high-end market through differentiated competition

- First Choice: Huadong Medicine (000963.SZ), P/E ratio of18.82x, clear generic drug logic

- Second Choice: Livzon Group (000513.SZ), P/E ratio of14.64x, low valuation and diversification

- Allocation: LLY, enjoy the growth dividend of the global GLP-1 market

- Observation: NVO, wait for the valuation repair opportunity after patent expiration

- Target: Innovent Biologics (1801.HK), P/E ratio of109.12x, bet on domestic innovative drug breakthroughs

- Risk Tips: Need to bear large fluctuations and R&D failure risks

- Tirzepatide’s China region sales data (starting from Q1 2025)

- Semaglutide generic drug approval progress (Q1-Q2 2026)

- Innovent Biologics’ Mazdutide Phase III clinical data (2025-2026)

- China’s overall GLP-1 market penetration rate change trend

[0] Gilin API Data - Includes real-time stock prices, market values, financial data and technical analysis of Eli Lilly (LLY), Novo Nordisk (NVO), Innovent Biologics (1801.HK), Huadong Medicine (000963.SZ), Livzon Group (000513.SZ)

[1] Background Information Provided by Users - Tirzepatide’s70% price reduction and inclusion in medical insurance, Semaglutide’s patent expiration in March2026, China’s GLP-1 market penetration rate, etc.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.