Analysis of Xiaomi's High-End Strategy Sustainability and Impact Assessment on Hong Kong Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and analysis, I will provide you with a comprehensive analysis report on the sustainability of Xiaomi’s high-end strategy and its impact on Hong Kong stocks.

According to the latest market information, the market performance of Xiaomi 17 Ultra Leica Edition shows the following characteristics:

- Booming Pre-sales: Sold out across all channels within hours, with JD.com pre-order volume exceeding one million [Context]

- Improved Premium Capacity: The top configuration version was resold at 20,000 yuan on second-hand platforms (official price starts at 8999 yuan), with a premium rate of 122% [Context]

- Brand Value Manifestation: In-depth cooperation with Leica and multiple intellectual property applications for the Ultra series indicate the construction of a technical moat [Context]

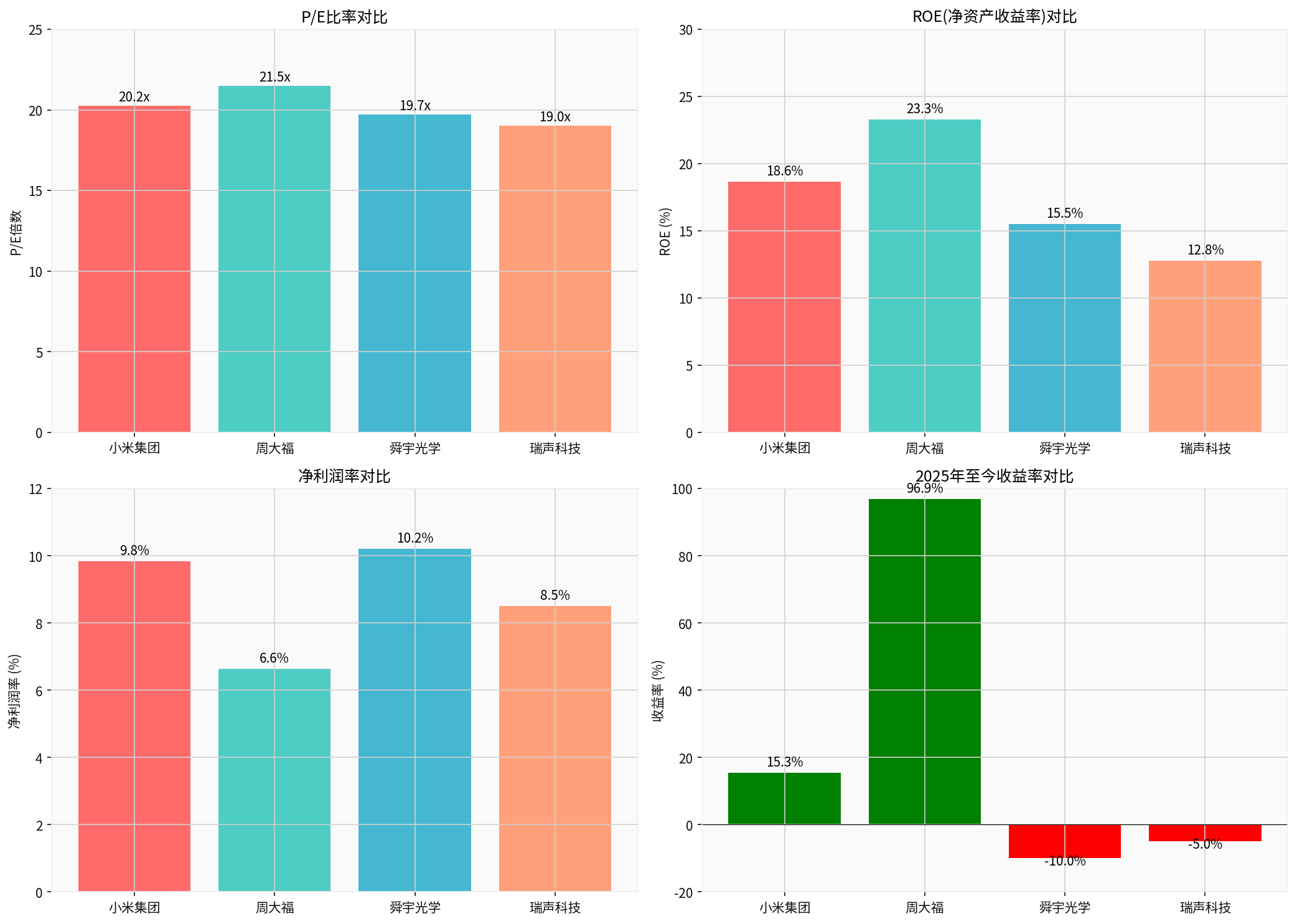

| Indicator | Xiaomi Group | Zhou Dafu | Sunny Optical | AAC Technologies |

|---|---|---|---|---|

| P/E Ratio | 20.25x | 21.48x | 19.70x | 19.01x |

| ROE | 18.65% | 23.29% | 15.50% | 12.80% |

| Net Profit Margin | 9.84% | 6.63% | 10.20% | 8.50% |

| YTD Return | +15.35% | +96.93% | -10.00% | -5.00% |

| Market Cap (HK$ Trillion) | 1.02 | 0.13 | 0.71 | 0.45 |

- 3-Year Gain: +249.55% (significantly outperforming the market)

- Current Stock Price: HK$39.22

- 52-Week Range: HK$32.20 - 61.45

- Recent Correction: Approximately 36% correction from the year’s high (from HK$61.45 to HK$39.22)

-

Construction of Technical Moat

- Leica Strategic Cooperation: Continuously deepening image technology collaboration to form a differentiated competitive advantage

- Intellectual Property Layout: Multiple patent applications related to the Ultra series to protect technical barriers [Context]

- R&D Investment: Financial analysis shows the company adopts aggressive accounting policies, reflecting emphasis on R&D and innovation [0]

-

Improvement of Brand Premium Capacity

- Continuous ASP Growth: Ultra series price increased to start at 8999 yuan, with second-hand market price exceeding 20,000 yuan

- User Acceptance: Million-level pre-order volume reflects market recognition of high pricing

- Brand Remodeling: Phased results achieved in transitioning from “cost-effectiveness” to “tech luxury”

-

Financial Data Support

- ROE Improvement: An ROE of 18.65% indicates improved capital utilization efficiency [0]

- Net Profit Margin: A net profit margin of 9.84% provides profit space for high-endization [0]

- Healthy Cash Flow: The latest free cash flow reaches HK$31.998 billion [0]

-

Market Space

- High-End Mobile Phone Market: Apple and Huawei dominate, but there is room for domestic substitution

- Consumption Upgrade Trend: Zhou Dafu’s 96.93% YTD gain reflects strong demand for high-end consumption [0]

-

Valuation Pressure

- DCF Valuation: Conservative scenario HK$17.08, base scenario HK$21.00, both lower than the current HK$39.22 [0]

- Overly High Market Expectations: Current stock price already reflects expectations of high-endization success, with risk of unmet expectations

- High P/E Ratio: A valuation of 20.25x is relatively high compared to traditional hardware manufacturers

-

Intense Competition

- Apple’s Moat: iOS ecosystem is hard to shake

- Huawei’s Return: Reshuffling of the high-end market

- Competition from Samsung, OV: Continuous competition in the Android high-end market

-

Sustainability Doubts

- Dependence on Single Hit Product: Can the success of the 17 Ultra be sustained in subsequent products?

- Brand Perception Inertia: Consumers’ inherent impression of Xiaomi’s “cost-effectiveness” label

- Technology Iteration Risk: The pace of image technology progress may be faster than moat construction

- Sunny Optical: P/E 19.70x, down 10% YTD

- AAC Technologies: P/E19.01x, down5% YTD

- Xiaomi Group: P/E20.25x, up15.35% YTD

- Positive Transmission: Xiaomi’s high-endization success → improved order quality → improved ASP and profit margins for the supply chain

- Valuation Reconstruction: The market may re-evaluate the growth of the consumer electronics supply chain and grant higher valuation multiples

- Sector Linkage: Xiaomi drives increased attention to the entire consumer electronics sector

- Opportunities: Higher specifications for high-end mobile phone lenses, increased per-unit value

- Risks: High customer concentration; Xiaomi’s underperforming high-endization will affect performance

- Opportunities: Growing demand for high-end acoustics and touch feedback

- Challenges: Overall smartphone market saturation, limited increments

- YTD Gain: +96.93%, significantly outperforming the market

- ROE Level:23.29%, indicating strong profitability

- P/E Valuation:21.48x, similar to Xiaomi

- Strong High-End Consumption Demand: Zhou Dafu’s sharp rise reflects an active high-end consumption market

- Obvious Consumption Stratification: Coexistence of high-end products and cost-effective products, in line with market stratification trends

- Not a luxury good in the traditional sense

- But an extension of “tech equity” — providing top-tier experience at a relatively reasonable price

- Similar to the “light luxury” concept: higher-end than mass brands but more accessible than traditional luxury goods

- Consumers are willing to pay for brand premiums but pursue cost-effectiveness

- Domestic brands have the opportunity to gain recognition in the high-end market

- Tech products are becoming a new category of “luxury goods”

| Dimension | Rating | Reason |

|---|---|---|

| High-Endization Sustainability | ⭐⭐⭐☆☆ | Technical moat is being built but needs continuous verification |

| Short-Term Stock Price Catalyst | ⭐⭐⭐⭐☆ | Booming sales of 17 Ultra are expected to boost short-term performance |

| Long-Term Investment Value | ⭐⭐⭐☆☆ | Valuation is high, need to wait for a better entry opportunity |

| Impact on Consumer Electronics Sector | ⭐⭐⭐☆☆ | Positive effect is limited, the overall industry is still under pressure |

| Impact on Luxury Sector | ⭐⭐☆☆☆ | Correlation is weak, impact is limited |

-

Xiaomi Group (1810.HK):

- Short-Term: Benefiting from the booming sales of 17 Ultra, there are trading opportunities

- Medium to Long-Term: Current valuation has fully reflected expectations; it is recommended to wait for a correction to below HK$30 before considering entry

- Focus Points: Performance of subsequent products, magnitude of gross margin improvement, overseas market expansion

-

Consumer Electronics Supply Chain:

- Sunny Optical, AAC Technologies: Current valuation is reasonable, but overall industry demand is weak; it is recommended to allocate cautiously

- Catalysts: Xiaomi’s high-endization continues to exceed expectations, AI phone penetration rate increases

-

Luxury Retail:

- Zhou Dafu (1929.HK): Huge YTD gain, short-term profit-taking pressure exists

- Investment Logic: High-end consumption demand is independent of consumer electronics, more affected by macroeconomics and consumer confidence

-

Market Risks:

- Global economic recession risk affects high-end consumption demand

- Continuous saturation of the smartphone market

- Geopolitical risks affect the supply chain

-

Company Risks:

- High-endization strategy underperforms expectations

- Excessive R&D investment affects short-term profits

- Risk of core talent loss

-

Valuation Risks:

- Current stock price is higher than DCF valuation

- Overly high market expectations, risk of performance miss exists

The success of Xiaomi 17 Ultra provides

- Whether the technical moatcan be continuously built and form a differentiated competitive advantage

- Whether brand perceptioncan truly shift from “cost-effectiveness” to “high-end technology”

- Whether financial performancecan continue to improve (gross margin, net profit margin, free cash flow)

For Hong Kong stocks, the success of Xiaomi’s high-endization is

[0] Gilin API Data (real-time quotes, financial analysis, valuation models, market data)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.