Integrated Analysis: Reddit Trading Psychology Transformation

Executive Summary

This analysis is based on a Reddit discussion [7] where a trader shares their breakthrough experience of achieving consistent profitability after abandoning attempts to “beat the market.” The post highlights a fundamental psychological transformation from competitive trading to patient, systematic approaches, resulting in improved market perception and sustainable results. The discussion occurred during mixed market conditions in Chinese indices, with weekly gains of 0.53% in Shanghai and 0.55% in CSI 300, contrasted against monthly weakness in Shenzhen (-2.34%) and ChiNext (-1.64%) [0].

Integrated Analysis

Psychological Transformation Framework

The author’s experience represents a classic trading psychology evolution that aligns with established research [1][2]. The transformation involved three critical components:

Emotional Detachment

: Moving away from the psychological need to be “right” about market direction [1]. This shift reduces cognitive biases that often lead to poor decision-making under pressure.

Process Orientation

: Focusing on consistent execution rather than outcome prediction [2]. Professional traders typically emphasize following their system rigorously rather than attempting to outsmart market movements.

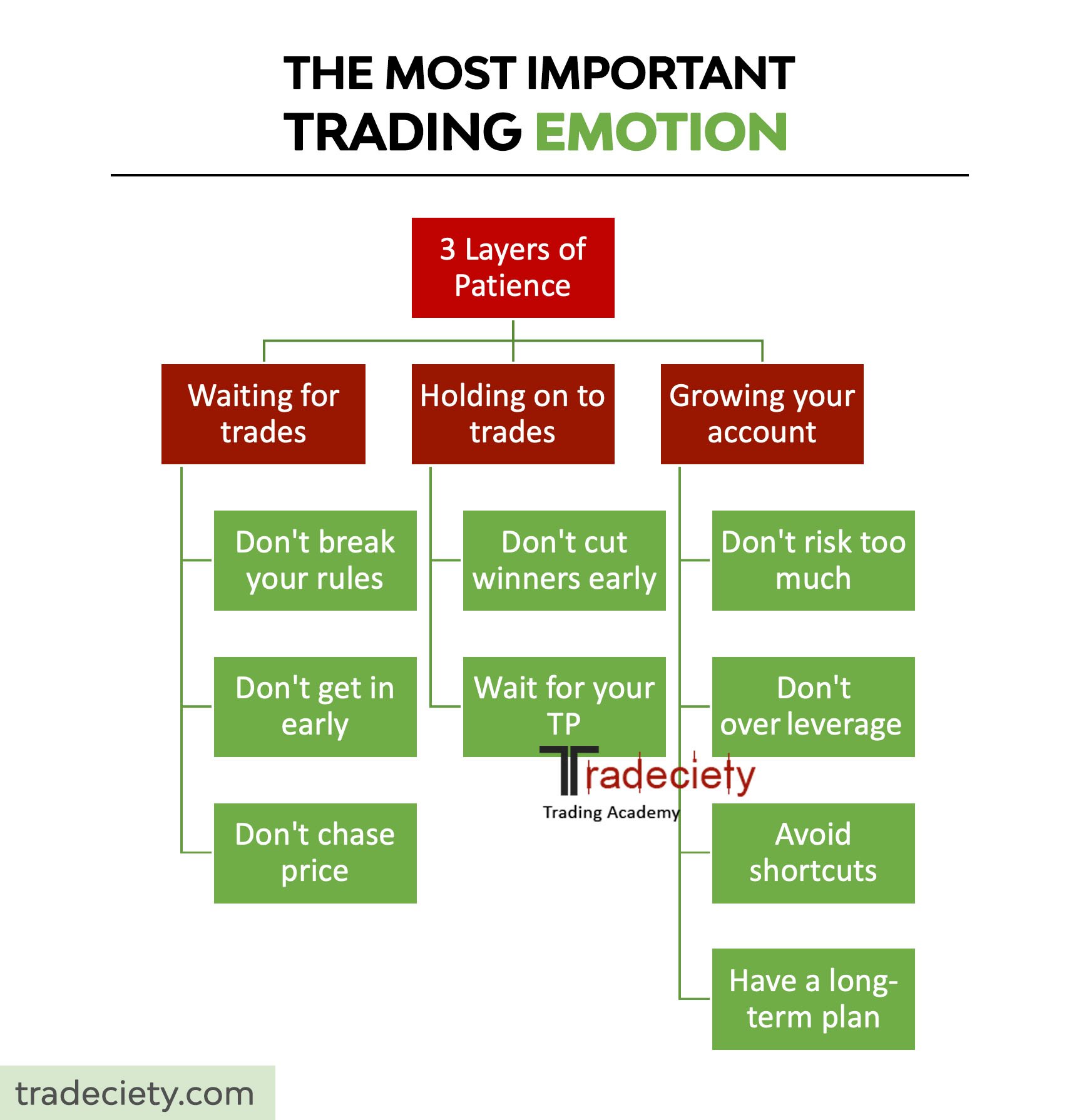

Patience Development

: Learning to wait for high-probability setups rather than forcing trades [3]. This approach significantly improves risk-adjusted returns by avoiding low-quality entries.

Market Maker Trap Recognition Enhancement

The author’s improved ability to identify market maker traps reflects a significant advancement in market reading skills. Market makers frequently manipulate price action to trigger stop losses and induce panic among retail traders [4]. By adopting a patient approach, traders gain several advantages:

Strategy Evolution: From Complexity to Simplicity

The transition to small, controlled trades mirrors professional trading approaches that prioritize consistency over spectacular gains [5][6]. This methodology offers several structural advantages:

Risk Management

: Smaller position sizes naturally limit potential losses while allowing for trade frequency increases [5].

Psychological Benefits

: Reduced stakes per trade decrease emotional interference, leading to more objective decision-making [3].

Statistical Edge

: High-frequency small gains compound more reliably than occasional large wins, providing more consistent performance metrics.

Key Insights

Cross-Domain Correlations

Psychology ↔ Performance

: The direct correlation between emotional detachment and trading performance highlights the importance of mental state in financial decision-making. This connection is often underestimated by technical-focused traders.

Simplicity ↔ Effectiveness

: The paradox that simpler strategies often outperform complex ones reflects a broader market principle where over-optimization frequently leads to diminished returns.

Patience ↔ Pattern Recognition

: The enhanced ability to identify market maker traps demonstrates how reduced psychological noise improves observational capabilities and pattern recognition.

Systemic Implications

Educational Evolution

: This discussion reflects a broader trend in trading education where emphasis is shifting from complex technical analysis to psychological mastery and risk management [2].

Community Learning

: Reddit trading communities serve as important platforms for peer-to-peer learning, where authentic personal experiences often resonate more effectively than formal educational materials [7].

Market Adaptation

: The timing during mixed market conditions suggests traders are seeking more stable approaches during periods of uncertainty, indicating adaptive behavior in response to market volatility.

Risks & Opportunities

Risk Considerations

Strategy Validation Risk

: The analysis notes the absence of quantitative performance metrics and specific strategy details, making it difficult to validate the claimed effectiveness objectively.

Implementation Risk

: Without concrete entry/exit criteria and risk management parameters, other traders attempting to replicate this approach may face significant execution challenges.

Market Condition Dependency

: The strategy’s effectiveness may vary significantly across different market regimes, particularly during high-volatility periods or structural market changes.

Opportunity Windows

Psychological Training

: There’s growing demand for trading psychology education, as evidenced by the community’s positive response to mindset-focused content [1][2][3].

Simplified Strategy Development

: The market shows increasing interest in straightforward, systematic approaches that prioritize consistency over complexity [5][6].

Community Knowledge Sharing

: Platforms like Reddit continue to provide valuable opportunities for traders to share practical experiences and psychological insights [7].

Key Information Summary

Core Transformation

: The trader’s shift from attempting to “beat the market” to working with market dynamics represents a fundamental paradigm change from amateur to professional trading approaches [1].

Strategy Characteristics

: The successful approach involves small, patient, controlled trades that focus on process execution rather than prediction accuracy [5][6].

Market Perception Enhancement

: Reduced emotional interference improved the trader’s ability to identify market maker traps and institutional manipulation patterns [4].

Environmental Context

: The discussion occurred during mixed market conditions, suggesting traders seek stable approaches during periods of uncertainty [0].

Educational Value

: Personal experience sharing on platforms like Reddit provides valuable peer-to-peer learning opportunities, particularly for traders facing similar psychological challenges [7].

Research Alignment

: The experience correlates with established trading psychology research emphasizing emotional control, process orientation, and patience as key success factors [1][2][3].

Information Gaps

: Critical details missing include specific strategy parameters, quantitative performance metrics, implementation timeline, and detailed risk management approaches.