Utilities as AI Investment Opportunities: Analysis of AEP and Sector Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit discussion [Reddit context] published on November 8, 2025, which questioned why utilities aren’t more discussed as AI beneficiaries given data centers’ reliance on power and water infrastructure. The author suspected long capital expenditure cycles might explain market oversight and questioned whether the opportunity was already priced in.

The investment thesis supporting utilities as AI beneficiaries has proven remarkably accurate in 2025. According to Morningstar/MarketWatch analysis, the S&P 500 Utilities Sector Index delivered a total return of 23.7% year-to-date as of October 14, 2025, making it the best-performing sector in the S&P 500, outpacing both Communication Services (22.9%) and Information Technology (21.3%) [1]. This represents a dramatic reversal from 2023, when utilities were the worst-performing sector [1].

American Electric Power (AEP) has been a significant beneficiary of this trend, with current stock data showing:

- Current Price: $121.43 (as of November 8, 2025)

- YTD Performance: +32.08%

- 1-Year Performance: +25.96%

- Market Cap: $64.99B

- P/E Ratio: 17.74x

- ROE: 12.79%

- Net Profit Margin: 17.08%

- Analyst Consensus: BUY (52.9% of analysts) [0]

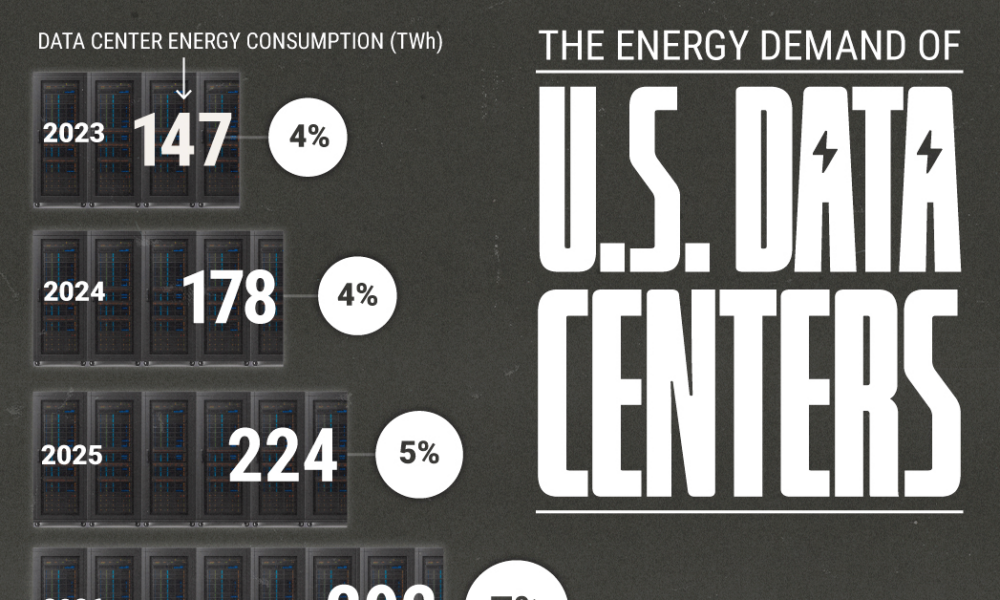

The fundamental driver is unprecedented power demand from AI data centers. Grid Strategies estimates 120 gigawatts of additional electricity demand by 2030, including 60 gigawatts from data centers alone - equivalent to Italy’s entire peak power demand [2]. Utilities are forecasting record capital expenditures of $212 billion in 2025 across 47 utilities, a 22% year-over-year increase, sharply higher than the 7.6% CAGR over the past decade [2].

The Reddit author’s concern about market oversight appears partially valid historically, but the market has clearly recognized the opportunity in 2025. Several key insights emerge:

-

Demand-Driven Infrastructure Boom: U.S. electricity prices rose 6.2% in the 12 months through August 2025, significantly outpacing the 2.9% headline CPI increase [1]. This pricing power reflects genuine supply-demand imbalances.

-

AEP’s Proactive Strategy: AEP announced a comprehensive $72 billion capital investment plan for 2026-2030, specifically designed to “enhance service for customers and support the growing energy needs of our communities” [3]. On November 5, 2025, AEP announced long-term strategic agreements with Quanta Services to advance transmission and power infrastructure, specifically mentioning “the rapidly growing data center market” [3].

-

Supply Chain Solutions: The Quanta partnership includes expanding domestic manufacturing capacity for extra-high-voltage transformers and circuit breakers, addressing critical supply chain constraints that could limit growth [3].

Despite strong performance, utilities still represent only 2.5% of the S&P 500, compared with 34.7% for technology [1]. However, the sector’s P/E multiple hit 19.6 in October 2025, the highest level since the bull market began in October 2022 [1], suggesting the opportunity may no longer be overlooked.

Power producers like Constellation Energy (CEG), Vistra (VST), NRG Energy (NRG), and Talen Energy (TLN) may be better positioned to benefit from rising electricity prices as they operate more freely than regulated utilities [1].

Users should be aware of several risk factors that warrant careful consideration:

-

Demand Forecast Uncertainty: There are questions about whether all projected demand increases will materialize. Some regions have already “readjusted back” their initial huge projections [2]. The magnitude and timing of AI-related power demand growth remain uncertain.

-

Regulatory Risk: As regulated utilities, AEP’s ability to pass through costs and earn adequate returns depends on regulatory commissions. Major infrastructure investments require regulatory approval, which can be time-consuming and uncertain.

-

Valuation Concerns: The Reddit author’s concern about whether the opportunity is already priced in appears valid given the sector’s valuation expansion and strong YTD performance.

-

Interest Rate Sensitivity: Utilities are traditionally sensitive to interest rate changes due to their capital-intensive nature and dividend-focused investor base.

-

Technology Disruption: While AI currently drives power demand, future efficiency improvements could reduce per-computation energy requirements.

Despite risks, several opportunities remain:

-

Selective Positioning: AEP’s strategic partnership with Quanta Services and specific focus on data center markets may differentiate it from peers.

-

Supply Chain Solutions: Companies addressing transformer and equipment shortages could capture outsized returns.

-

Long-Term Demand Growth: Even with some projection adjustments, the fundamental trend of increased electricity demand from AI appears durable.

The Reddit discussion raises valid points about utilities as AI beneficiaries that have been validated by 2025 market performance. The investment thesis is fundamentally sound, with AI data centers driving unprecedented power demand growth. AEP demonstrates strong strategic positioning through its $72 billion capital plan and Quanta Services partnership specifically targeting data center infrastructure needs.

However, the market has clearly recognized this opportunity, with utilities becoming 2025’s top-performing sector and valuation multiples expanding significantly. The opportunity may not be as overlooked as the Reddit author suggested, but selective opportunities like AEP’s strategic positioning in data center markets may still offer value.

Decision-makers should monitor data center construction timelines, regulatory commission decisions, supply chain progress, and competitive positioning. While long-term demand trends support utilities as AI beneficiaries, short-to-medium term execution risks and valuation concerns warrant careful consideration.

[0] Ginlix InfoFlow Analytical Database - AEP stock data and financial metrics

[1] Morningstar/MarketWatch - “These stocks are soaring because of AI - and none of them are tech. Here’s what’s going on” (October 15, 2025)

[2] CNBC - “Utilities are grappling with how much AI data center power demand” (October 17, 2025)

[3] PR Newswire - “AEP and Quanta Services Announce Strategic Partnership to Advance Transmission and Power Infrastructure” (November 5, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.