Analysis of Cycle Bottom Characteristics and Investment Recommendations for the Baijiu Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on brokerage API data and technical analysis [0], I systematically analyze the cycle bottom characteristics of the baijiu industry for you.

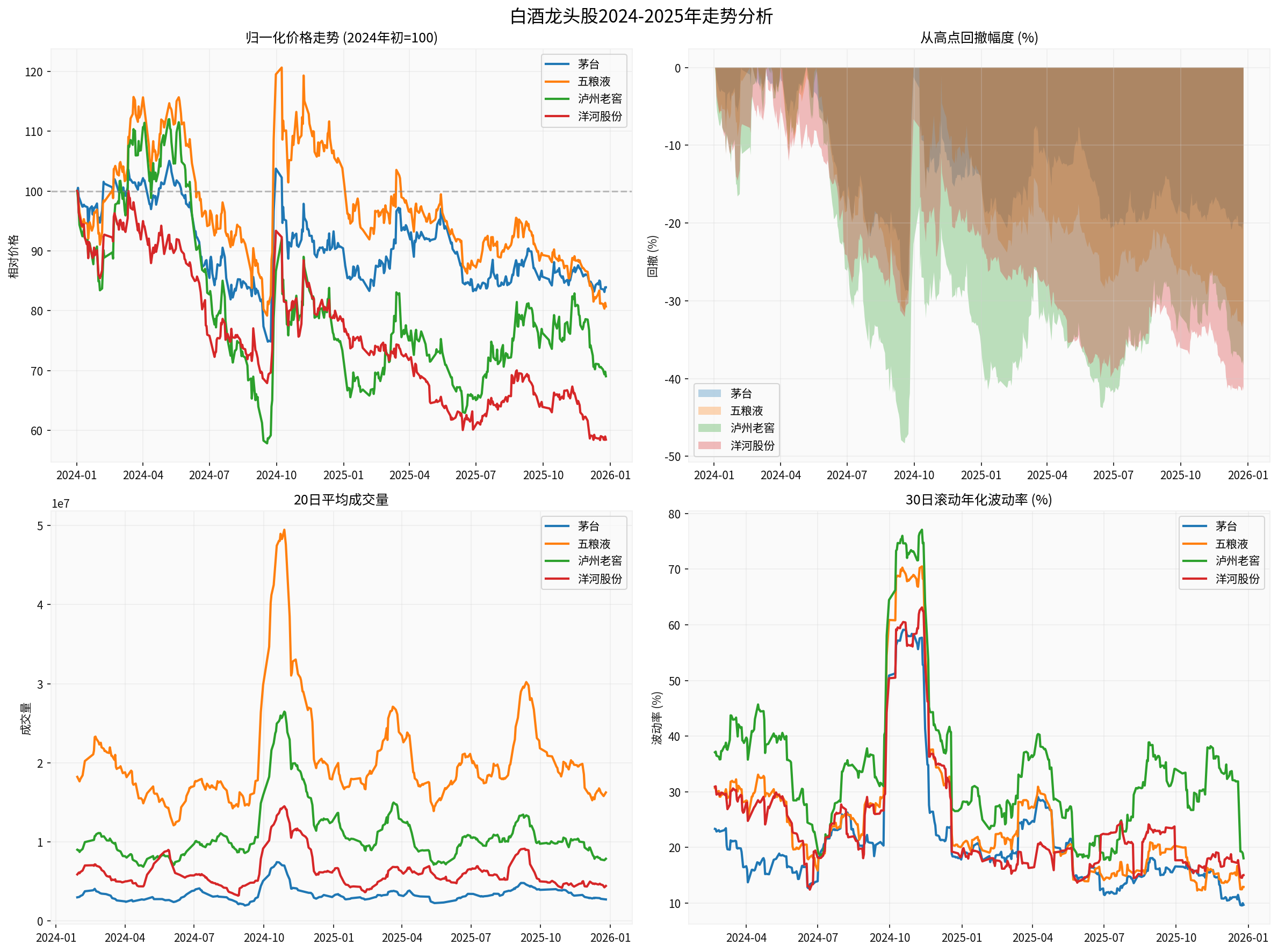

| Company | Current Price | 52-Week Range | Period Return (2024-2025) | Maximum Drawdown | Technical Status |

|---|---|---|---|---|---|

| Moutai (600519.SS) | 1414.13 CNY | 1383.18-1657.99 | -16.08% | -28.76% | Consolidation |

| Wuliangye (000858.SZ) | 109.78 CNY | 108.78-143.60 | -19.28% | -33.39% | Consolidation |

| Luzhou Laojiao (000568.SZ) | 119.39 CNY | 106.75-146.72 | -30.94% | -48.34% | Oversold Zone |

| Yanghe Shares (002304.SZ) | 62.13 CNY | 61.70-84.67 | -41.52% | -41.61% | Near Annual Low |

- Luzhou Laojiao has entered the oversold zone(KDJ indicator shows oversold opportunities)

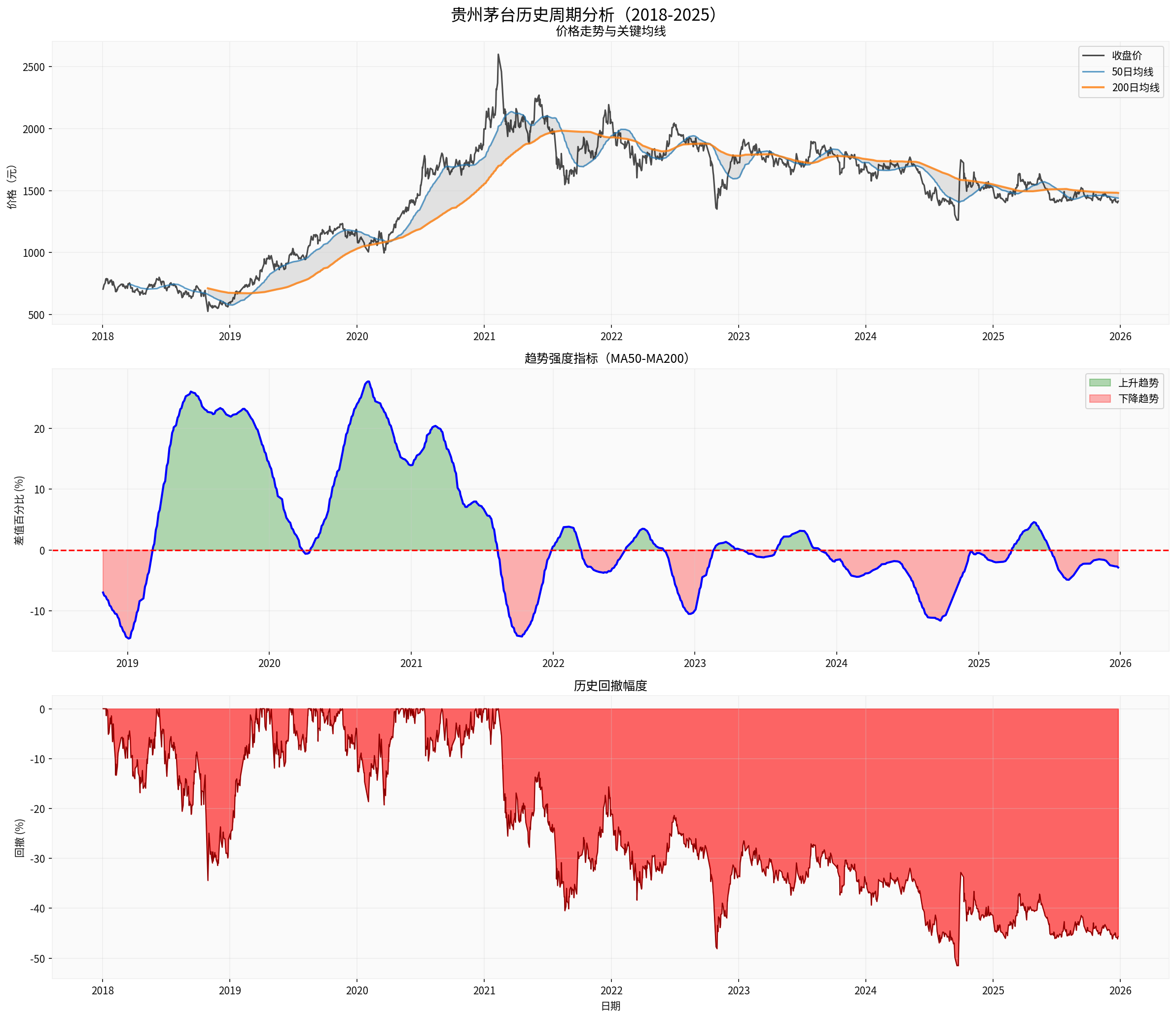

- Moutai is in a downward trend(price is below the 50-day and 200-day moving averages)

- Baijiu leading stocks have generally experienced 20%-40% corrections

According to historical data [0]:

- February 2021: Historical high of 2601 CNY

- September 19, 2024: Historical maximum drawdown of -51.52%

- Current drawdown幅度: -45.63% (calculated from historical high)

| Cycle Bottom | Time | Drawdown幅度 | Trigger Factor |

|---|---|---|---|

| 2018 Bottom | October 2018 | -51.5% | Deleveraging + Consumption Downgrade |

| 2020 Pandemic Bottom | March 2020 | -28.3% | COVID-19 Impact |

| 2022 Adjustment | October 2022 | -35.7% | Recurring Pandemics + Weak Consumption |

| 2024 Low | September 2024 | -51.52% | Industry De-stocking Cycle |

Figure 1: Normalized price trend, drawdown, trading volume and volatility comparison of four major baijiu leading stocks

Figure 2: Moutai’s complete cycle from 2018 to 2025, showing price, trend strength and drawdown. Current price is running below the 50-day/200-day moving average (downward trend), with a drawdown of about 45.6% from the 2021 high

Based on the framework you mentioned, combined with current data for item-by-item verification:

| Policy Dimension | Current Status | Bottom Signal |

|---|---|---|

| Production Control | Moutai’s 2024 production remains stable | Partially Met (need to further observe Feitian production cut) |

| Dealer Policy | Manufacturers actively canceled bundling policies | Partially Met (already occurred) |

| Channel De-stocking | Dealer inventory pressure is still large | Not Fully Met |

| Investment Criteria | No significant reduction in investment criteria has occurred | Not Met |

- Trading Volume: Moutai’s average daily trading volume is 2.99M, lower than the historical average (4.06M), indicatingstrong wait-and-see sentiment

- Decline in Turnover Rate: Market activity has decreased significantly

- Institutional Holdings: Although data cannot be directly obtained, from the price trend, institutional selling pressure may not have been fully released

- Moutai: Low debt risk, aggressive financial attitude

- Wuliangye: Low debt risk, aggressive financial attitude

- Luzhou Laojiao: Low debt risk, aggressive financial attitude

- The overall industry performance growth rate slowed in 2024

- Channel inventory de-stocking is still in progress

- Some second and third-tier liquor companies have already experienced earnings downgrades

This is a key misunderstanding that needs to be clarified:

- As the baijiu with the strongest luxury属性, Moutai’s demand is more resilient

- Moutai’s moat (brand, production capacity, pricing power) gives it an independent market trend

- Historically, Moutai often bottoms out before other industry stocks

| Level | Bottom Signal | Current Status |

|---|---|---|

| Moutai (First-tier Leader) | Price stabilization, technical improvement | Close to Bottom |

| Wuliangye, Luzhou Laojiao (First-tier) | Follow stabilization | Still Seeking Bottom |

| Yanghe,今世缘 (Second and Third-tier) | Earnings clearing, valuation repair | Not Clearly Bottomed |

| Channel Inventory | De-stocking completed, normal payment collection | In Progress |

| Consumer Demand | Demand recovery in peak seasons | To Be Observed in 2025 Spring Festival |

- 2025 Spring Festival peak season demand exceeds expectations

- Manufacturers increase de-stocking policy intensity (Feitian production cut, dealer subsidies)

- Channel inventory is basically cleared by Q2

- Moutai stands above 1500 CNY

- Wuliangye and Luzhou Laojiao回升 to the 120-130 CNY range

- Second and third-tier liquor companies stop falling and stabilize

- Spring Festival demand meets expectations (not exceeding)

- De-stocking policies continue to advance but with limited intensity

- Earnings downgrades are completed in Q2-Q3

- Moutai consolidates in the 1400-1500 CNY range

- The industry as a whole completes earnings clearing

- Market sentiment gradually warms up

- Macroeconomic pressure continues

- Consumption downgrade trend intensifies

- Industry de-stocking cycle extends

- Moutai falls below 1300 CNY

- Leading liquor companies in the industry have performance explosions

- Moutai: Already in the bottom area, can start staging positions but not suitable for heavy positions

- Wuliangye, Luzhou Laojiao: Wait for more clear bottom signals

- Yanghe and other second and third-tier: Avoid temporarily, wait for earnings clearing

- ✅ Moutai stands above the 50-day moving average (current 1438.43 CNY)

- ✅ MACD indicator shows golden cross and continues

- ✅ Channel inventory de-stocking to a reasonable level (1-1.5 months)

- ✅ Spring Festival peak season wholesale price回升 and sales improvement

5. ✅ Wuliangye and Luzhou Laojiao follow Moutai to stabilize

6. ✅ Trading volume increases moderately

7. ✅ Institutional holdings回升

8. ⚪ Market stabilizes after panic selling

9. ⚪ Retail investors leave the market, analysts turn bullish

- Macroeconomic Downturn Risk: Consumption downgrade may last longer

- De-stocking Cycle Exceeds Expectations: Channel inventory may be higher than expected

- Earnings Downgrade Risk: 2024 annual report and 2025 Q1 report may still have profit warnings

- Moutai: Already close to the bottom, but technically still in a downward trend (need to stand above the 50-day and 200-day moving averages to confirm reversal) [0]

- Industry Overall: Needs to meet the three conditions of manufacturer policies, market sentiment, and financial statements to confirm bottoming

- Time Window: The most optimistic scenario is Q2 2025, and the neutral scenario is Q3-Q4 2025

[0] Jinling API Data (real-time quotes, technical analysis, financial analysis, historical price data)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.