Lithium Stocks Valuation Analysis: Tianqi (002466) & Ganfeng (002460)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

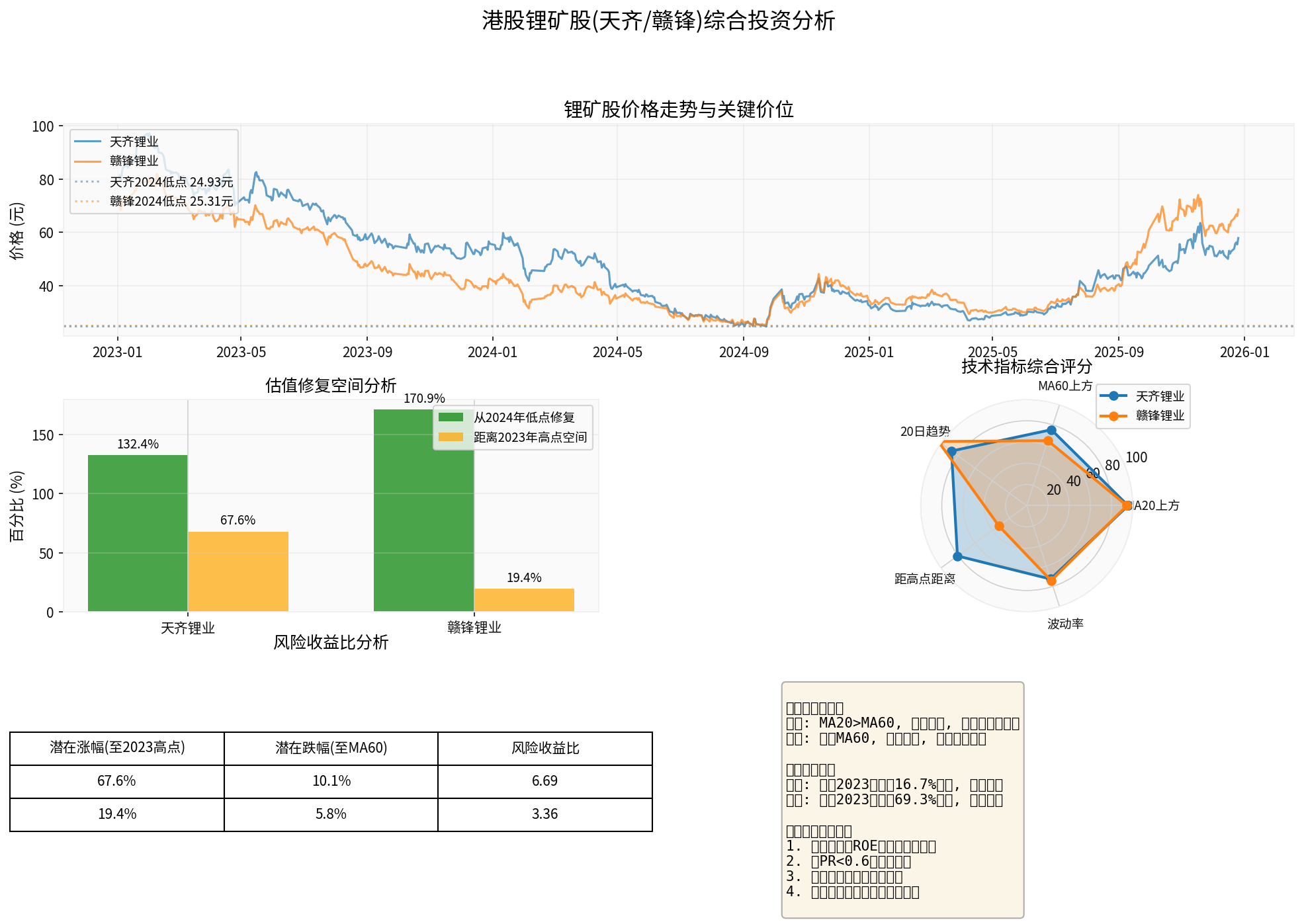

- The author’s self-created “Price-Earning-Return (PR = PE/ROE/100)” is a composite valuation indicator aimed at finding the cost-performance relationship between ROE and PE. If the ROE disclosed in the Q1 2026 financial report declines simultaneously and PR falls within the range of 0.4~0.6 (i.e., a clear undervaluation of 40%~60% discount), it meets the signal for opportunistic buying; if ROE improves and PR is less than 0.4, it indicates that the profit quality is being undervalued, and appropriate early intervention is feasible. Supplementing ROE data after next year’s Q1 is a key node. [0]

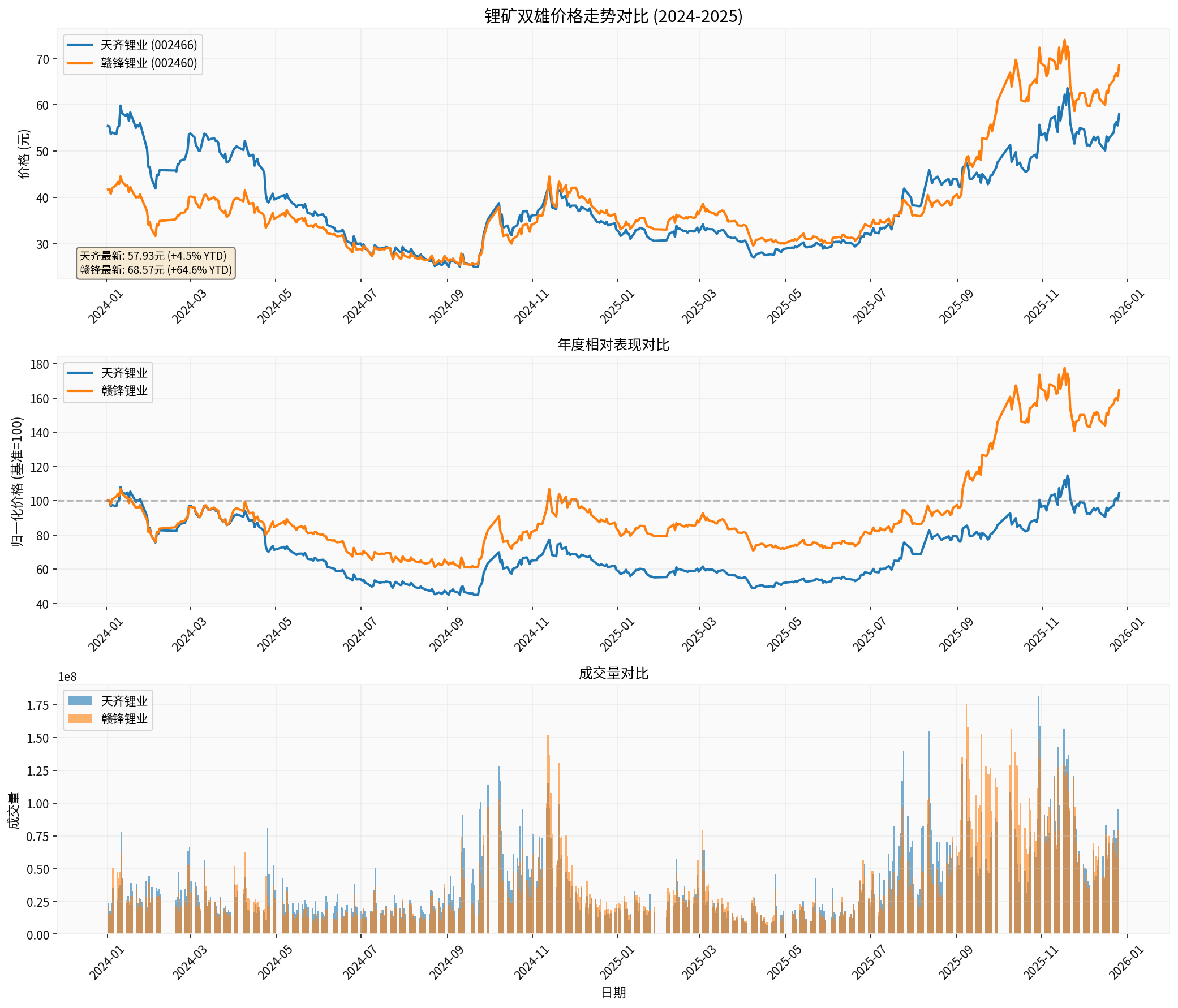

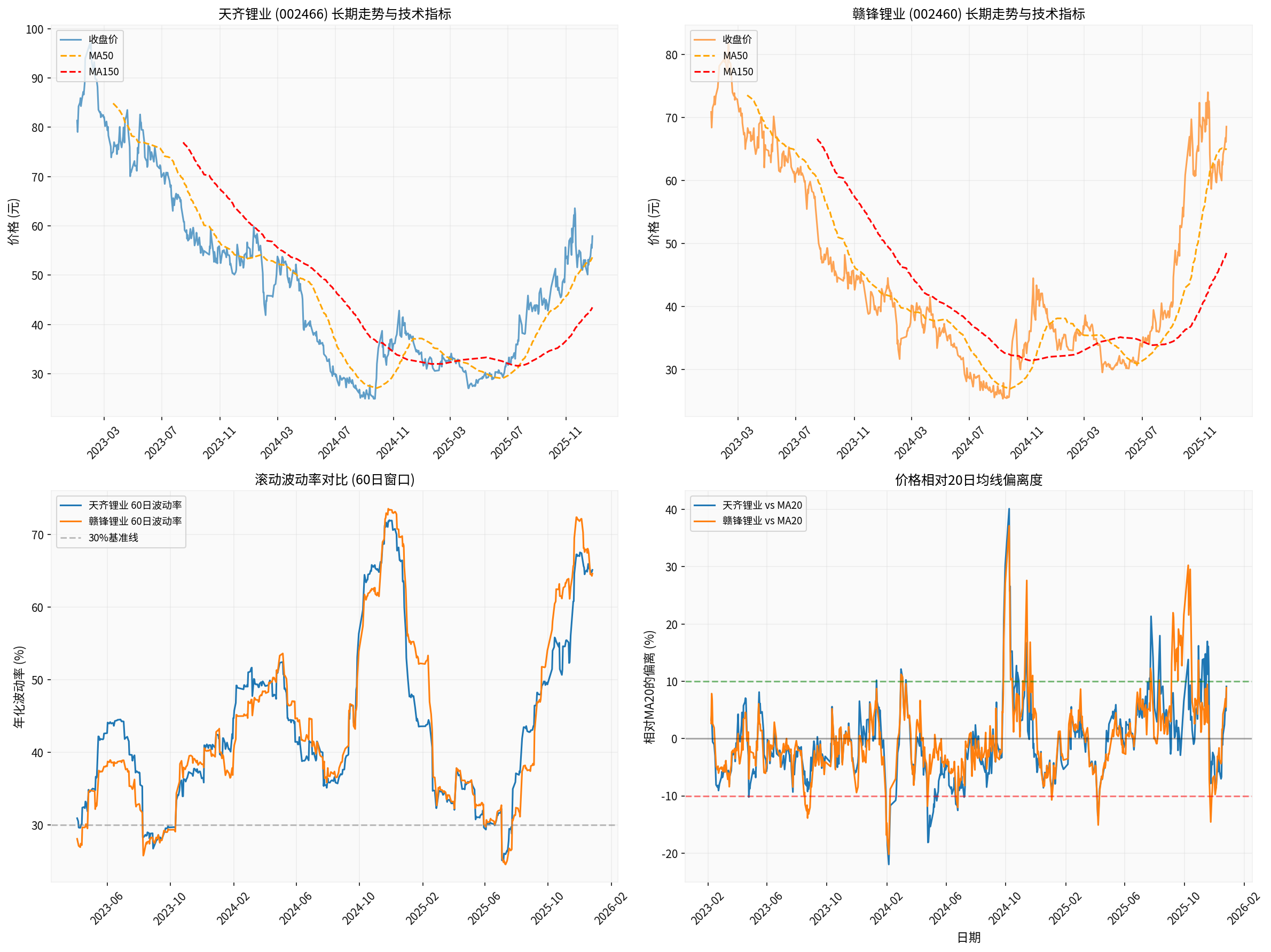

- Price and Trend: As of 2025-12-26, Tianqi closed at 57.93 CN¥ and Ganfeng at 68.57 CN¥. Year-to-date, they have risen by only 4.5% and 64.6% respectively (Ganfeng’s gains are more concentrated) [0]. Tianqi has returned above the 20/60/120-day moving averages with a trend strength of +0.376%, showing short-term strength; Ganfeng is between MA20 and MA60 and slightly below MA60, with a 20-day trend of +0.529%, requiring confirmation of a breakthrough in the short term [0].

- Repair Space: Tianqi has recovered 132.4% from its 2024 low of 24.93 CN¥, but still has nearly 67.6% upside to its 2023 high; Ganfeng has repaired 170.9% from its 2024 low of 25.31 CN¥, with only 19.4% left to reach its 2023 high, indicating that Ganfeng’s valuation repair pace is faster while Tianqi still has significant upside potential. [0]

- Technical/Risk Reminder: Tianqi’s current price is only at the 16.7% position of its 2023 range (50.08-97.09 CN¥) with a volatility of about 49.1% [0], which can be regarded as a valuation low after confirming ROE and PR; Ganfeng is at the 69.3% position of its 2023 range with a volatility of 49.7% [0], meaning that previous gains have partially updated expectations, and the risk of retracement to MA60 needs to be prevented.

- In 2025, the futures price of carbonate lithium has continued to rebound. As of December 27, the latest price is 34.59 (unit and specific contract are defined by the market), with a year-to-date increase of nearly 98.3%, a range high of 46.44, and a low of 16.11 [0]. This rebound has started from the 2024 low, with trading heat and volume increasing simultaneously, indicating that bullish sentiment remains.

- If anti-involution policies can continue to suppress disorderly expansion (such as capacity integration, differentiated access), it will help maintain the tight supply-demand situation of carbonate lithium, thereby supporting the current price. However, we need to be alert to indirect disturbances from factors such as export tax rebates and local infrastructure stimulus on the raw material side (e.g., spodumene), and it is recommended to make comprehensive judgments based on cost-side/inventory data.

- Wait for ROE to Confirm PR: Continue to pay attention to the ROE in the 2026 Q1 report; if Tianqi/Ganfeng’s PR falls between 0.4~0.6, gradual position building is feasible. If PR recovers to above 0.8, consider partially taking profits.

- Tianqi as the Main Line of Valuation Repair: Currently, Tianqi still has about 67% upside to its 2023 high and is still above the MA indicators. Before PR is clear, a phased strategy can be used for valuation bottom layout, focusing on the comparison of PR and ROE trends.

- Ganfeng Has Stronger Elasticity but More Expensive Valuation: Ganfeng has already repaired most of its valuation, and its upside space depends more on profit expansion; if the carbonate lithium price remains high and ROE increases, it can be maintained in the short term, but it is recommended to take Tianqi as the core and Ganfeng as an elastic allocation.

- Policies and Prices Need Dynamic Tracking: The carbonate lithium price is already at a high level. If policies continue to suppress disorderly competition, it will be the supporting tone; otherwise, we need to be alert to the negative impact of price corrections on ROE and PR.

- Chart 1 (b4eb0421): Comparison of price trends, normalized performance, and trading volume of the two leaders, clearly showing Tianqi’s trend of high-level oscillation and Ganfeng’s stronger elasticity this year. [0]

- Chart 2 (0439832b): Long-term trend, MA50/MA150, rolling volatility, and price deviation, reflecting that Tianqi still has support at high levels and Ganfeng needs to confirm the MA60 breakthrough. [0]

- Chart 3 (0ca4c5fe): Comprehensive chart of price repair, risk-return ratio, and investment signals, focusing on valuation repair and operation rhythm. [0]

- Chart 4 (cfdf3aad): Futures price and volume trend of carbonate lithium, confirming the rebound intensity of raw material prices and market attention. [0]

Chart links:

[0] Gilin API Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.