Tenaya Therapeutics (TNYA): Promising Clinical Data Overshadowed by FDA Clinical Hold

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Reddit discussion [1] and official clinical data released by Tenaya Therapeutics on November 8, 2025, which was presented at the American Heart Association Scientific Sessions 2025 [2]. The situation presents a complex narrative of promising scientific achievement tempered by immediate regulatory challenges.

The MyPEAK-1 Phase 1b/2a trial results demonstrate compelling efficacy signals across multiple dimensions. TN-201 gene therapy achieved meaningful protein expression increases (4% average in Cohort 1, 14% in one Cohort 2 patient), significant cardiac biomarker improvements (48%-74% reduction in cardiac Troponin I), substantial structural improvements (21%-39% reduction in left ventricular posterior wall thickness), and complete symptom resolution with all patients improving by at least one NYHA class [2]. The safety profile was favorable with only reversible, asymptomatic liver enzyme elevations observed.

However, the FDA’s decision to place the trial on clinical hold on November 7, 2025 [2] - just one day before the data presentation - has created significant market uncertainty. This regulatory action appears to be the primary driver of the stock’s recent decline, with shares closing at $1.28 on November 8, 2025, down 5.19% for the day and 30.05% over the past 30 days [0].

Additional risks include:

- Cash Burn: As a clinical-stage biotech with negative profitability (ROE: -93.83%) [0], extended delays could impact funding needs

- Long-term Safety: Gene therapies carry unique safety considerations that may emerge over time

- Competitive Landscape: Other companies developing HCM treatments could gain ground during any delay

The clinical data suggests several potential opportunities:

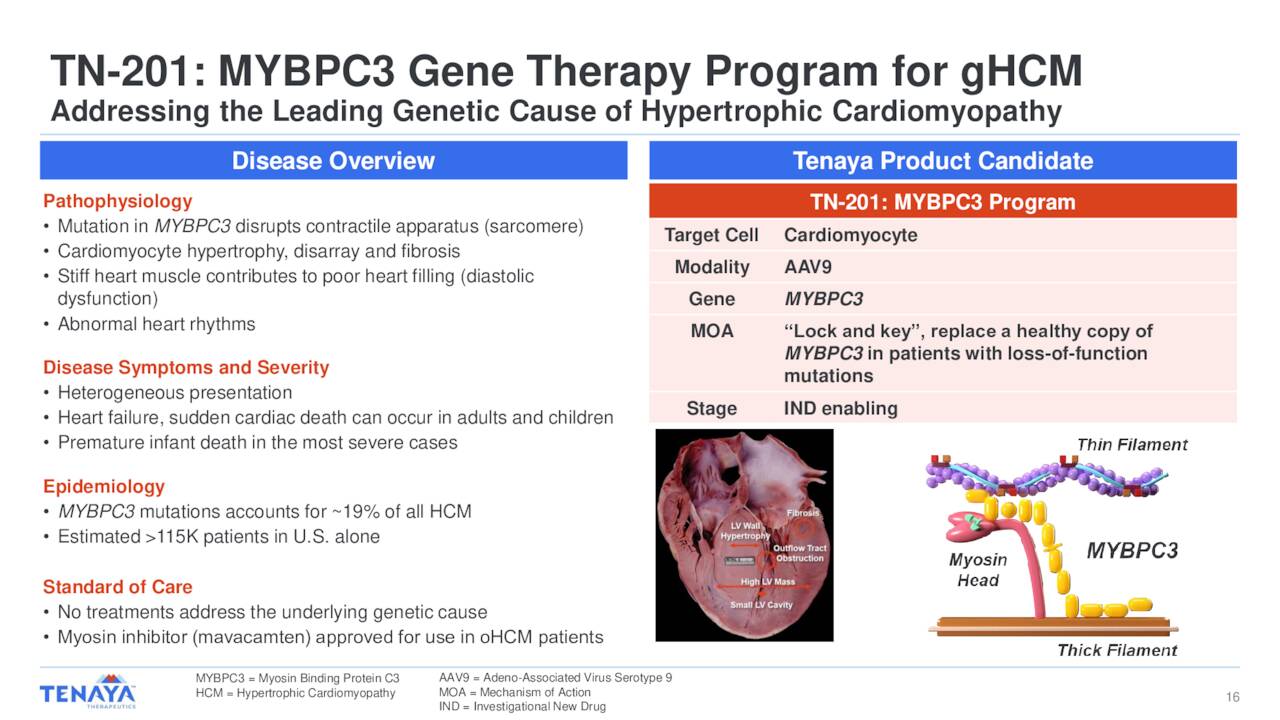

- Unmet Medical Need: No approved treatments address the underlying genetic cause of MYBPC3-associated HCM [2]

- Strong Efficacy Signals: Multi-dimensional improvements across protein expression, biomarkers, structure, and symptoms

- Regulatory Support: Multiple FDA designations suggest pathway advantages once concerns are addressed

- Market Potential: Significant patient population with no current disease-modifying options

The situation requires careful consideration of individual risk tolerance, as the investment thesis hinges on regulatory resolution rather than scientific questions about efficacy or safety.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.