Envicool (002837) In-depth Analysis of Energy Storage Thermal Management Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest disclosed data, Envicool’s energy storage thermal management business has shown strong growth momentum [1][2]:

| Time Period | Revenue Scale | YoY Growth Rate | Business Characteristics |

|---|---|---|---|

| Full Year 2024 | ~90 million yuan | over 80% |

Rapid volume growth of liquid cooling thermal management |

| Q1 2025 | ~30 million yuan | doubled YoY |

Growth momentum continues to strengthen |

| Jan-Sept 2025 | Cabinet thermal management products contribute significantly | Expected 25%-35% | Strong demand for energy storage construction |

- The global electrochemical energy storage installation has entered a high-growth period. As a core component ensuring battery safety, lifespan, and performance, the value of thermal management systems accounts for approximately 3%-5% of the cost of energy storage systems [3]

- Energy storage projects have increasingly higher requirements for safety, cycle life, and full-cycle costs, making thermal management systems more important

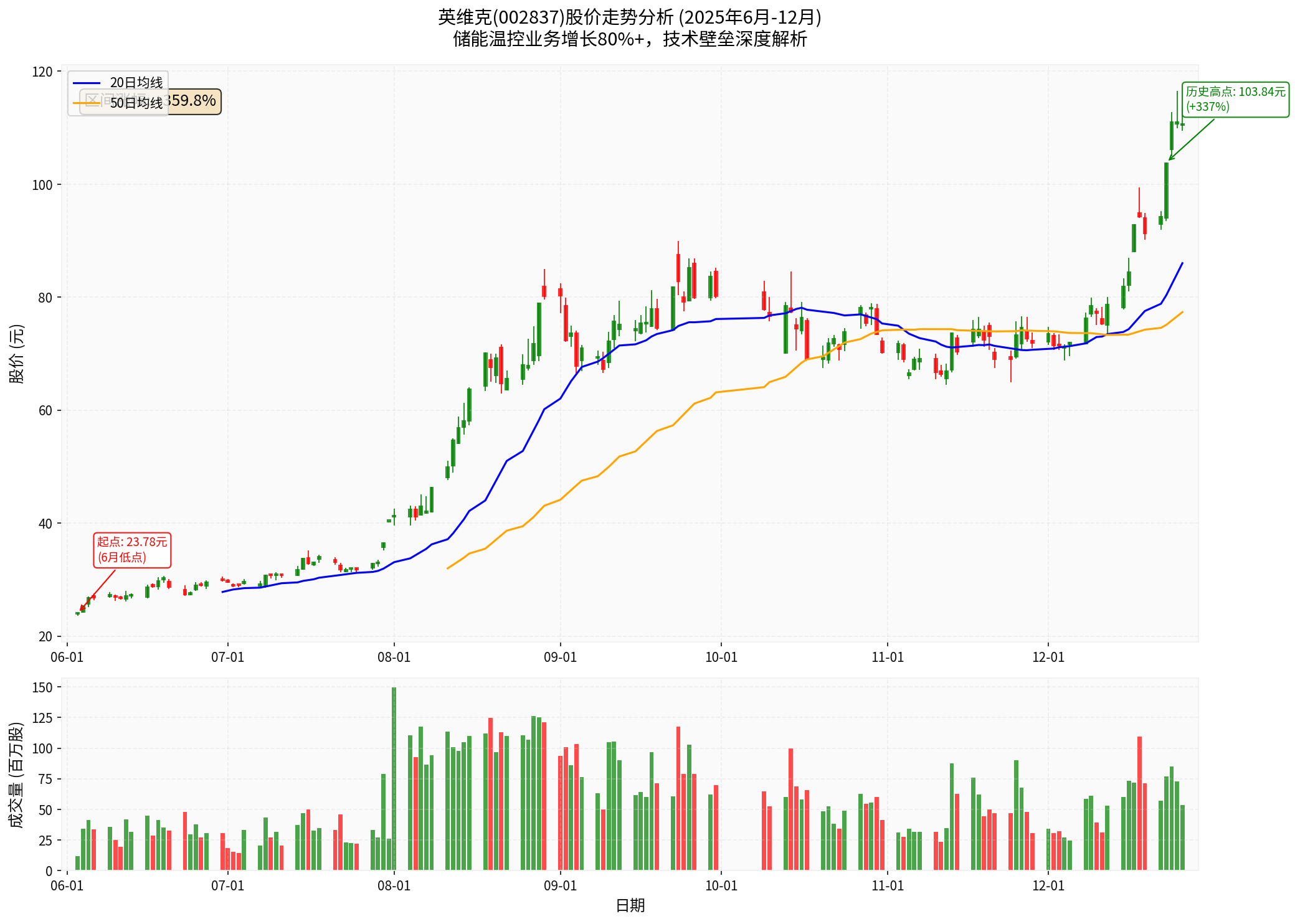

Chart Description: Envicool’s stock price soared from a low of 23.6 yuan in June 2025 to a high of 116.5 yuan in December, an increase of over 359%, with a market capitalization exceeding 100 billion yuan, reflecting the market’s high recognition of the prospects of its liquid cooling technology [0].

Envicool has established multi-level technical barriers in the field of energy storage thermal management [2][4]:

| Technical Field | Technical Level | Competitive Barriers |

|---|---|---|

Microchannel Liquid Cooling Technology |

Fin spacing 0.08mm, channel precision ±5μm, heat dissipation density 500W/cm² | Leading in China, advanced internationally |

Immersion Liquid Cooling System |

Self-developed hydraulic balance design, PUE ≤1.08 | Few companies have large-scale capability |

Full-chain Liquid Cooling Solution |

Coolinside covers the entire chain from cold plate → CDU → quick connector | Scarce capability in the industry |

Process Technology |

Masters core processes such as cold heading, laser welding, vacuum diffusion welding | Double barriers of equipment and know-how |

- January 2025: Obtained utility model patent authorization for “microchannel cold plate” [4]

- Has multiple liquid cooling-related patents and software copyrights

- Forward-looking layout for supply chain introduction to North American customers

Envicool participated in drafting multiple industry standards [1][2]:

- 10 international/industry standards such as “Energy Efficiency Evaluation and Energy-saving Technical Guidelines for Data Center and Communication Room Infrastructure”

- Won the first prize of the Science and Technology Award of China Communications Standards Association in 2017

- The standard compiled in 2023 won the second prize of the “Science and Technology Award”

- In 2024, the energy storage liquid cooling product won the “Best Energy Storage Thermal Management Technology Solution Award”

| Customer Type | Cooperation Depth | Barrier Value |

|---|---|---|

International Chip Giants |

Participated in GB300 standard formulation, the only Tier1 liquid cooling supplier in mainland China | Certification cycle of 12-18 months, significant first-mover advantage |

Leading Server Manufacturers |

Sample verification passed for New H3C and others | Supply chain introduction barrier |

Internet Leaders |

Stable cooperation with ByteDance, Tencent, Alibaba, etc. | Scale verification and reputation barrier |

Telecom Operators |

5-year computing power service contract with Zhejiang Branch of China Unicom | Long-term cooperation relationship barrier |

Envicool has formed the positioning of “

- “End-to-end, full-chain” platform layout capability

- “Factory-to-site” full-scenario solution from server manufacturing factories to data center operation sites

- “From birth to upgrade” full-life-cycle solution

| Dimension | Advantages | Potential Challenges |

|---|---|---|

Technology |

Full-chain capability, leading in microchannel/immersion technology | Uncertainty in technical route evolution |

Customers |

NVIDIA/Intel certification, cooperation with leading Internet enterprises | Customer concentration risk |

Scale |

150,000 liquid cooling plate production line under construction | Capacity expansion speed |

Finance |

R&D expense ratio of 7%-8%, continuous high investment | High valuation (P/E 212x) |

-

Technical Barriers (High):Leading core technologies such as microchannel liquid cooling and immersion liquid cooling, complete patent layout, continuous R&D investment (7%-8% expense ratio)

-

Certification Barriers (High):NVIDIA NPN certification cycle of 12-18 months, significant first-mover advantage as the only Tier1 supplier in mainland China

-

Customer Barriers (Medium-High):Passed verification by leading enterprises, stable cooperation relationships, but there is customer concentration risk

-

Scale Barriers (Medium):150,000 liquid cooling plate production line under construction, capacity expansion in progress

-

Standard Barriers (High):Participated in international/industry standard formulation, with the ability to “define standards”

[1] Xueqiu - Latest News on Envicool (SZ002837) (https://xueqiu.com/S/SZ002837/news)

[2] NetEase Finance - Stock Price Rises Nearly 3x in Half a Year, Market Cap Exceeds 90 Billion Yuan: Why Is Envicool Advancing Vigorously? (https://www.163.com/dy/article/KH0PUA120514R9P4.html)

[3] The Paper - Stock Price Rises Nearly 3x in Half a Year, Market Cap Exceeds 90 Billion Yuan: Why Is Envicool Advancing Vigorously? (https://m.thepaper.cn/newsDetail_forward_32196846)

[4] Sina Finance - Envicool In-depth: Leader in Thermal Management Systems, AI Computing Server Liquid Cooling Builds New Growth Pole (https://finance.sina.com.cn/roll/2025-12-17/doc-inhcaqyr7358836.shtml)

[5] DoNews - Liquid Cooling “Bull Stock”: Why Did Envicool Become a “Legend” All the Way? (https://www.donews.com/article/detail/7331/93739.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.