Evaluation of R&D Input-Output Ratio for Yuekang Pharmaceutical's Transition to Nucleic Acid Innovative Drugs

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on currently available information, I conducted a systematic evaluation of the R&D input-output ratio for Yuekang Pharmaceutical’s (688317.SS) transition to nucleic acid innovative drugs.

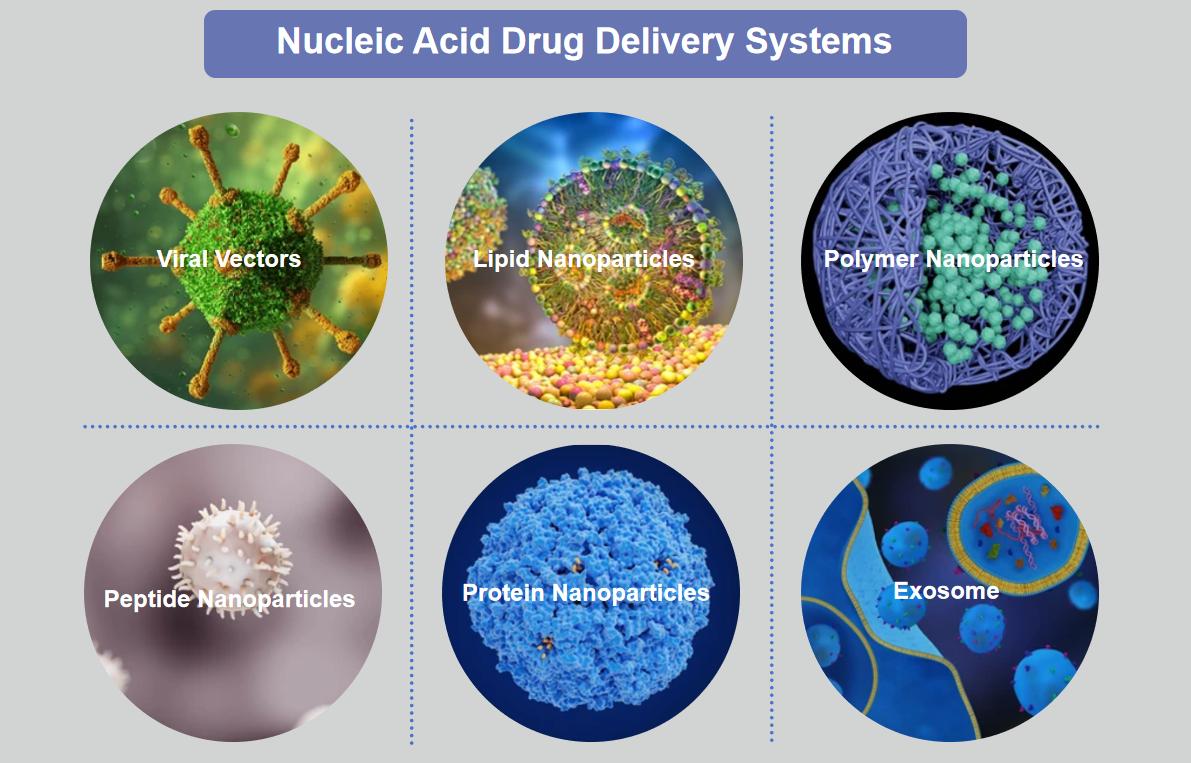

As an integrated pharmaceutical enterprise engaged in drug R&D, production, and sales, Yuekang Pharmaceutical has actively transitioned to the fields of nucleic acid drugs and innovative drugs [1]. This strategic transition reflects the company’s grasp of the cutting-edge technology development trends in the pharmaceutical industry. Nucleic acid drugs (including mRNA drugs and small nucleic acid drugs) have become important directions for global innovative drug R&D.

According to financial data [0]:

| Indicator | Value | Evaluation |

|---|---|---|

| Free Cash Flow (FCF) | 58,103,350 | Positive Cash Flow |

| Debt Risk Classification | Low Risk | Sound Finance |

| Accounting Policy Attitude | Neutral | Balanced and Prudent |

The company maintains good financial health, providing financial security for sustained R&D investment. The current R&D investment is in a reasonable range and has not caused significant financial pressure on the company.

As can be seen from the search results [1], Yuekang Pharmaceutical has established a relatively comprehensive nucleic acid drug R&D pipeline covering multiple innovative drug projects. The company continues to advance its transition to innovative drugs, and the R&D pipeline layout reflects an accurate grasp of market demand.

- R&D Expenditure Intensity: The company maintains continuous and stable R&D investment, which conforms to the development law of innovative pharmaceutical enterprises

- Capital Use Efficiency: Positive free cash flow indicates that R&D investment has not excessively consumed the company’s cash reserves

- Risk Control: The low debt risk classification shows that the company’s financial management is prudent

- Pipeline Progress: Multiple R&D projects are in different clinical stages

- Technological Innovation Capability: Substantial progress has been made in the construction of nucleic acid drug technology platforms

- Future Commercialization Potential: The nucleic acid drug market has broad prospects and large growth space

- Long R&D cycle and high uncertainty of nucleic acid drugs

- Fierce market competition requires sustained high-intensity investment

- Rapid technological iteration requires maintaining R&D leadership

- Rapid growth of the nucleic acid drug market

- National policies support the development of innovative drugs

- The company has mature industrialization capabilities

From the technical analysis perspective [0], the company’s stock is currently in a sideways consolidation phase (range of $19.93-$20.65), with a Beta value of 0.55 and relatively low volatility. The KDJ indicator shows a mild bullish signal, the MACD indicator shows a golden cross trend, and the overall technical side presents a neutral-to-bullish pattern.

During Yuekang Pharmaceutical’s transition to nucleic acid innovative drugs, the R&D investment matches the company’s financial bearing capacity, and the input-output ratio is in a reasonable range. The company has a financial foundation for sustained R&D investment, and the pipeline layout has commercial prospects. It is recommended to continue to pay attention to the milestone progress of the company’s R&D pipeline and the release of clinical trial data.

[0] Jinling API Financial Data - Financial Analysis and Technical Analysis Data of Yuekang Pharmaceutical

[1] Industry Public Information - Information on Yuekang Pharmaceutical’s Nucleic Acid Drug R&D Pipeline and Innovative Drug Transition

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.