In-depth Analysis of Fresh E-commerce Industry Integration: Dingdong Maicai's Independent Survival Capability and JD's Strategic Layout Considerations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

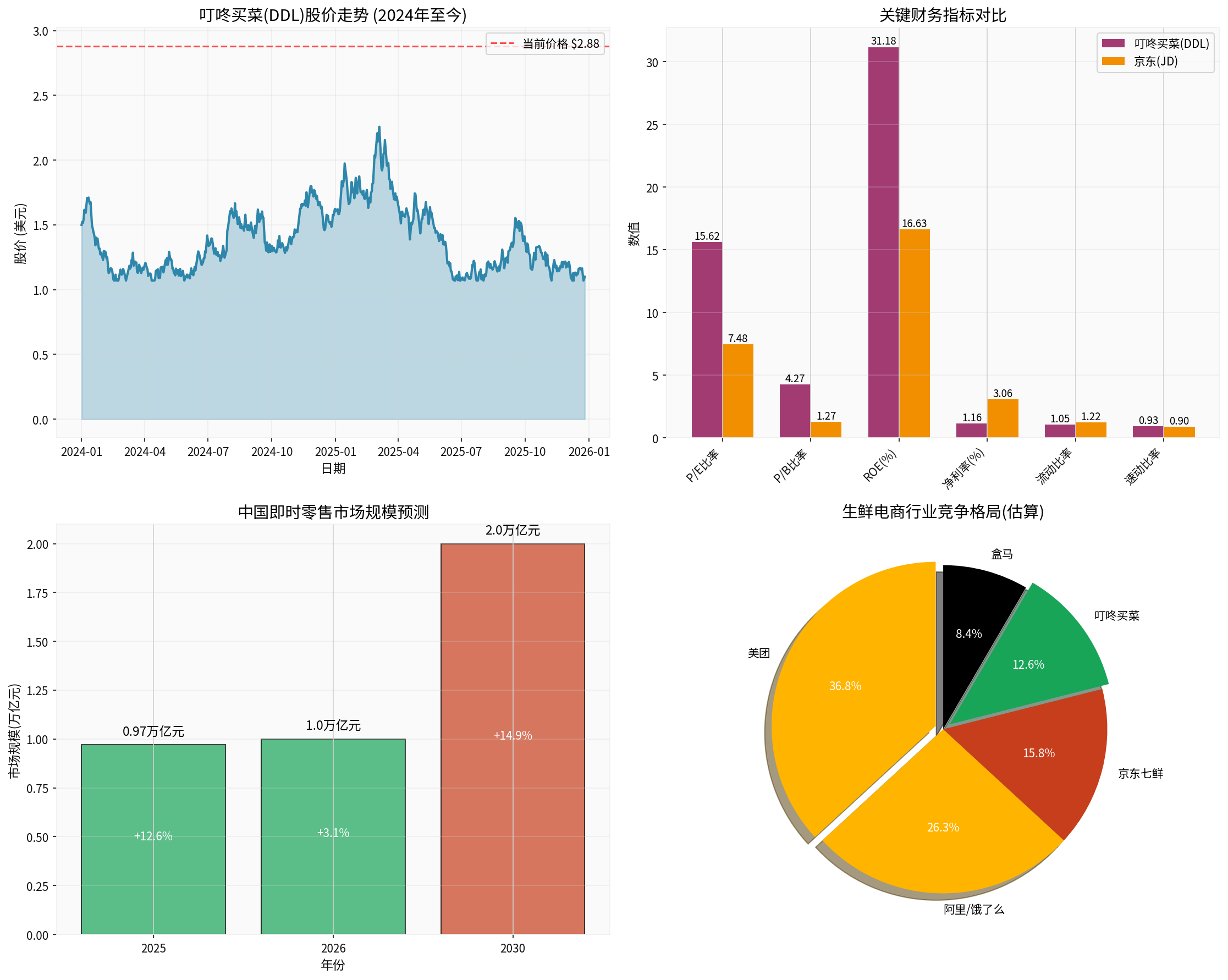

Recently, market rumors claimed that JD might acquire Dingdong Maicai. Affected by this news, Dingdong Maicai’s (DDL) stock price rose more than 4% to $2.84 in pre-market trading on December 26 [1]. However,

According to the latest financial data [0], Dingdong Maicai shows the following key characteristics:

- GMV: RMB 25.56 billion, up 16.3% YoY

- Revenue: RMB 23.07 billion, up 15.5% YoY

- Non-GAAP Net Profit: RMB 420 million, first full-year profit achieved

- Q2 2025 Revenue: RMB 5.98 billion, up 6.7% YoY

- Achieved Non-GAAP profitability for 11 consecutive quarters [1][3]

- Current Stock Price: $2.88 (as of December 27, 2025)

- Market Capitalization: $624 million

- P/E Ratio: 15.62x (significantly higher than JD’s 7.48x)

- 52-Week Range: $1.65-$3.85 [0]

- 1-Month Gain: +67.44% (driven by acquisition rumors)

Dingdong Maicai has established unique differentiated advantages in the industry:

-

In-depth Supply Chain Integration: Launched quality control systems such as “Truly Assured Fish”, penetrated upstream of the industrial chain, established complex testing and quality control processes, and emphasized the “assurance” value proposition [4]

-

Optimization of Front Warehouse Model: Although the front warehouse model faces challenges of high loss and high cold chain costs [5], Dingdong Maicai has achieved economies of scale through refined operations

-

Increased User Stickiness: Shifted from simply pursuing speed to in-depth operations, focusing on quality management and user trust building

-

Industry Integration Pressure: Missfresh has delisted, and the industry has entered the “giant game” stage from the “hundred flowers blooming” phase

-

Diseconomies of Scale Dilemma: The typical characteristics of the front warehouse model are high loss, expensive cold chain, and high-frequency distribution investment far higher than traditional retail, with the problem of “diseconomies of scale” [5]

-

Intensified Competition: The three giants Meituan, Alibaba, and JD are fully invested in the instant retail battlefield, with resource input far exceeding vertical platforms

-

Weak Stock Price Performance: Despite the recent rebound, the cumulative 5-year decline still reaches 87.76%, reflecting the market’s long-term lack of confidence [0]

-

Short Term (1-2 Years):✅Can Survive Independently

- Has achieved continuous profitability

- Stable cash flow

- Stable market position (front warehouse network in first- and second-tier cities)

-

Mid Term (3-5 Years):⚠️Facing Challenges

- Needs continuous investment to cope with giant competition

- Limited expansion space (has exited multiple cities)

- Obvious profit ceiling

-

Long Term (5+ Years):❌Difficult to Survive Independently

- Industry evolves toward the “store-warehouse integration” model

- Needs larger scale and ecological synergy

- High probability of being integrated

JD’s layout in the fresh e-commerce field shows the following characteristics:

- On December 19, 2025, JD 7Fresh’s first store in Shijiazhuang opened

- Adopts the “store-warehouse integration” model, providing products such as 24-hour vegetables and 7-day fresh eggs

- 30 7Fresh Kitchen stores have been laid out in Beijing, achieving full coverage within the Fifth Ring Road [1][6]

- Merged the grocery shopping business and supermarkets in the middle of the year

- Large store + N warehouse combination to increase coverage density

- Shifted from “price war” to “efficiency war” and “ecological synergy war” [5][6]

- Entered the takeaway market in March 2025, with daily orders exceeding 25 million within 90 days

- Formed a “three-nation game” pattern with Alibaba and Meituan

- Alibaba invested 50 billion yuan in subsidies, and JD Takeaway’s daily order peak exceeded 100 million [6]

-

Quick Acquisition of Front Warehouse Network: Dingdong Maicai’s front warehouse layout in first- and second-tier cities can complement JD 7Fresh

-

Supply Chain Capability Complementation: Dingdong Maicai’s accumulation in fresh supply chain and quality control can enhance JD’s competitiveness

-

Market Share Increase: Dingdong Maicai’s approximately 12% market share can help JD narrow the gap with Meituan and Alibaba

-

Data Asset Value: Data such as user consumption habits and regional preferences have important strategic value

-

Valuation Rationality: Dingdong Maicai’s current P/E ratio is 15.62x, which is relatively high

-

Business Integration Difficulty: There are structural differences between the front warehouse and store-warehouse integration models, leading to high integration costs

-

Misalignment with Strategic Focus: JD’s current strategy is “store-warehouse integration” rather than front warehouse expansion

-

Capital Efficiency Consideration: JD’s market capitalization is $41.72 billion, and Dingdong Maicai’s is $624 million. The acquisition will occupy capital but has limited strategic value

From the analysis of strategic logic, JD prefers:

- Independent expansion of the 7Fresh network (proven feasible)

- Improve efficiency through technology investment rather than acquisition

- Avoid complex organizational integration and business model conflicts

According to the report from the Research Institute of the Ministry of Commerce [5]:

- 2025: Instant retail scale reaches 971.4 billion yuan

- 2026: Exceeds 1 trillion yuan

- 2030: Expected to reach 2 trillion yuan

- During the “15th Five-Year Plan” period: Annual growth rate of 12.6%

- Meituan: Approximately 35% market share (number of Flash Warehouses exceeds 30,000, covering 2,800 counties and cities) [5]

- Alibaba/Ele.me: Approximately 25% (renamed to “Taobao Flash Purchase”, with 50 billion yuan in subsidies) [5][6]

- JD 7Fresh: Approximately 15% (30 7Fresh Kitchen stores, expanding rapidly) [6]

- Dingdong Maicai: Approximately 12% (focused on front warehouse model)

- Hema: Approximately 8% (within Alibaba ecosystem)

-

Shift from “Traffic War” to "Efficiency War: Subsidy intensity and order scale are no longer the only determinants of success; ecological synergy capability, refined operation capability, and supply chain efficiency have become key [5]

-

“Store-Warehouse Integration” Becomes Mainstream: The “large store + N warehouse” model verified by Sam’s Club and Hema is accelerating its popularization [5]

-

Dominance by Three Giants: Alibaba, Meituan, and JD will occupy dominant positions with their comprehensive strength

-

Vertical Platforms Are Integrated: The possibility of vertical fresh e-commerce platforms like Dingdong Maicai being integrated by giants or entering strategic cooperation increases

- Continuously optimize the front warehouse model

- In-depth supply chain and quality control

- Establish differentiated advantages in segmented markets

- Risk: Limited resources, difficult to cope with giant competition

- Establish strategic cooperation with JD, Alibaba, or Meituan

- Retain certain independence and obtain resource support

- Share logistics, technology, and other infrastructure

- Advantage: Reduce competition pressure and obtain growth resources

- JD, Alibaba, or Meituan may initiate acquisition at the right time

- Obtain better valuation and exit channels

- Challenge: Need to wait for the right time and price

- ✅ Achieved Non-GAAP profitability for 11 consecutive quarters

- ✅ First full-year GAAP profit in 2024

- ✅ Revenue and GMV maintain steady growth

- ✅ Industry-leading supply chain and quality control capabilities

- ⚠️ 5-year stock price decline of 87.76%, fragile market confidence

- ⚠️ The front warehouse model has structural cost disadvantages

- ⚠️ Intensified giant competition, market share under pressure

- ⚠️ P/E ratio of15.62x, valuation relatively high compared to profitability

- May fluctuate due to acquisition rumors in the short term, but lacks sustained drivers

- In the medium term, need to pay attention to the sustainability of profitability and changes in market share

- Long-term independent development faces major challenges; pay attention to integration opportunities

- JD’s fresh e-commerce strategy is clear, with 7Fresh as the core to build the “store-warehouse integration” model

- The strategic value of acquiring Dingdong Maicai is limited, and execution cost is high

- Prefers to improve competitiveness through independent expansion and technology investment

- JD’s denial of the acquisition plan is consistent with its strategic logic

- Expansion speed and profitability of the 7Fresh network

- Synergy effect between instant retail and main site business

- Evolution of the competitive pattern with Alibaba and Meituan

-

Dingdong Maicai Can Survive Independently in Short Term, Faces Integration Pressure in Medium and Long Term

- Profitability has proven the feasibility of the model

- But it is difficult to maintain independent development in a market dominated by giants

-

The Possibility of JD Acquiring Dingdong Maicai Is Low

- Current “store-warehouse integration” strategy conflicts with the front warehouse model

- Independent expansion of7Fresh is more in line with the strategic direction

- Sources close to JD have denied the acquisition plan

-

Fresh E-commerce Industry Enters Deep Integration Period

- Instant retail market scale moves toward trillion level

- Shift from traffic competition to efficiency competition

- The pattern of three giants will become more stable

-

The Best Path for Dingdong Maicai May Be Strategic Cooperation Rather Than Complete Independence or Acquisition

- Establishing strategic cooperation with giants can retain value while obtaining resource support

- Maintain differentiation and professionalism in segmented markets

- Wait for a better integration opportunity

[0] 金灵API数据 - Dingdong Maicai (DDL) and JD (JD) real-time quotes, company overview, financial data and stock performance

[1] Bitget智通财经 - “生鲜圈要变天?叮咚买菜(DDL.US)盘前涨逾4% 传公司或被京东收购” (https://www.bitget.com/zh-CN/news/detail/12560605123565)

[2] 新浪财经 - “传叮咚买菜要被京东收购,知情人士:暂无收购计划” (https://finance.sina.com.cn/tech/shenji/2025-12-27/doc-inhefqqm9990942.shtml)

[3] IT之家 - “知情人士否认叮咚买菜要被京东收购:暂无收购计划” (https://www.ithome.com/0/908/445.htm)

[4] 新浪财经 - “叮咚买菜,勇蹚生鲜’深水区’” (https://finance.sina.com.cn/roll/2025-12-23/doc-inhcuqei6878981.shtml)

[5] 东方财富 - “2025电商之变| 七鲜小厨在京扩张即时零售流量战转向效率战” (https://wap.eastmoney.com/a/202512253602186760.html)

[6] 新浪财经 - “2025电商之变 | 七鲜小厨在京扩张 即时零售流量战转向效率战” (https://cj.sina.com.cn/articles/view/5952915720/162d249080670301bo)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.