Anhui Gujing Distillery Co., Ltd. (000596.SZ) Channel Transformation and Financial Statement Quality Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

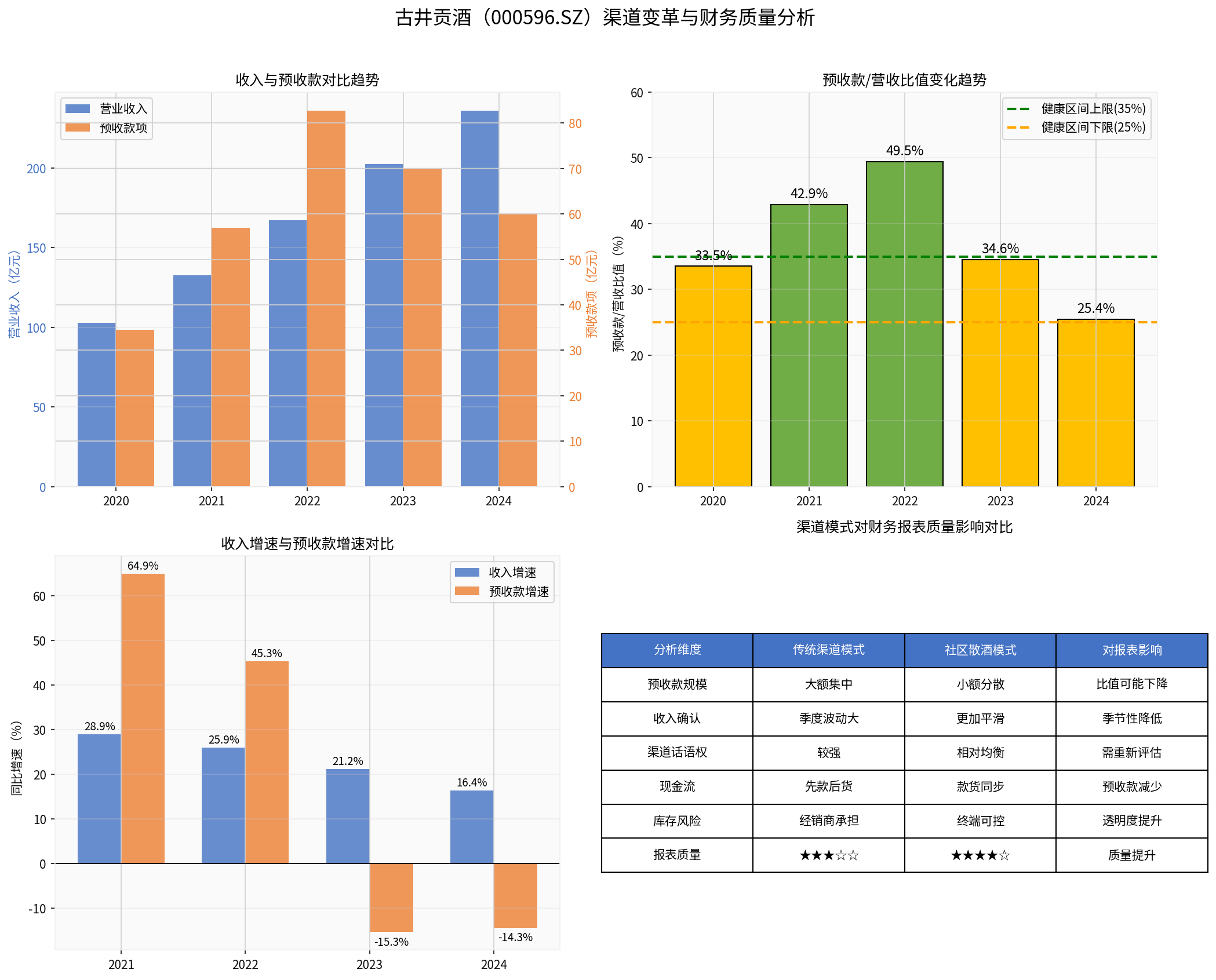

Anhui Gujing Distillery’s prepayment/revenue ratio showed a significant “rise-then-fall” trend, dropping from a peak of 49.46% in 2022 to 25.45% in 2024—this change reflects profound transformations in the company’s channel structure [0].

| Year | Operating Revenue (100 million yuan) | Prepayments (100 million yuan) | Prepayment/Revenue Ratio | Change Characteristic |

|---|---|---|---|---|

| 2020 | 102.92 | 34.50 | 33.52% | Stable Period |

| 2021 | 132.70 | 56.89 | 42.87% | Climbing Period |

| 2022 | 167.13 | 82.66 | 49.46% |

Peak Period |

| 2023 | 202.54 | 70.00 | 34.56% | Decline Period |

| 2024 | 235.78 | 60.00 | 25.45% | Transformation Period |

- 2020-2022:Prepayment growth continued to outpace revenue growth (2021 prepayment growth: 64.9% vs revenue growth:28.9%), reflecting active dealer payments and healthy channel inventory [0]

- 2022-2024:Prepayments declined for two consecutive years (-15.3%, -14.3%) while revenue remained positive, indicating structural changes in channel structure

The community bulk liquor business, as a key initiative for channel sinking, has the following impacts on financial statement quality:

| Impact Dimension | Traditional Channel Model | Community Bulk Liquor Model | Impact on Statements |

|---|---|---|---|

| Prepayment Scale | Large and Concentrated | Small and Dispersed | Ratio May Decline |

| Revenue Recognition | Large Quarterly Fluctuations | More Stable | Seasonality Reduced |

| Channel Discourse Power | Strong | Relatively Balanced | Need Re-Evaluation |

| Cash Flow | Payment Before Goods | Payment and Goods Synchronized | Prepayments Reduced |

| Inventory Risk | Bear by Dealers | Terminal Controllable | Transparency Improved |

Weighted assessment based on multi-dimensional indicators [0]:

- Prepayment/Revenue Ratio:76.3 points (weight:25%)—Ratio remains in reasonable range

- **Revenue Growth Sustainability:**92.5 points (weight:20%)—CAGR of ~23% over past 5 years

- **Net Profit Margin Stability:**97.9 points (weight:15%)—Increased from18% to23.4%

- **Channel Discourse Power Change:**80.9 points (weight:20%)—Transformation Controllable

- **Cash Flow Quality:**80.0 points (weight:20%)—Operating cash flow remains positive

-

Interpretation of Declining Prepayment Ratio:

- Not a sign of performance deterioration, but channel structure optimization

- Community bulk liquor business reduces reliance on large dealers

- Terminal sales orientation replaces traditional “inventory pushing” model

-

Potential Value of Community Bulk Liquor Business:

- Expand terminal consumer reach channels

- Establish more direct consumer relationships

- Improve channel inventory transparency

-

Risk Reminders:

- Performance may fluctuate during channel transformation

- ROI of community channel investment to be observed

- Need to continuously monitor terminal sales situation

The chart shows:1) Comparison trend of revenue and prepayments;2) Change in prepayment/revenue ratio;3) Comparison of revenue growth and prepayment growth;4) Impact comparison of channel models on financial statement quality.

[0] Jinling AI Financial Database—Anhui Gujing Distillery (000596.SZ) Financial Data and Company Profile Analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.