Analysis of Valuation Repair Space for Jiangxi Copper Under the Background of a Surge in the Non-Ferrous Metals Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

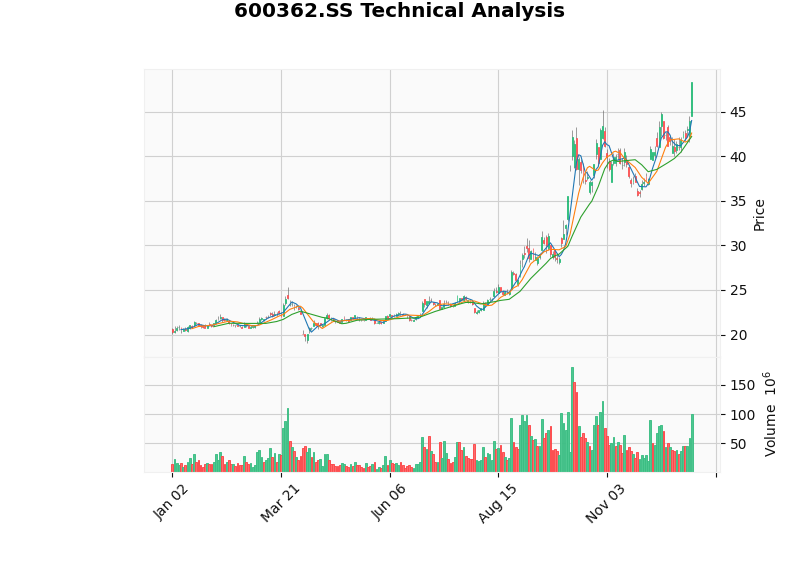

Jiangxi Copper (600362.SS) performed strongly today, closing at $48.31 with a single-day increase of 10.00% and a turnover of 10.242 billion yuan, significantly higher than the average level of 6.053 billion yuan [0]. From a technical analysis perspective, the stock is in a clear uptrend, with a buy signal appearing on December 22. It currently faces a resistance level of $48.31, with the next target level at $50.24 and a support level at $42.59 [0].

Over a longer period, Jiangxi Copper has shown an extremely strong upward trend. Its year-to-date increase has reached 138.69%, with a 54.35% increase in the past three months, 29.59% in the past month, and 130.60% in the past year [0]. This sustained sharp rise reflects the market’s optimistic expectations for copper price prospects and the repricing of the company’s fundamentals.

According to the latest market data, copper prices have broken through the important psychological threshold of $12,000 per ton, and 2025 is expected to be the best-performing year since 2009 [1]. The global copper market is facing major changes, with supply-demand imbalances increasingly intensifying. China’s changing role in the global copper market and uncertainties in international trade policies have jointly driven the rise in copper prices.

The supply side faces multiple constraints. New global copper mine capacity cannot be effectively released in the short term, and the problem of insufficient investment in new capacity is increasingly prominent. Major copper-producing countries face multiple pressures such as declining resource grades, rising mining costs, and stricter environmental protection policies, leading to a significant decline in supply elasticity. This rigid constraint on the supply side provides solid support for copper prices.

From the perspective of the inventory cycle, copper is in a critical stage of transition from active inventory replenishment to passive inventory replenishment. Global copper inventories are at historical lows, and inventory replenishment demand will provide additional upward momentum for copper prices [1]. At the same time, the rapid development of the new energy industry is reshaping the demand structure of copper.

The new energy vehicle industry is an important engine for copper demand growth. Each new energy vehicle consumes an average of about 80 kg of copper, which is 3-4 times that of traditional fuel vehicles. With the continuous increase in the penetration rate of new energy vehicles globally, the new energy vehicle sector alone will add hundreds of thousands of tons of copper demand every year. In addition, the construction of renewable energy facilities such as photovoltaics and wind power also requires a large amount of copper materials, and the development of grid upgrades and energy storage systems will further expand the application scenarios of copper.

The booming development of the artificial intelligence industry also brings new growth points for copper demand. Factors such as data center construction, grid infrastructure upgrades, and accelerated electrification process jointly support the long-term demand growth of copper.

From a financial analysis perspective, Jiangxi Copper shows characteristics of aggressive accounting treatment, with a low ratio of depreciation to capital expenditure, which means that the upside potential of reported earnings may be limited [0]. The latest free cash flow data shows a negative value of about -4.08 billion yuan, reflecting that the company is facing greater capital expenditure pressure during the expansion period.

The company’s core profit indicators show that the P/E ratio is about 20.84 times, the P/B ratio is 2.04 times, and the P/S ratio is only 0.32 times [0]. From the perspective of the price-to-sales ratio, the company’s valuation is at a low level, which provides a certain safety margin for the stock price. However, the net profit margin and operating profit margin are only 1.54% and 1.91% respectively, and the profitability is relatively limited, which is mainly受制于 copper price fluctuations and changes in raw material costs.

Financial analysis shows that Jiangxi Copper’s debt risk is at a medium level [0]. The company’s current ratio is 1.21 and quick ratio is 0.82, indicating that short-term solvency is basically stable, but the low quick ratio means that it may face certain liquidity pressure in extreme cases. Considering comprehensively, the company’s financial situation is generally controllable, but it is necessary to pay close attention to changes in debt costs during the copper price fluctuation cycle.

According to the discounted cash flow valuation model, the valuation range corresponding to Jiangxi Copper’s current stock price of $48.31 is as follows [0]:

| Scenario | Intrinsic Value | Deviation from Current Price |

|---|---|---|

| Conservative | $31.18 | -35.5% |

| Base | $41.00 | -15.1% |

| Optimistic | $57.11 | +18.2% |

| Weighted Average | $43.10 | -10.8% |

From the perspective of DCF valuation, the current stock price is significantly higher than the intrinsic value, suggesting that the market may have fully priced in the expectation of copper price increases. However, the DCF model has a certain lag and fails to fully reflect the profit improvement expectations brought by the breakthrough rise in copper prices.

From a comprehensive assessment of multiple dimensions, the valuation repair space of Jiangxi Copper needs to be viewed dialectically:

##5. Investment Recommendations and Risk Warnings

Considering comprehensively the copper price trend, supply-demand pattern, company fundamentals and technical factors, the valuation repair space of Jiangxi Copper presents the following characteristics:

In the short term, after breaking through the resistance level of $48.31, the next target level for the stock price is $50.24, with an upward space of about 4% [0]. Considering the fundamental support of continuous copper price increases and the sustained high market sentiment, the stock price is expected to challenge the range of $55-$60.

In the medium term, if copper prices can stabilize above $12,000 per ton, combined with the continuous realization of new energy demand growth, the company’s profitability is expected to improve significantly. Based on the current copper price calculation, the company’s profit expectations may exceed the base assumptions of the DCF model, thereby supporting a higher valuation level.

Investors need to pay attention to the following risk factors: Risk of copper price correction - if global economic growth is lower than expected or the supply side releases more than expected, it may lead to a fall in copper prices, thereby affecting the company’s profits and stock price; Risk of valuation correction - the current stock price is significantly higher than the DCF valuation range, and technical indicators show overbought, so there is a need for valuation repair; Exchange rate risk - the company’s business involves international trade, and fluctuations in the RMB exchange rate may affect its performance denominated in US dollars; Policy risk - changes in trade policies and adjustments in export tariffs may affect the company’s profits.

As a leading domestic copper enterprise, Jiangxi Copper benefits from the dual positives of rising copper prices and growing new energy demand, with considerable valuation repair space. From a conservative assessment, the current stock price has partially discounted the expectation of copper price increases, and the upward space is relatively limited; but from an optimistic analysis, if copper prices can maintain high levels or even rise further, the company’s valuation still has room to expand upward. It is recommended that investors closely monitor copper price trends and changes in the company’s fundamentals, look for layout opportunities during corrections, and at the same time do a good job in risk control and set reasonable stop-loss levels.

[0] Gilin API Data - Jiangxi Copper Real-time Quotes, Company Overview, Technical Analysis and DCF Valuation Data

[1] Bloomberg - “Copper Tensions Run High With Global Market at ‘Historic Point’” (https://www.bloomberg.com/news/articles/2025-11-28/copper-tensions-run-high-with-global-market-at-historic-point)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.