Lithium Industry Market Analysis 2026: Transition to Energy Storage Demand

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and industry information, I provide the following comprehensive analysis:

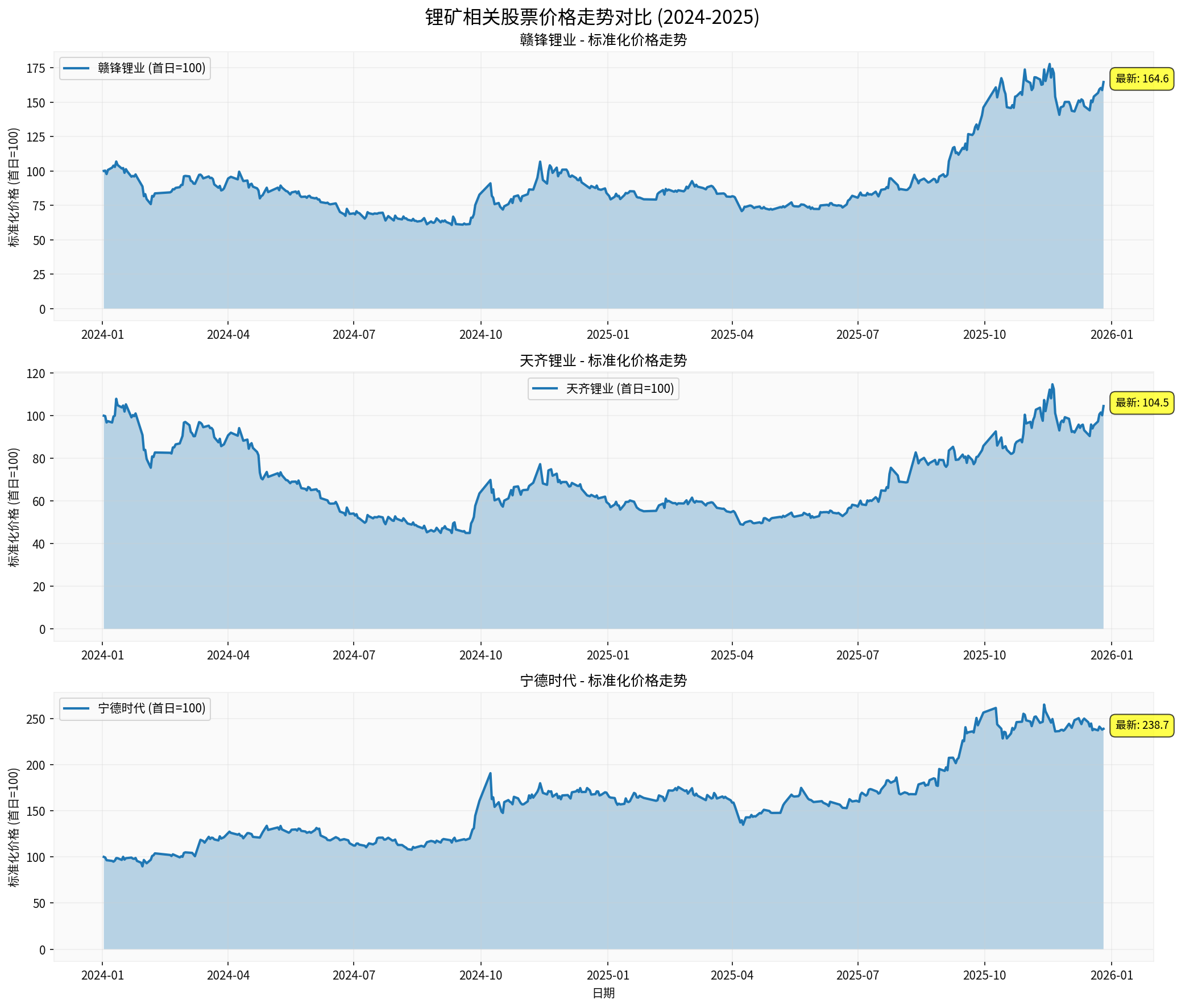

- Ganfeng Lithium (002460.SZ):Today rose sharply by +3.69% to 68.57 yuan, with a cumulative increase of 95.24% over the past 6 months and a year-to-date increase of 64.55%[0]

- Tianqi Lithium (002466.SZ):Today rose by +4.32% to 57.93 yuan, with a 73.81% increase over the past 6 months, but only +4.53% year-to-date[0]

- Both stocks are in an uptrend (to be confirmed),but KDJ and RSI indicators both showoverbought risks[0]

- Ganfeng Lithium’s K value reaches 83.9, Tianqi Lithium’s K value reaches 82.8—both are in the overbought range

- The risk of chasing highs in the short term is relatively high; it is recommended to wait for a pullback opportunity

Both lithium giants are currently in a

| Company | P/E Ratio | Net Profit Margin | ROE | Current Ratio |

|---|---|---|---|---|

| Ganfeng Lithium | -99.60x | -7.18% | -3.41% | 0.73 |

| Tianqi Lithium | -46.94x | -19.46% | -4.82% | 3.18 |

Despite the sharp rise in stock prices,

- The market expects production to resume around the Spring Festival, which will increase supply pressure[1]

- Costs for spodumene and mica lithium extraction range from 36,000 to 81,000 yuan/ton, and supply is relatively flexible

- Web searches show that lithium mine capacity may continue to be released in 2025-2026

- Some analysts warn that next year’s lithium supply growth rate may still exceed demand growth rate[1]

- China’s auto market sales fell by a rare 8% in November, facing growth pressure next year[2]

- Tesla’s global delivery volume is expected to decrease by about 9% year-on-year in 2025 and remain roughly flat in 2026[2]

- The effect of the trade-in subsidy policy is gradually weakening

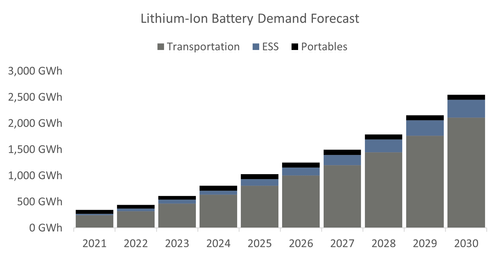

- Demand for lithium in the energy storage sector may grow by 55%in 2026, far exceeding the 19% increase in the electric vehicle sector[1]

- Institutions such as Citi, UBS, and Bernstein predict that the global lithium market may face a supply shortagesituation in 2026[1]

- The chairman of Tianqi Lithium expects that global lithium demand will reach 2 million tonsof lithium carbonate equivalent in 2026[1]

- Technical overbought: KDJ and RSI both show overbought signals; there is a need for a pullback in the short term[0]

- Increased supply: CATL’s lithium mine resumption will increase supply

- Seasonal demand lull: Q1 is usually a slow season for new energy vehicle sales

- Judgment: Lithium carbonate prices are likely to fluctuate at current levels, and lithium stocks will follow the adjustment

- Explosive growth in energy storage demand (+55%) becomes a new core driver[1]

- The supply-demand structure is expected to improve in 2026, with the market expecting a “shift from surplus to shortage”[1]

- Leading companies’ competitive advantages are strengthened, and profit margins start to recover[2]

- Slowdown in electric vehicle growth (expected +19%)[1]

- Capacity is still being released, and short-term supply pressure remains

- Macroeconomic downward pressure

- Not recommended to chase highs: Current technical indicators are overbought, with short-term pullback risks[0]

- Watch for pullback opportunities: If stock prices pull back by 10-15%, consider building positions in batches

- Key Targets: Ganfeng Lithium (dual advantages in technology and energy storage), Tianqi Lithium (high resource self-sufficiency rate)

- Core Logic: Shift from “EV-driven” to “energy storage-driven”[1]

- Key Indicators: Monitor energy storage installed capacity, energy storage cell prices, and the proportion of energy storage business in enterprises

- Time Node: Q2-Q3 2026 may be the period for confirming the supply-demand inflection point

- Supply Risk: CATL’s lithium mine resumption, unexpected release of new capacity

- Demand Risk: EV sales below expectations, energy storage installed capacity below expectations

- Policy Risk: The U.S. Trump administration may relax fuel efficiency standards and revoke electric vehicle incentive policies[1]

- Technology Risk: Accelerated commercialization of new technologies such as solid-state batteries may reduce lithium demand

-

Short-term (1-3 months):Volatile consolidationis more likely. Under the triple pressures of technical overbought, increased supply, and seasonal demand lull, the sector needs time to digest previous gains.

-

Mid-to-Long Term (2026):Structural opportunitiesexist. The explosive growth of energy storage demand (+55%) will become a new core driver, which is expected to push the market back to supply-demand balance or even shortage in 2026[1].

-

Investment Rhythm: It is not appropriate to chase highs now; it is recommended to wait for a technical pullback before deploying. Focus on leading enterprises withhigh energy storage business proportion and obvious cost advantages.

[0] 金灵API数据 (股票价格、财务数据、技术分析)

[1] Yahoo财经 - “儲能需求大爆發!鋰價告別低谷2026年可望將「由供轉缺」” (https://hk.finance.yahoo.com/news/儲能需求大爆發-鋰價告別低谷-2026年可望將-由供轉缺-130003982.html)

[2] Yahoo财经 - “中國11月車市銷量罕見降8% 明年恐面臨成長壓力” (https://hk.finance.yahoo.com/news/中國11月車市銷量罕見降8-明年恐面臨成長壓力-002130255.html)

[3] Yahoo财经 - “交車量不再主導股價特斯拉長期計畫成焦點” (https://hk.finance.yahoo.com/news/交車量不再主導股價-特斯拉長期計畫成焦點-060002659.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.