Analysis of Investment Opportunities and Timing in Hong Kong Stock Market's Consumer Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on your question, I have systematically analyzed the investment opportunities in the Hong Kong stock market’s consumer sector for you.

-

CICC: Maintains the Hang Seng Index’s 2026 base scenario target at 28,000-29,000 points, with an optimistic scenario looking up to 31,000 points (potential upside of approximately 7%-19% from current levels). The bank expects earnings growth of 3%-4% and a slight valuation increase, recommends allocating to Chinese high-dividend stocks and AI-related stocks, and is optimistic about sectors like innovative drugs [1].

-

China Merchants Securities International: Hong Kong stocks are expected to shift from “valuation repair” to being led by “earnings growth”; the bank recommends first choices for Q1 2026 including new consumer targets like Pop Mart (09992.HK), while also being optimistic about traditional consumer sectors such as automobiles and education [2].

-

McKinsey: China’s consumption shows structural differentiation. The total retail sales in 2024 are expected to grow by about 4%, but there are significant differences between different categories, channels, and city levels. Home appliances and electric vehicles performed well under subsidy policies; food and beverages, tourism, and service consumption are strong, while non-essential consumption growth is weak [3].

-

Pop Mart (09992.HK): One of China Merchants Securities International’s top picks for Q1 2026 [2]. As a leader in the trendy toy industry, the company benefits from the upgrade of “self-pleasing consumption” among young groups and IP monetization capabilities.

-

Xiaomi Group (01810.HK): Continues to advance the “full ecosystem of people, cars, and homes”; mobile phone shipments are recovering, and the auto and AIoT businesses form new growth engines. Brokerages and media generally recognize the revenue contribution and ecosystem synergy brought by its electric vehicle volume growth in 2025.

- Brand premium and IP-driven pricing power

- Young customer base and social fission effect

- Online-offline integration and digital operation capabilities

- Sports Apparel(e.g., Anta Sports 02020.HK): Domestic brand substitution and global channel expansion

- Food and Beverages: Healthization, functionalization, and high-endization

- Automotive Industry Chain: Intelligent electrification, localization of parts (institutions are optimistic about the profit certainty of related targets) [2]

- The pace of fundamental repair varies; some leading companies see a resonance between performance and valuation recovery

- Relatively low valuation, with attractive safety margins and potential dividend returns

-

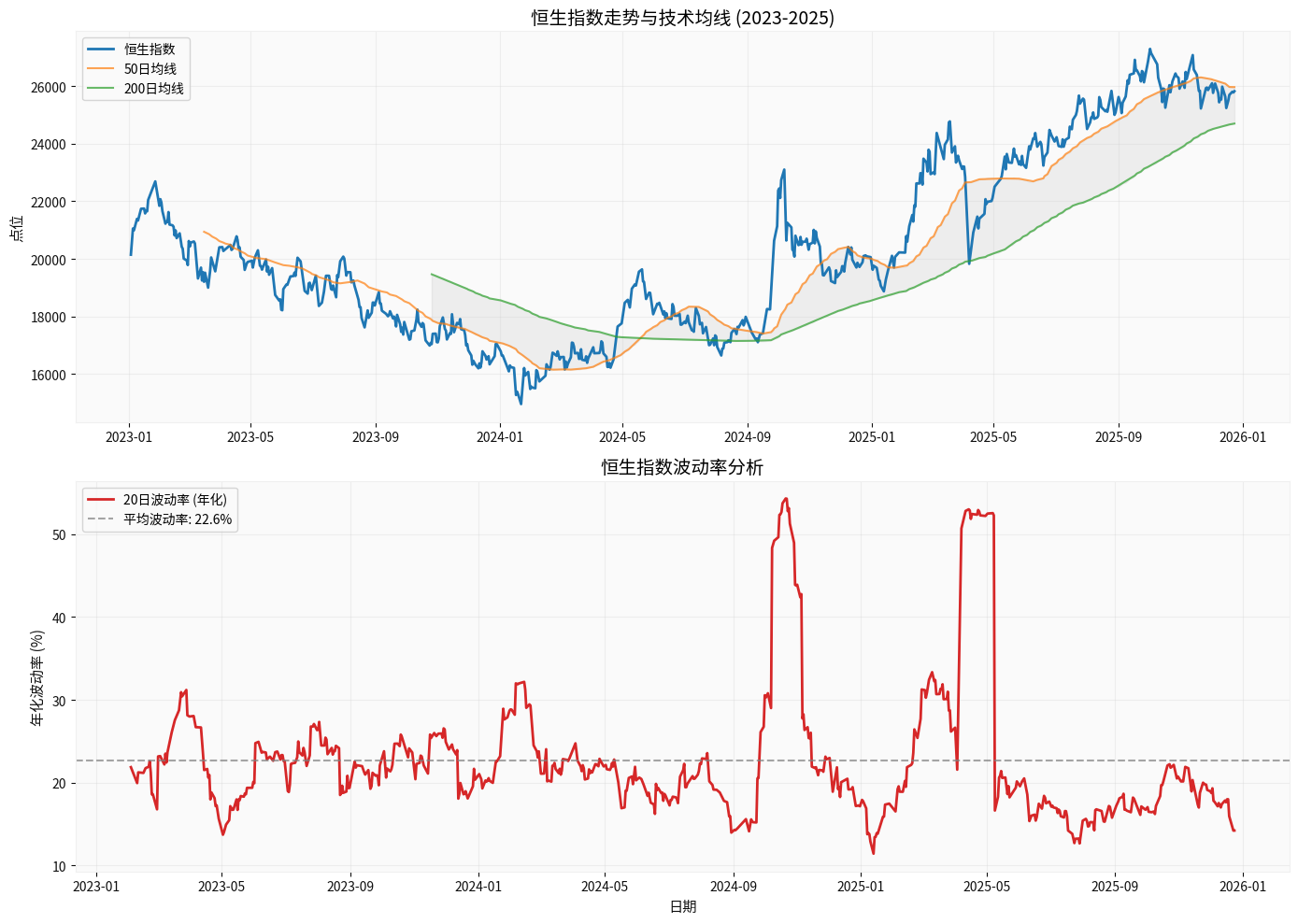

Valuation Repair Space: Although the Hang Seng Index has risen significantly since 2024, the valuation of consumer sub-sectors is still in a historically relatively low range compared to the long-term average, providing a basis for valuation repair.

-

Policy and Capital Side: The monetary policy environment is relatively loose, coupled with the inflow of southbound funds and some overseas funds, providing liquidity support for the market; fiscal subsidies and consumption promotion policies are beneficial to related categories.

-

Earnings Improvement Expectations: In the drive shift from “valuation repair → earnings growth”, leading companies are expected to realize earnings elasticity through market share expansion and cost optimization.

-

Macro Uncertainties: The interest rate path of major global central banks, geopolitics, tariffs, and trade policies may affect risk appetite and capital flows.

-

Differentiated Consumption Recovery: The pace of repair in employment and income expectations varies, and non-essential consumption demand recovery may be slow.

-

Market Sentiment and Liquidity: Short-term volatility increases in some sectors after previous gains; if capital flows tighten periodically, high-beta varieties are more sensitive.

- One end allocates leading companies with stable fundamentals, low valuation, and high dividend rates (some traditional consumer, high-dividend targets)

- The other end allocates new consumer and innovative leaders with outstanding growth and long-term tracks (like Pop Mart, etc.)

- New Consumption: Trendy toy IP, experience-based consumption, digital retail, and related supply chains

- Traditional Consumption: Healthy food and beverages, sportswear and functional products, intelligent electric vehicle industry chain

- Gradually build positions, add to high-quality targets on dips

- Pay attention to the calibration of earnings expectations during the financial report season

- Maintain cross-industry and cross-market diversification to reduce single-track risks

The overall valuation of the Hong Kong stock market’s consumer sector is still attractive, but sub-sectors are significantly differentiated. Now is not the best starting point for a “universal rise”, but a

- New Consumption: Stronger long-term growth and story logic, suitable for tracking core targets from a medium-to-long-term perspective

- Traditional Consumption: Higher safety margins and potential dividend returns, suitable for configurations pursuing stable returns and valuation repair opportunities

It is recommended to adopt a “barbell” allocation based on your own risk tolerance and investment horizon, dynamically optimize the portfolio in combination with policy and fundamental changes, and seize the structural opportunities in Hong Kong’s consumer sector.

[0] Gilin API Data — Hang Seng Index Real-time and Historical Quotes, Valuation and Volatility

[1] Yahoo Finance Hong Kong — “CICC: Hang Seng Index’s Most Optimistic 31,000 Next Year, Looking Forward to Mainland Policy Support for Fundamentals”

https://hk.finance.yahoo.com/news/中金-恒指明年最乐观31000-憧憬内地政策发力基本面有支持-182300712.html

[2] Yahoo Finance Hong Kong — “Major Bank: China Merchants Securities Expects U.S. Economy to Maintain Moderate Growth Next Year; Hong Kong Stocks Will Move Toward Earnings Growth Leadership”

https://hk.finance.yahoo.com/news/大行-招商证券料美国明年经济保持温和增长-港股将迈向盈利增长主导-021730564.html

[3] Yahoo Finance Hong Kong — “McKinsey Analyzes China Market! Answers the 4 Key Questions Global CEOs Care Most About and the Keys to Consumption Growth”

https://hk.finance.yahoo.com/news/麦肯锡解析中国市场-解答全球执行长最关心的4大问题与消费成长关键-093005361.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.