Liquor Industry Cycle Bottom Judgment and Luzhou Laojiao's Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

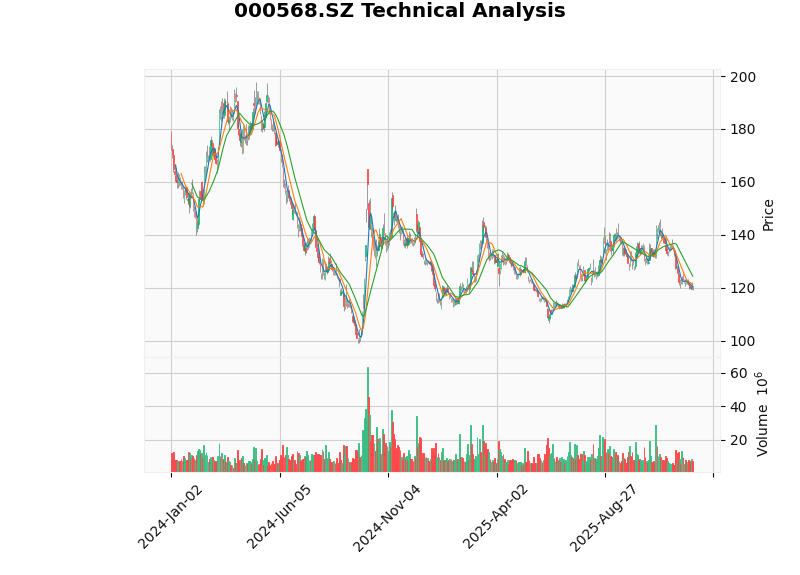

Price and Trend: From the stock price performance since 2024, leading companies in the industry have seen significant vertical declines (Luzhou Laojiao down 33.4% in this cycle, Moutai -17.5%, Wuliangye -21.8%). In the short term, they are consolidating within their respective broad ranges. Especially, Luzhou Laojiao is in a sideways range of 119-124 yuan. MACD has not diverged, but KDJ/RSI both point to the oversold zone, indicating that selling pressure has temporarily been released but a reversal has not yet been confirmed. This is a typical “sideways accumulation” in the late cycle [0].

-

Profit and Cash Flow: Despite short-term sales pressure, Luzhou Laojiao still maintained a high ROE (26.1%), net profit margin of 42%, and strong cash generation capacity in 2024. This indicates that it still has solid profitability even as the concentration of high-end liquor declines. Healthy cash flow (FCF ≈18 billion yuan) provides a financial buffer for the “cycle bottom” [0].

-

Price War and Social Inventory: Currently, Moutai’s high social inventory resonates with the overall economic downturn, forcing the industry to offer wide-ranging price concessions. The “performance clearance” led by Wuliangye has triggered price drops in core areas. It is expected that the price range of high-end liquor will narrow before the supply-demand margin improves. If inventory and channel digestion speed are slightly better than expected in the next two quarters, inventory replenishment and policy support are expected to form an “accumulation + inflection point”. Attention should be paid to the sales/inventory ratio and inventory turnover improvement after price stabilization.

-

Cycle Bottom Judgment Logic: Combining price, demand, cash flow, and channel inventory, when three conditions are met simultaneously: ① Stock price hovers near previous support levels, technical indicators are oversold and gradually diverge; ② Cash flow remains positive with no signs of asset impairment; ③ Price war shows “asymmetric competition” (trading market share for sales volume instead of universal price cuts), it can be considered close to the cycle bottom. If Moutai and Wuliangye’s price ranges start to stabilize, core SKUs resume positive pricing, plus seasonal recovery in high-end domestic sales and gift-giving demand, the bottom signal will be more clear.

-

Performance Smoothing and Regional Deepening: Management smoothed the financial statements to maintain profitability after high-end sales declined, while focusing on protecting core regions. Wuliangye proposed strengthening marketing in Luzhou Laojiao’s core regions, indicating that industry leaders are adopting a relatively “encirclement” strategy. Luzhou Laojiao needs to improve single-bottle prices and increase channel inventory through product portfolio (e.g., Touqu/Guojiao 1573) to maintain bargaining power in competition.

-

Price War Response: Luzhou Laojiao adopts a “volume and price increase” strategy in concentrated cities, i.e., promoting through segmented channels (such as custom gift boxes, member selection, experience stores) without triggering full-scale price cuts, avoiding direct price reduction compared to Wuliangye, turning the price war into a “differentiated demand war”. At the same time, maintaining the scarcity of high-end products and matching the “official price + channel quota” strategy helps buffer gross profit erosion from universal industry price cuts.

-

Channel and Social Inventory Management: Under dual crises, management needs to prevent price war transmission to terminals through more refined dealer level management and inventory monitoring. Respond to Wuliangye’s “clearance” strategy by adjusting sales rhythm, while accelerating terminal payment collection and inventory turnover to ensure stable capital chain.

-

Fundamentals and Valuation: Luzhou Laojiao’s current price is about 119.4 yuan, with a 13.9x TTM P/E ratio and 26.1% ROE, showing strong profitability but significantly compressed valuation [0]. Technical indicators suggest oversold in the sideways range; if the industry shows marginal improvement, it is expected to attract valuation repair space.

-

DCF Scenario Analysis: DCF provides three scenarios: conservative scenario target price 194.8 yuan (+63%), base scenario 249.9 yuan (+109%), optimistic scenario 381.6 yuan (+220%), weighted value 275.4 yuan, indicating current price is already conservative for its future cash flow; long-term signal is below reasonable range; if revenue can recover annual growth above 17% and maintain high gross profit, valuation repair space is significant [0].

-

Volatility and Risk Points: Need to警惕 economic slowdown leading to delayed terminal demand recovery, cyclical回升 of high-end channel inventory, and policy regulation. If short-term price war intensifies, it may lower gross profit margin and trigger profit decline. If controllable, current price has low-position absorption value; if price war gets out of control, consider waiting for further confirmation; if price range stops falling and core channels return to normal, it has significant dual drivers of growth + valuation repair.

- Luzhou Laojiao Price and Technical Indicators Chart

X-axis is daily trading days from 2024 to 2025, Y-axis is stock price (yuan). Red and green K-lines show price fluctuations, with RSI and KDJ indicators attached, showing current price is at the lower part of historical range; technical indicators are oversold, suggesting attention to whether short-term cumulative buying appears as a relay. Data source: Jinling AI Brokerage API [0].

- Cycle Perspective: The liquor industry is currently in the “price震荡 + inventory de-stocking” stage. If high-end price ranges stop falling and inventory turnover recovers moderately, it can be regarded as a bottom signal; short-term attention can be paid to dealer inventory at the end of Q4 and price stability after promotions.

- Luzhou Laojiao Strategy: Based on high profitability and cash flow, it resists price wars through regional refined operations, differentiated pricing, and gift strategies, while continuing to maintain stable financial statements, helping to守住 core profits in competition.

- Investment Value: Current price is significantly lower than DCF scenarios; its profitability and cash flow level still support long-term value; it is recommended to build positions in batches before industry inflection point confirmation, and closely monitor inventory/price signals. If the market enters deep price war or macro demand continues to shrink, consider waiting for further confirmation; if price range stops falling and core channels return to normal, it has significant dual drivers of growth + valuation repair.

[0] Jinling API Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.