4% Dividend Yield Valuation Rule for A-Share Utilities: Applicability Analysis and Framework Reconstruction

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on current market data [0] and the latest interest rate environment analysis [1], I will systematically address this valuation methodology question.

According to the latest market data, China’s 10-year government bond yield is currently in a historical low range of around

- Uneven economic recovery and weak consumption

- Persistent pressure on the real estate market

- Persistent deflationary pressure

- Expectations of loose monetary policy from the central bank

The “4% Rule” uses the

Critical Dividend Yield = Risk-Free Rate + Equity Risk Premium

In the current environment: 1.7% + 2.3% ≈4%

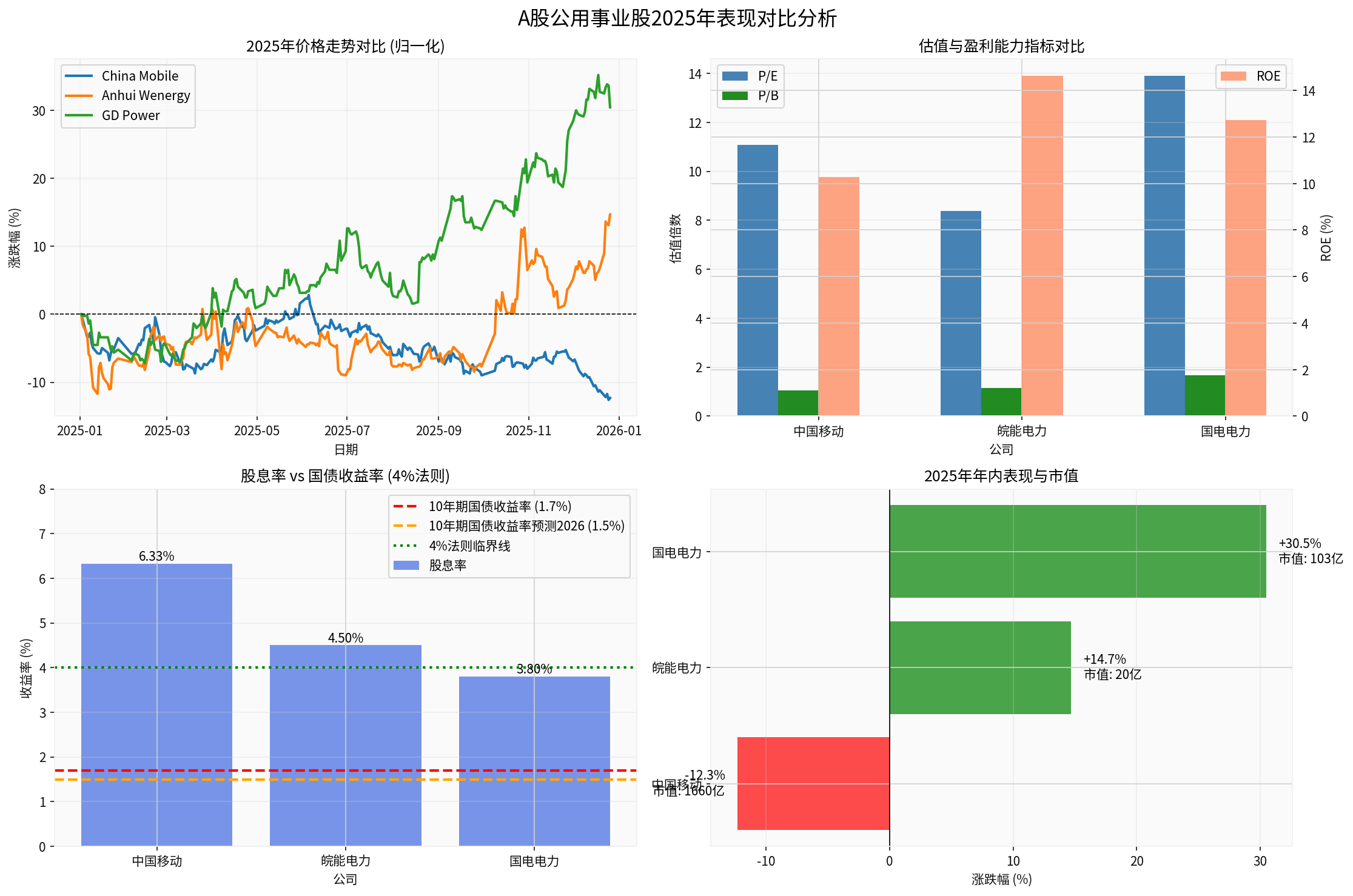

- Current Price: 100.84 CNY

- Dividend Yield: ~6.33%

- P/E Ratio:11.08x

- P/B Ratio:1.05x

- ROE:10.27%

- YTD Performance: -12.31%

- ✅ Generous Dividend Yield:6.33% far exceeds government bond returns

- ✅ High Dividend Stability:Adequate cash flow and stable dividend payout ratio

- ✅ Valuation in Reasonable Range:P/B close to 1x, limited downside potential

- ⚠️ Slowing Growth Expectations:The communication industry has entered a mature stage, and capital expenditure pressure remains

- ⚠️ Weak Stock Price Performance:12.31% YTD decline reflects market concerns about growth

- ⚠️ Long Payback Period for 5G Investment:Capital expenditure will continue to suppress free cash flow

- ✅ Digital Transformation Opportunities:Cloud computing and data center businesses have growth potential

- Current Price:8.82 CNY

- Estimated Dividend Yield:~4.5%

- P/E Ratio:8.38x

- P/B Ratio:1.16x

- ROE:14.63%

- YTD Performance:+14.69%

- ✅ Regulatory Protection Attribute:The power industry has quasi-public utility attributes and relatively stable returns

- ✅ High ROE Feature:14.63% ROE indicates good capital return capability

- ⚠️ Coal Price Volatility Risk:Fuel costs account for a large proportion, and profitability is affected by coal prices

- ✅ Valuation Repair:14.69% YTD increase reflects market pursuit of high-dividend assets

- Current Price:5.78 CNY

- Estimated Dividend Yield:~3.8%

- P/E Ratio:13.90x

- P/B Ratio:1.68x

- ROE:12.72%

- YTD Performance:+30.47%

- ⚠️ Dividend Yield Not Meeting Standard:3.8% below the4% rule’s critical point

- ✅ Growth Premium:Renewable energy transformation brings growth expectations

- ✅ Valuation Upgrade:13.90x P/E reflects market recognition of its transformation prospects

- ⚠️ Dividend Sustainability:Large-scale new energy investments may squeeze the dividend payout ratio

- Mature Utility Stocks:Stable business, predictable cash flow, high dividend payout ratio

- Interest Rate Downward Cycle:Declining government bond yields enhance the relative attractiveness of dividend yields

- Defensive Allocation Needs:High-dividend assets have safe-haven value when market volatility increases

###3.2 Inapplicable Scenarios (❌)

- High Growth Stage:For example, power companies in the new energy transformation period need DCF valuation instead of dividend yield method

- Cyclical Volatility Industries:Profit fluctuations lead to unstable dividends

- Aggressively Expanding Enterprises:Low dividend payout ratio, stock price driven by capital appreciation rather than dividends

###4.1 Recommended Valuation Matrix

| Dividend Yield Range | Valuation Status | Investment Advice | Applicable Investors |

|---|---|---|---|

<3.0% |

Significantly Overvalued | Avoid/Reduce Position | - |

3.0%-4.0% |

Reasonably High | Cautiously Hold | Type B Investors |

4.0%-5.0% |

Reasonable Range | Batch Allocation | Type A + Type B Investors |

5.0%-6.5% |

Undervalued Zone | Actively Buy | Mainly Type A Investors |

>6.5% |

Deeply Undervalued | Heavy Position Opportunity | Type A Investors |

###4.2 Dynamic Adjustment Factors

- Further decline in government bond yields (e.g., to1.5%)

- Decline in market risk appetite

- Increased expectations of economic recession

- Accelerated economic recovery

- Rising inflationary pressure

- Rebound in risk-free interest rates

###5.1 Type A Investors (Pursuing Stable Income)

- China Mobile:6.33% dividend yield, sufficient safety margin, as core position

- Wanneng Power:4.5% dividend yield, moderate allocation, pay attention to coal price risk

###5.2 Type B Investors (Pursuing Growth Income)

- Guodian Power:New energy transformation leader, but need to wait for correction opportunities

- Power ETF:Diversified allocation to reduce individual stock risk

- Interest Rate Risk:If the 10-year government bond yield rebounds above 2.5%, the 4% rule needs to be adjusted upward to4.8%

- Policy Risk:Electricity price regulation, changes in industry regulatory policies

- Dividend Sustainability:Need to pay attention to enterprises’ free cash flow and capital expenditure plans

- Industry Transformation Risk:Huge new energy investment scale may affect short-term dividend capacity

- Interest Rate Anchor:Based on the 10-year government bond yield (current1.7%)

- Risk Premium:Maintain an equity risk premium of2-3 percentage points

- Industry Characteristics:Distinguish between communication services (stable type) and power (cyclical + growth type)

- Investor Type:Type A focuses on dividend yield, Type B balances growth

In the current low-interest rate environment, a dividend yield of

[0] Jinling API Data - Real-time stock prices, financial indicators, historical price data (2025)

[1] Bloomberg - “China Bond Yields May Fall Back Toward Record, HSBC Asset Says” (https://www.bloomberg.com/news/articles/2025-12-02/china-bond-yields-may-fall-back-toward-record-hsbc-asset-says)

[2] Bloomberg - “China Bond Yield Forecast: SocGen Sees Record Lows After Interest Rate Cuts” (https://www.bloomberg.com/news/articles/2025-12-11/china-bond-yield-forecast-soc-gen-sees-record-lows-after-interest-rate-cuts)

[3] Yahoo Finance Hong Kong - China Mobile dividend yield data (https://hk.finance.yahoo.com/quote/0941.HK/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.