Moutai Price Bottom Signal and Baijiu Industry Cycle Inflection Point Judgment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data analysis, I systematically解析茅台价格见底信号与白酒行业周期拐点判断问题 for you.

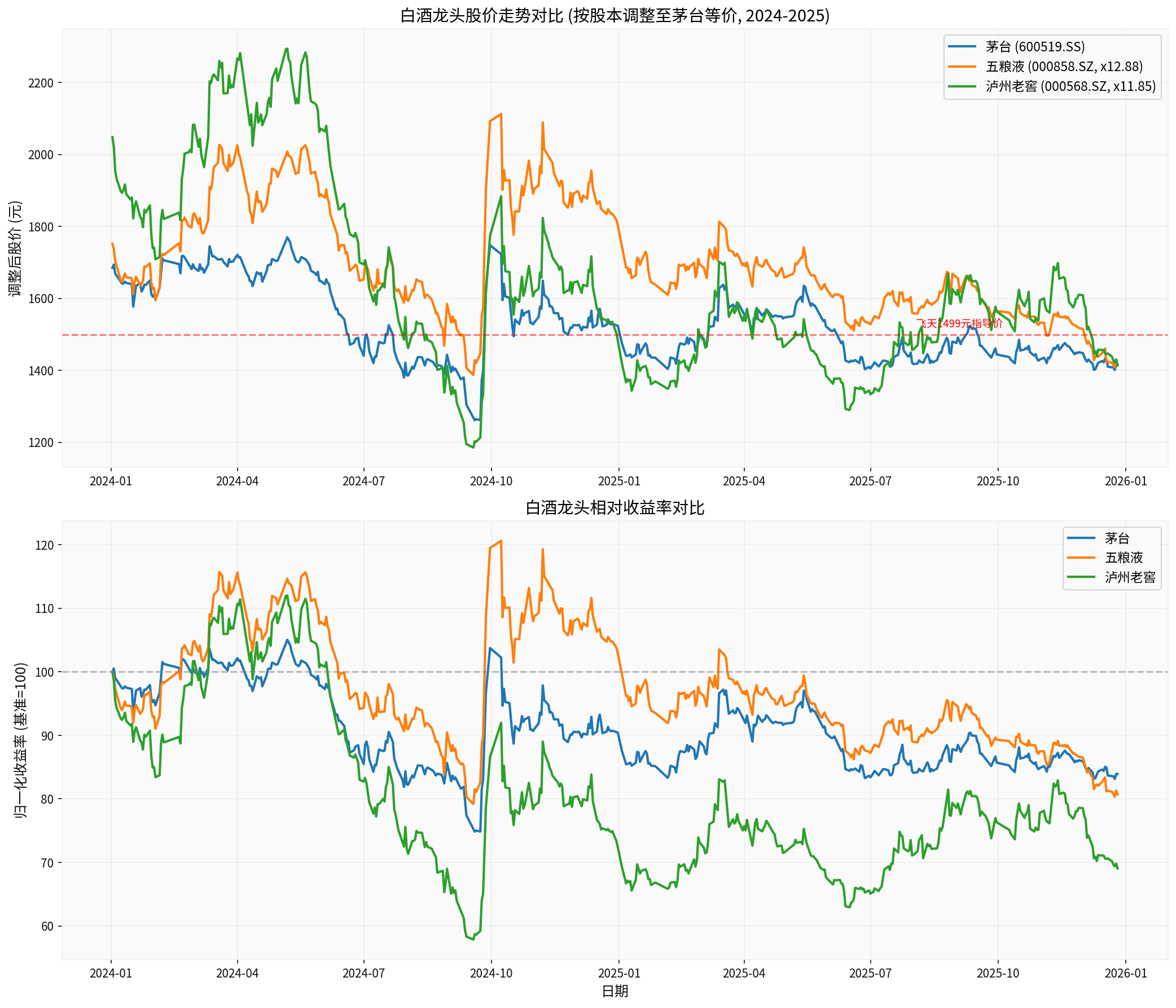

- Moutai (600519.SS):Current stock price is 1414.13 yuan, with a period decline of-16.08%, already5.66%below the 1499 yuan guide price [0]

- Wuliangye (000858.SZ):Current stock price is 109.78 yuan, with a period decline of-19.28%[0]

- Luzhou Laojiao (000568.SZ):Current stock price is 119.39 yuan, with a period decline of-30.94%,the weakest performer[0]

- All three leaders are in a sideways consolidation state, with no clear upward or downward trend formed [0]

- Moutai:MACD has agolden cross (bullish signal), but KDJ is bearish; support level at 1406.29 yuan, resistance level at 1421.97 yuan [0]

- Luzhou Laojiao:Both RSI and KDJ showoversold, with short-term rebound opportunities [0]

- Wuliangye:MACD has no clear cross, KDJ is bearish; support level at 109.02 yuan [0]

According to data, Moutai

- Price close to previous support level:The lowest point in 2024 was 1261 yuan, with only 11% downside space from the current price of 1414.13 yuan [0]

- Volatility convergence:Current annualized volatility tends to stabilize, market panic情绪缓解

- Technical indicator divergence:MACD golden cross and stock price decline form potential bottom divergence [0]

According to your analysis framework, the following signals have not been fully confirmed:

- Feitian production cut:No official production cut announcement observed

- Dealers lowering standards for recruitment:No major adjustments in channel policies

- 15-year Moutai price stabilization:As your proposedkey leading indicator, it needs to be focused on

- Stage 1 (current):Price breaks 1499 yuan, market sentiment is pessimistic (achieved)

- Stage 2:Channel inventory clearance, dealer policy loosening (in progress)

- Stage3:Demand recovery, 15-year Moutai price stabilization and rebound (to be observed)

- Synchronous indicators:Feitian wholesale price, dealer confidence index

- Leading indicators(your core view): 15-year Moutai price trend

- Confirmation indicators:Stock price continuously stands above the 20-day moving average, trading volume increases

-

Price ceiling moves down:

- Moutai wholesale price decline compresses the price increase space for high-end Baijiu

- The pricing anchor effect of Wuliangye Pu Wu and Guojiao 1573 weakens

-

Channel confidence is hit:

- Dealer inventory impairment pressure increases

- Luzhou Laojiao’s period decline of -30.94%reflects market concerns about its elasticity [0]

- Market share restructuring:If Moutai continues to control volume and support price, Wuliangye and Luzhou Laojiao are expected to take over spillover demand

- Cost-performance advantage emerges:Wuliangye PE is 13.04x, Luzhou Laojiao PE is13.88x,valuation is more attractive[0]

###3.2 Competition Pattern Evolution Deduction

| Scenario | Feitian Wholesale Price | Wuliangye Performance | Luzhou Laojiao Performance |

|---|---|---|---|

Optimistic |

Stable at1400-1500 yuan | Follows upward movement, price increase space opens | Most elastic, benefits from consumption upgrade |

Baseline |

Oscillates at1300-1400 yuan | Maintains status quo, market share slowly increases | Channel adjustment, performance under pressure |

Pessimistic |

Breaks below1300 yuan | Price war risk, profit margin under pressure | High inventory risk, destocking pressure large |

###3.3 Financial Health Comparison

From the perspective of financial stability:

###4.1 Current Cycle Position Judgment

According to technical analysis and price data:

- Industry stage:Late adjustment, bottoming stage

- Confirmation signals:Three major leaders’ stocks are in sideways consolidation, volatility convergence [0]

- Key observation points:2025 Spring Festival sales situation,15-year Moutai price trend

###4.2 List of Bottom Signals (Sorted by Priority)

- ✅ Significant stock price correction (Moutai -16%, Wuliangye -19%, Luzhou Laojiao -31%) [0]

- ✅ Moutai breaks below1499 yuan guide price [0]

- ✅ Technical indicators oversold (Luzhou Laojiao RSI oversold) [0]

- ⏳15-year Moutai price stabilization (key leading indicator)

- ⏳Dealer inventory drops to healthy level

- ⏳Spring Festival sales exceed expectations

- ⏳Stock price breaks through 60-day moving average with volume

###4.3 Investment Strategy Recommendations

- Focus on:Moutai (highest certainty, already broken 1499 yuan)

- **Position control:**20-30% exploratory position

- **Observation indicators:**15-year Moutai price, wholesale price trend

- Position increase signal:Spring Festival sales exceed expectations +15-year Moutai price rises for 2 consecutive weeks

- Allocation direction:Wuliangye, Luzhou Laojiao (elastic targets)

- Target position:Increase to50-60%

- Full-scale attack:Balanced allocation of three leaders

- **Target position:**70-80%

- **Holding period:**1-2 years (complete Baijiu cycle)

- Demand recovery is less than expected

- Channel inventory destocking cycle extends

- Macro-economic pressure affects high-end consumption

- Weekly monitoring:Feitian,15-year Moutai wholesale price trend

- Monthly tracking:Dealer inventory data, sales data

- Quarterly verification:Financial report performance guidance, cash flow changes

[0] Gilin API Data (real-time stock price, financial indicators, technical analysis, Python calculation)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.