Comprehensive Analysis: Winter Storm Impact on U.S. Airline Operations and Stock Performance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Winter Storm “Devin” struck the U.S. Northeast on December 26-27, 2025, causing significant operational disruptions across major airlines during peak post-holiday travel. While the storm created immediate operational challenges and modest stock price declines, historical data indicates that weather-related disruptions typically have

- 1,800+ flights canceledacross the U.S. on December 26, 2025

- 22,000+ flights delayedduring the peak holiday travel period

- 1,650 flightscanceled within, into, or out of the U.S. specifically

- Northeast airports hit hardest:JFK, LaGuardia, and Newark Liberty International issued travel advisories

| Airline | Cancellations | Percentage of Schedule |

|---|---|---|

| JetBlue (JBLU) | 225+ | ~22% of operations |

| Delta (DAL) | 186 | ~5% of mainline schedule |

| Republic Airways | 153 | N/A |

| American (AAL) | Not specified but | significant impact |

| United (UAL) | Not specified but | significant impact |

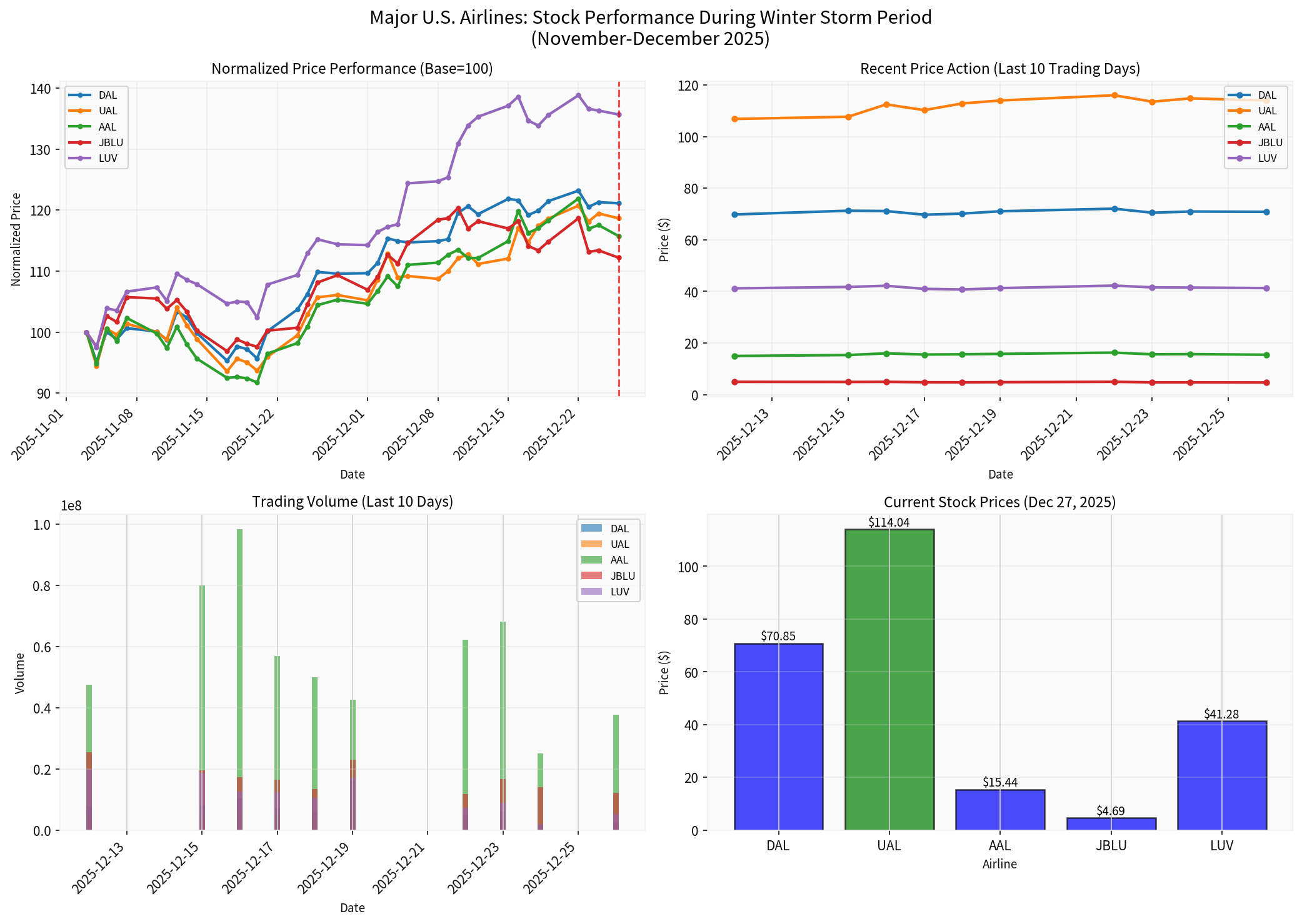

The winter storm caused modest declines across major airline stocks on December 27, 2025, reflecting short-term investor concerns about operational costs and revenue disruption:

| Airline | Current Price | Daily Change | 52-Week Range |

|---|---|---|---|

American (AAL) |

$15.44 | -1.53% ⬇️ |

$8.50 - $19.10 |

JetBlue (JBLU) |

$4.69 | -1.05% ⬇️ |

$3.34 - $8.31 |

United (UAL) |

$114.04 | -0.67% ⬇️ |

$52.00 - $116.32 |

Southwest (LUV) |

$41.28 | -0.48% ⬇️ |

$23.82 - $43.54 |

Delta (DAL) |

$70.85 | -0.16% ⬇️ |

$34.74 - $72.34 |

Alaska (ALK) |

$51.49 | +0.21% ⬆️ |

$37.63 - $78.08 |

- American Airlines experienced the largest decline (-1.53%), despite having fewer cancellations than JetBlue

- JetBlue’s -1.05% decline reflects its operational vulnerability as a Northeast-focused carrier

- Delta demonstrated relative resilience (-0.16%), consistent with its strong operational performance

- Market reaction was measured, suggesting investors view this as a temporary disruption

Despite the winter storm disruptions, major airlines have demonstrated

Figure: Normalized price performance showing major U.S. airlines from November to December 2025. The red dashed line indicates when Winter Storm Devin struck (December 26).

| Airline | Period Return | Volatility | 20-Day MA | Analysis |

|---|---|---|---|---|

Southwest (LUV) |

+36.87% |

2.32% | $39.28 | Strongest performer |

Delta (DAL) |

+23.67% |

2.37% | $68.89 | Consistent gains |

United (UAL) |

+21.32% |

2.71% | $108.72 | Solid upward trend |

American (AAL) |

+17.95% |

2.68% | $15.11 | Moderate gains |

JetBlue (JBLU) |

+13.01% |

2.41% | $4.79 | Lagging peers |

- Market Cap:$46.26B

- P/E Ratio:9.99x (attractive valuation)

- Net Profit Margin:7.36%

- ROE:27.64% (excellent)

- Analyst Consensus:BUY with target price of $74.00 (+4.4% upside)

- YTD Performance:+19.94%

- 5-Year Performance:+76.46%

- Market Cap:$36.92B

- P/E Ratio:11.43x

- Net Profit Margin:5.64%

- ROE:24.87%

- Analyst Consensus:BUY with target price of $132.50 (+16.2% upside)

- YTD Performance:+19.50%

- 5-Year Performance:+159.65%

- Market Cap:$1.71B (significantly smaller)

- P/E Ratio:Negative (-3.64x)

- Net Profit Margin:-5.16% (loss-making)

- ROE:-19.21%

- Analyst Consensus:HOLD with target price of $5.00 (+6.6% upside)

- YTD Performance:-37.30%

- 5-Year Performance:-68.33%

The most significant recent winter storm event occurred in December 2022, when Southwest Airlines experienced a

- Thousands of flights canceledstarting December 21, 2022, continuing through Christmas

- Contributing factors:Winter storm + inadequate staffing + outdated scheduling systems

- Industry impact:Highlighted operational vulnerabilities at capacity-constrained hubs during winter weather

- Stock impact:Significant short-term decline but eventual recovery

The NOAA documented multiple billion-dollar winter storms in early 2024:

- January 12-14, 2024:Northwest Winter Storm affecting Western Washington and Oregon

- January 14-18, 2024:Central, Southern, Northeastern Winter Storm and Cold Wave

- Operational impact:Widespread disruptions across multiple carriers

- Market reaction:Temporary stock declines followed by recovery

- Geographic concentration in affected regions (e.g., JetBlue in Northeast)

- Weaker financial positions

- Operational vulnerabilities (staffing, technology)

- S&P 500:+1.52%

- NASDAQ:+1.42%

- Dow Jones:+1.11%

- Russell 2000:+3.80%

The

- Operational costsincrease due to de-icing, crew accommodation, and repositioning

- Revenue lossfrom canceled flights (partially offset by rebookings)

- Customer compensationcosts and potential brand damage

- Recovery timeof 3-7 days to normalize operations after weather clears

- Additional 1-2% declinepossible if disruptions persist

- Quick recoverylikely once operations stabilize (historical pattern)

- Delta and Unitedexpected to recover fastest due to strong balance sheets

- JetBluefaces extended pressure if Northeast operations remain disrupted

- Holiday travel demandremains robust despite disruptions

- Analyst optimism:Citi initiated coverage on American Airlines with BUY rating in December 2025, citing stronger demand cycle expected in 2026

- Pricing power:Airlines maintaining fare discipline amid high demand

- Cost management:Carriers have improved operational resilience since 2022 Southwest crisis

- Additional winter stormscould compound operational challenges

- JetBlue financial stress:Ongoing losses (-5.16% margin) limit recovery capacity

- Fuel price volatilitycould pressure margins if costs rise

- Post-pandemic travel normalizationcontinuing into 2026

- Capacity disciplinemaintained by major carriers

- Technology investmentsimproving operational resilience (e.g., United’s Starlink IFE integration, cloud-based systems)

- Strategic partnershipsevolving (note: JAL-JetBlue partnership ending March 31, 2026, may impact JBLU)

- Buy on weakness:Consider accumulating positions in DAL and UAL on any weather-related pullbacks

- Focus on quality:Prioritize financially strong carriers (DAL, UAL) over financially stressed peers (JBLU)

- Short-term trading:Swing trade opportunities as stocks overreact to weather news

- Wait for clarity:Allow 5-7 days for operations to normalize before adding positions

- Diversify:Consider airline ETF exposure rather than single-stock picks

- Monitor earnings:Q4 2025 earnings (late January 2026) will quantify storm impact

- Avoid JetBlue (JBLU):Carrier faces fundamental challenges beyond weather (loss-making, -37.3% YTD)

- Consider alternatives:Other transportation/logistics stocks with less weather exposure

- Wait for seasonal pattern:February-March historically better for airline stocks

Winter Storm Devin’s impact on U.S. airline operations and stocks demonstrates a

-

Operational disruption is significant but temporary- 1,800+ flights canceled, but historically airlines normalize within 3-7 days

-

Stock market reaction is measured- 1-2% declines reflect investor understanding that weather events are episodic rather than structural

-

Financial strength determines resilience- Delta (-0.16%) and United (-0.67%) showed smaller declines than American (-1.53%) and JetBlue (-1.05%) due to stronger fundamentals

-

Long-term trends remain positive- Despite the storm, major airlines significantly outperformed the market over the past two months

-

Historical precedents suggest recovery- Similar winter storms in 2022 and 2024 caused temporary disruptions followed by stock price recovery

[0] 金灵AI Financial Data API - Real-time quotes, company overviews, and historical price data for DAL, UAL, AAL, LUV, JBLU, ALK (retrieved December 27, 2025)

[1] Reuters via U.S. News & World Report - “Winter Storm Bears Down on U.S. Northeast, Disrupting Airline Travel” (December 27, 2025) - https://www.usnews.com/news/top-news/articles/2025-12-27/winter-storm-bears-down-on-u-s-northeast-disrupting-airline-travel

[2] Benzinga - “Holiday Travel Chaos: JetBlue, Delta, American, United Flights Cancelled As Winter Storm Devin Strikes Northeast US” (December 27, 2025) - https://www.benzinga.com/news/travel/25/12/49600176/holiday-travel-chaos-jetblue-delta-american-united-flights-cancelled-as-winter-storm-devin-strikes-no

[3] CNBC - “Airlines cancel more than 1500 flights for winter storm” (December 26, 2025) - https://www.cnbc.com/2025/12/26/winter-storm-flight-cancellations.html

[4] Patch.com - “Hundreds Of JetBlue, Delta Flights Canceled As Winter Weather Disrupts Travel: Report” (December 26, 2025) - https://patch.com/new-york/longisland/hundreds-jetblue-delta-flights-canceled-winter-weather-disrupts-travel-report

[5] Economic Times - “Winter storm Devin grounds over 1,800 US flights amid holiday chaos” (December 26, 2025) - https://m.economictimes.com/us/news/winter-storm-devin-grounds-over-1800-us-flights-amid-holiday-chaos-and-coastal-storms/articleshow/126200416.cms

[6] StockTwits - “American Airlines Stock Slides As Winter Storm Chaos Cancels Over 1,500 Flights During Holiday Rush” (December 26, 2025) - https://stocktwits.com/news-articles/markets/equity/american-airlines-stock-slides-as-winter-storm-chaos-cancels-over-1-500-flights-during-holiday-rush/cLeU0kXREDd

[7] NOAA National Centers for Environmental Information - “Billion-Dollar Weather and Climate Disasters: United States Summary” - https://www.ncei.noaa.gov/access/billions/state-summary/US

[8] Wikipedia - “Southwest Airlines - December 2022 holiday meltdown” - https://en.wikipedia.org/wiki/Southwest_Airlines

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.