2026 Market Uncertainty Narrative: Valuation, Policy, and Geopolitical Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Seeking Alpha article published on December 25, 2025, titled “Will Market Uncertainty Continue In 2026?” [5], which aligns with late December 2025 narratives from multiple financial sources warning of potential 2026 market challenges.

On December 24 (Christmas Eve, early market close), major U.S. indices rose modestly: the S&P 500 closed at 6,932.04 (+0.39%), NASDAQ at 23,613.31 (+0.24%), and Dow at 48,731.17 (+0.63%) [0]. Notably, defensive sectors outperformed growth sectors: Consumer Defensive (+1.198%) and Utilities (+0.810%) led gains, while Technology (the most valuation-sensitive sector) rose only 0.367% [0], indicating pre-holiday investor caution.

Related reports amplify the uncertainty theme: Forbes [1] noted the top 10 S&P 500 stocks account for 40% of market capitalization, with Goldman Sachs warning of a 10-20% market decline if these high valuations correct. NAI500 [2] reported S&P 500 valuations exceed those of the dot-com bubble, combined with rare Fed dissent signaling volatile 2026 markets. Project Syndicate’s Kenneth Rogoff [3] highlighted geopolitical risks and the likelihood of a correction after three years of strong returns. Additionally, ts2.tech [4] noted AustralianSuper plans to reduce equity allocations due to concerns about the maturity of the AI rally.

Since December 25 is a U.S. market holiday, no immediate trading reaction to the Seeking Alpha article was recorded. Post-holiday trading data (December 26) to measure direct market impact is not yet available, and specific 2026 valuation metrics from the original article remain inaccessible due to crawl errors.

- Pre-holiday defensive sector strength(Consumer Defensive, Utilities) signals early investor positioning to mitigate 2026 uncertainty, directly aligning with the article’s core theme.

- Concentration risk(top 10 S&P 500 stocks = 40% market cap [1]) amplifies the potential impact of a valuation correction, as underperformance in these stocks could disproportionately affect the broader market.

- Policy and AI cycle risks intersect: Fed dissent [2] introduces monetary policy volatility, while institutional concerns about AI rally maturity [4] add specific pressure to high-flying tech valuations.

- Geopolitical and structural risks are interconnected; the three-year market rally [3] and dot-com-era valuations [2] create a fragile environment vulnerable to external shocks.

- Valuation correction: High market multiples could trigger a 10-20% decline [1].

- Policy volatility: Fed dissent and changing tariff policies may disrupt market stability [2].

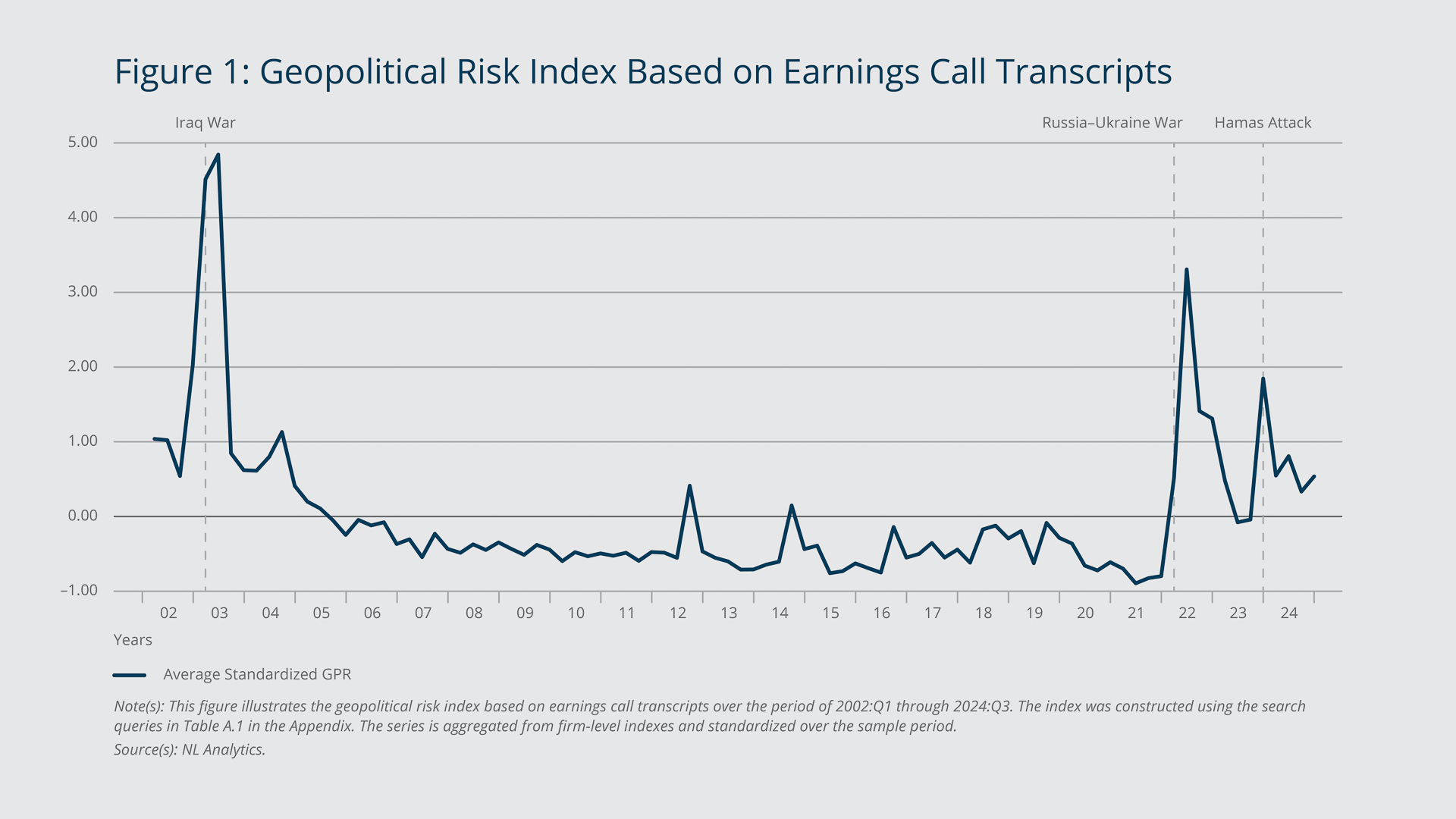

- Geopolitical instability: Ongoing global tensions could impact asset markets [3].

- Concentration risk: The top 10 S&P 500 stocks face unmet earnings growth expectations [1].

- Defensive sector resilience: Pre-holiday strength in Consumer Defensive and Utilities [0] may offer relative stability amid uncertainty.

- Volatility as a potential entry point: Market fluctuations could create opportunities for long-term investors, though this is contingent on individual risk tolerance.

- December 26 trading session to assess immediate market reaction.

- 2026 Fed policy announcements and economic data (inflation, employment).

- Earnings reports from AI and tech companies to validate valuation multiples.

- Geopolitical developments affecting global trade and economic stability.

The Seeking Alpha article contributes to a growing late-2025 narrative warning of 2026 market uncertainty, supported by pre-holiday defensive sector strength and warnings from major financial institutions. Key risks include overvaluations, concentration in top stocks, policy dissent, and geopolitical tensions. Immediate market impact is delayed due to the U.S. holiday, with post-holiday data and the full article content still unavailable. Decision-makers should consider these factors alongside ongoing market developments to contextualize risk and opportunity.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.