Analysis of the Strong Performance of Beijing Capital Development Co., Ltd. (600376): Policy-Driven and Market Reaction

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

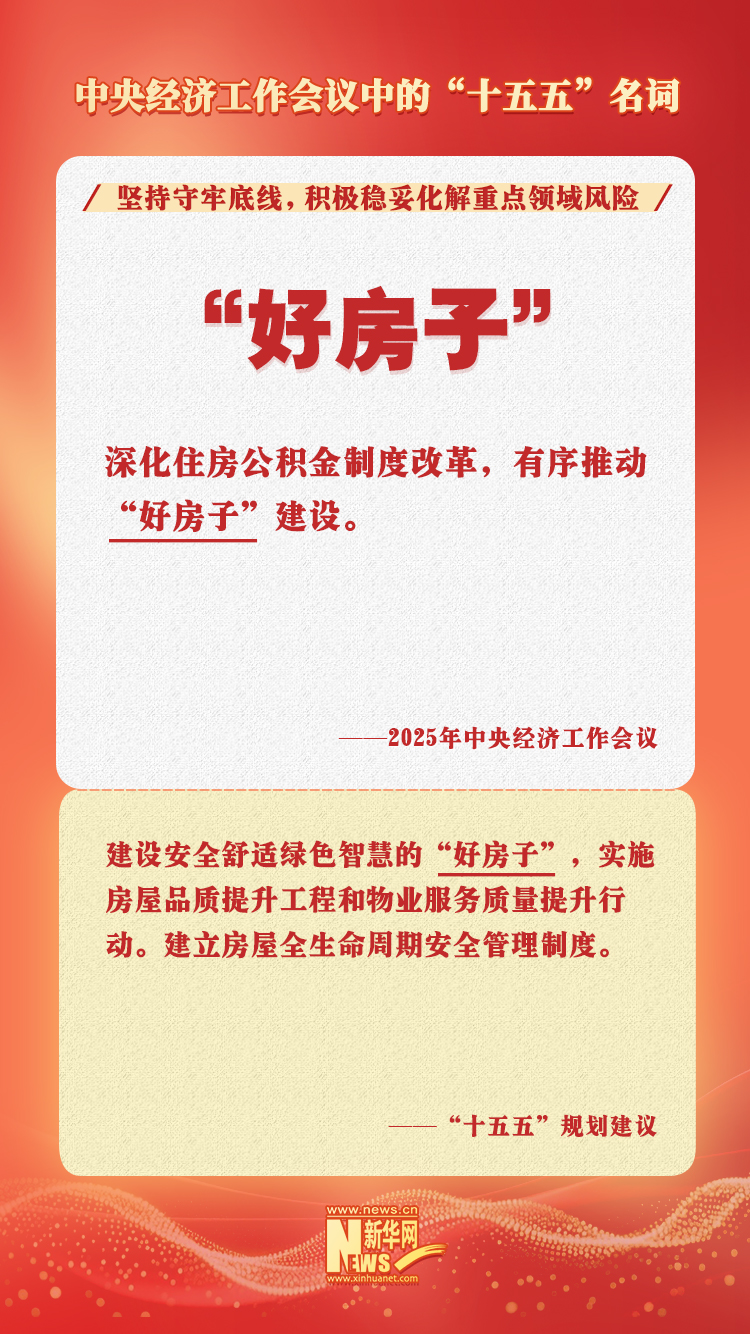

The core driver of the recent strong performance of Beijing Capital Development Co., Ltd. (600376) is the real estate policy signal from the Chinese government. The Central Economic Work Conference held on December 10-11 listed stabilizing the real estate market as a top priority for 2026, proposing the strategy of “controlling new supply, destocking, and optimizing supply”. The core content announced on the 21st directly推动了房地产板块整体上涨[1][2]. As a real estate development enterprise, Beijing Capital Development Co., Ltd. also benefited from this policy expectation. It rose by 21.31% in the past 5 trading days, with a single-day gain of 10.04% on December 25, 2025, and a closing price of $5.92[0].

Technically, the KDJ indicator of this stock is a bullish signal, and the MACD has formed a golden cross, indicating strong short-term upward momentum; the trading volume was 313 million shares, an increase of 57.6% compared to the average volume, showing obvious signs of capital inflow[0]. However, it should be noted that the current stock price is testing the key resistance level of $6.10. If it breaks through successfully, the upward trend may continue[0].

Fundamentally, the company’s EPS for the third quarter of 2025 was -$0.49, with a net profit margin of -21.14%, showing poor financial performance[0]. The Chinese real estate market still faces the pressure of 27-month high inventory and weak demand, and industry recovery will take time[2]. Although the DCF valuation model shows its fair value is $49.50 (far higher than the current price), this model is based on historical average data, and there is great uncertainty about future performance[0].

- Policy-driven sector linkage effect: The rise of Beijing Capital Development Co., Ltd. is not an isolated event. Leading real estate enterprises such as China Vanke and Poly Development rose simultaneously, showing the impact of policy signals on the entire sector[1].

- Deviation between short-term sentiment and long-term fundamentals: The increased trading volume and favorable technical indicators indicate that short-term investor sentiment is optimistic, but the company’s own financial problems and long-term industry pressure show that this rise may lack solid fundamental support.

- Uncertainty of policy details: Although the government has listed stabilizing the real estate market as a priority, specific policies have not been announced. The subsequent implementation effect will be the key to affecting the sustainability of the stock price[2].

- Fundamental challenges: The company’s recent financial performance is poor, and losses expanded in the third quarter of 2025[0].

- Policy uncertainty: Specific policy details have not been announced, and the implementation effect is variable[2].

- Industry pressure: The situation of high inventory and weak demand is difficult to change in the short term[2].

- Technical resistance: If the key resistance level of $6.10 cannot be broken through, it may trigger a correction[0].

- Policy dividends: If the government introduces substantive real estate support policies, the company may benefit from industry recovery.

- Valuation repair: The current stock price is far lower than the DCF valuation. If performance improves or market sentiment remains optimistic, there is room for valuation repair[0].

The strong performance of Beijing Capital Development Co., Ltd. (600376) is mainly driven by the policy expectation of the government to stabilize the real estate market. The technical side shows a short-term upward trend, but there are major challenges in fundamentals. Investors should pay attention to the announcement of policy details, the breakthrough of the $6.10 resistance level, and changes in the company’s own financial situation. In the short term, the increased trading volume and sector linkage effect show that the rise may continue, but in the long term, we need to be alert to the risks brought by industry pressure and policy uncertainty.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.