Analysis of Tianyi New Materials (688033) Strong Performance: Catalysts, Supports, and Sustainability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Tianyi New Materials (688033) is a STAR Market enterprise covering rail transit brake materials, photovoltaic new energy materials, automotive carbon-ceramic brake systems, and aerospace materials [0]. On December 25, 2025, this stock entered the strong stock pool, but no specific catalytic news was found on that day. Its strong performance can be inferred from fundamental and industry-level reasons:

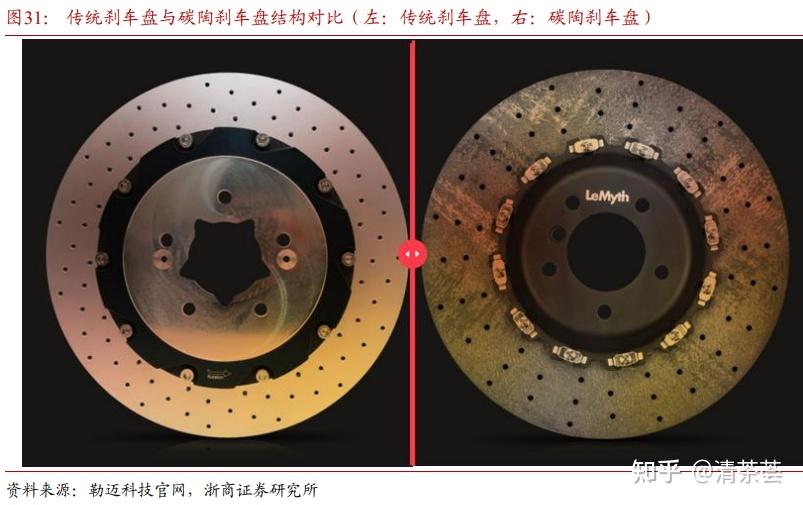

- Automotive Carbon-Ceramic Brake Disc Business: The company has obtained mass production project designations for carbon-ceramic discs for 3 key models from a leading new energy vehicle manufacturer, and established project cooperation relationships with more than 20 automotive OEMs and brake component suppliers [0]. As a high-end configuration for new energy vehicles, carbon-ceramic brake discs have advantages such as lightweight and excellent braking performance, with broad market prospects.

- Photovoltaic New Energy Business: Signed bulk procurement orders for carbon-carbon composite products with TCL Zhonghuan, and supplied lithium battery anode carbon-carbon composites to core customers such as Yunnan Lichen and Inner Mongolia Shanshan [0]. The continuous growth of the photovoltaic and lithium battery industries provides new performance growth points for the company.

Around December 25, 2025, the new energy and materials sectors performed strongly overall, and material companies related to new energy vehicles received market capital attention [0], which may have driven the company’s stock price.

Due to the lack of real-time price and volume data, from the perspective of market sentiment, institutions recognize the company’s technical strength in the carbon-ceramic brake disc business [0]. Investors are optimistic about the company’s transformation from traditional rail transit to the new energy field, expecting performance improvement brought by new businesses.

- Valuation Reconstruction from Business Transformation: The company is transforming from traditional rail transit brake materials to high-end new energy materials. New businesses (carbon-ceramic brake discs, photovoltaic carbon-carbon composites) align with current market investment hotspots and may drive valuation reconstruction.

- Expected Support from Order Implementation: Orders from leading new energy vehicle manufacturers and photovoltaic enterprises provide a foundation for the large-scale development of new businesses, strengthening the market’s expectation of the company’s performance reversal.

- Carbon-Ceramic Brake Disc Market Penetration: The rapid development and high-end trend of new energy vehicles will increase the market demand for carbon-ceramic brake discs. The company’s technical reserves and order foundation are expected to be converted into actual performance.

- Expansion of Photovoltaic and Lithium Battery Material Business: Under the dual-carbon goals, the photovoltaic and lithium battery industries continue to grow, and the company’s layout in this field will benefit from industry development.

- Financial Pressure: In the third quarter of 2025, the company’s revenue decreased by 11.69% year-on-year, net profit attributable to parent company was a loss of 3.49 billion yuan, and the sales gross profit margin was -16.12% [0]. The traditional rail transit business is under great pressure due to centralized procurement policies and intensified competition.

- Uncertainty of New Businesses: Although orders have been obtained, there are still uncertainties in the large-scale production and profit contribution of new businesses. It takes time to increase the market penetration rate of carbon-ceramic brake discs.

- Industry Competition: The new energy materials and brake system fields are highly competitive. The company needs to continuously improve its technical and cost advantages to maintain its market position.

Tianyi New Materials’ strong performance mainly stems from breakthroughs in new businesses (automotive carbon-ceramic brake discs, photovoltaic new energy materials) and the drive from sector performance. Although it currently faces financial pressure in traditional businesses, the layout of new energy businesses provides potential for future development. Investors should pay attention to the large-scale progress of new businesses, the improvement of financial indicators, and changes in the industry competition pattern.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.