Analysis and Outlook on the Strong Performance of Changguang Huaxin (688048)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

Strong Driving Factors

- Industry Hotspot Alignment: Changguang Huaxin focuses on the photonics field, coinciding with industry positives such as optical AI chip breakthroughs (LightGen chip speed and energy efficiency are 100 times that of NVIDIA) and growing demand for data center/AI optical components (AOI launches new laser products), leading to rising market sentiment [1][2].

- Sector Effect: The boom in the STAR Market AI chip sector (e.g., MetaX Integrated Circuits’ IPO surge) drives investment sentiment across the entire sector, pushing capital inflows [3].

-

Technical Aspects and Trading Volume

- Price Performance: On December 25, 2025, it rose by 13.16%, with a YTD increase of 320.46% and a 6-month increase of 190.92%, breaking through previous resistance levels to reach new highs [0].

- Trading Volume: The daily trading volume was 24.83M, higher than the 12-day average of 16.85M, indicating active trading [0].

- Trend Characteristics: It shows a continuous upward trend with strong technical performance.

-

Fundamental Status

- Current Challenges: Negative net profit; valuation indicators such as P/E and EV/OCF are negative; ROE is -0.52%, net profit margin is -3.76%; EPS and revenue in the latest financial report are both below expectations [0].

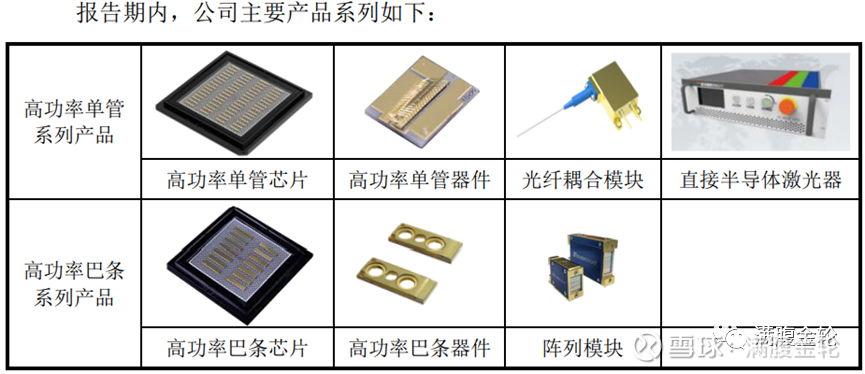

- Business Potential: The company is engaged in the optical AI and data center optical components fields, and its business direction aligns with industry development trends.

- Short-term Rise Driven by Hotspots: The company’s current strength is mainly driven by industry hotspots and sector effects, rather than significant improvements in its own fundamentals.

- Valuation and Fundamentals Divergence: Despite strong price performance, fundamental factors such as negative earnings and below-expectation financial reports indicate that valuations may have overdrawn future growth expectations.

- Technical Indicators Imply Correction Risk: After continuous sharp rises, technical indicators may be in an overbought state, facing short-term correction pressure.

- Main Risks: Weak fundamentals (negative net profit and below-expectation financial reports); overvaluation (may have reflected future growth expectations); technical overbought (short-term correction risk); fierce industry competition (need for continuous innovation) [0].

- Potential Opportunities: The optical AI and data center optical components fields have great growth potential; the company’s business direction aligns with industry trends; if there are technological breakthroughs or performance improvements, it may achieve long-term development.

Changguang Huaxin (688048)'s recent strong performance is mainly driven by industry hotspots and sector effects, with technical indicators showing an upward trend, but weak fundamentals, overvaluation, and short-term correction risks are worth attention. Support level is $140 (closing price on December 24, 2025), and resistance level is $162 (highest price on December 25, 2025).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.