K-Shaped Economy Analysis: Wealth Divergence and Investment Strategy Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the InvestorPlace article [1] published on November 8, 2025, which discusses America’s K-shaped economy and promotes trading strategies to navigate wealth divergence. The article accurately identifies real economic trends but transitions to promotional content for high-risk trading strategies without adequate risk disclosure. Recent market volatility, including the Nasdaq’s worst week since April 2025 [2], provides context for the timing of this content.

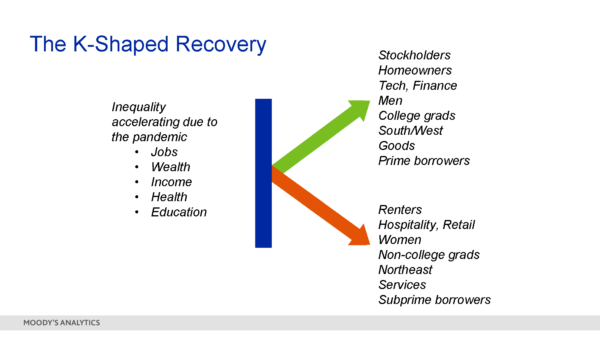

The K-shaped economy phenomenon described in the article is well-documented across multiple sources [3][4][5]. Current market data [0] reflects this divergence:

- Asset Performance: S&P 500 at 6,728.81 (+0.49%), Nasdaq at 23,004.54 (+0.49%), Dow Jones at 46,987.11 (+0.41%)

- Sector Divergence: Financial Services (+2.26%) and Utilities (+4.68%) show strong gains, while Consumer Defensive (-0.61%) underperforms

- Volatility Indicators: Nasdaq volumes reached 11.09 billion shares on November 6th, indicating heightened institutional activity

The article’s examples of wealth accumulation align with actual market behavior, including plausible 401(k) gains of 25% and real estate appreciation trends. However, the transition from legitimate economic analysis to promotional trading strategy content raises concerns about investor protection and risk disclosure.

External research confirms the article’s core premise about pronounced K-shaped characteristics:

- The top 10% of income earners accounted for nearly half of all consumer spending in Q2 2025 [4]

- Wealthy consumers benefit from booming stock markets and rising home values, while lower-income households face job market uncertainty and inflation [3]

- The “Magnificent 7” stocks show soaring earnings expectations for 2026, while the rest of the S&P 500 shows declining expectations [5]

- Market Volatility and Promotional Content: The timing of the article coincides with increased market uncertainty, creating fertile ground for high-risk trading strategy promotions

- Sector Performance as Economic Indicator: The divergence between Financial Services/Utilities strength and Consumer Defensive weakness directly illustrates the K-shaped economy in action

- Asset Inflation vs. Consumer Price Inflation: Wealthy households benefit from asset appreciation (stocks, real estate) while lower-income households face consumer price pressures (grocery bills rising 30%)

The K-shaped economy represents a fundamental shift in wealth distribution that affects:

- Consumer spending patterns across income segments

- Investment strategy suitability for different investor profiles

- Market volatility dynamics as different economic segments react differently to economic conditions

Key risks include:

- Strategy Suitability: High-risk options trading without proper risk assessment

- Performance Verification: Lack of independent verification for claimed trading system performance

- Cost Structure: Unclear fee structures and total costs of participation

- Regulatory Compliance: Limited discussion of investor protection measures

- Sector Rotation: Financial Services and Utilities showing strength may continue benefiting from the K-shaped economy

- Volatility Trading: Increased market volatility creates opportunities for sophisticated traders with appropriate risk management

- Divergence Strategies: Investment approaches that capitalize on the growing wealth gap between economic segments

- VIX Levels: Monitor continued volatility affecting options strategies

- Inflation Data: Consumer price trends impacting lower-income segments

- Housing Market: Real estate appreciation validation

- Employment Statistics: Wage growth and job security metrics

- AI Investment Flows: Institutional patterns in AI-related stocks

The K-shaped economy is a validated economic phenomenon where wealthier households experience significant asset appreciation while lower-income households face rising costs. Recent market data [0] confirms this divergence through sector performance variations and wealth accumulation patterns.

While the underlying economic analysis is sound, the promoted trading strategies require careful due diligence. The article’s claims of exceptional returns (49 winning trades with 267% average gains) lack independent verification and adequate risk disclosure.

Investors should consider their risk tolerance, investment timeline, and financial goals when evaluating strategies to navigate this economic environment. The wealth divergence trend appears sustainable based on multiple sources [3][4][5], but solutions require careful risk assessment rather than high-risk trading approaches.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.