UTime Limited Unauthorized SEC Filing: Corporate Governance Crisis and Market Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the GlobeNewswire report [1] published on September 9, 2025, regarding UTime Limited’s unauthorized SEC filing incident.

The unauthorized SEC filing represents a severe breach of corporate governance and information security protocols. A former employee allegedly retained access to EDGAR filing codes and submitted a fraudulent Form 6-K claiming complete leadership turnover [1]. This incident exposes critical weaknesses in UTime’s internal controls, particularly concerning access management for regulatory filing systems. The company’s response confirms that Hengcong Qiu remains CEO, CFO, and Chairman, while Minfei Bao continues as Director, with the full board consisting of Minfei Bao, Hengcong Qiu, Xiaoqian Jia, Hailin Xie, and Yanzhi Wang [1].

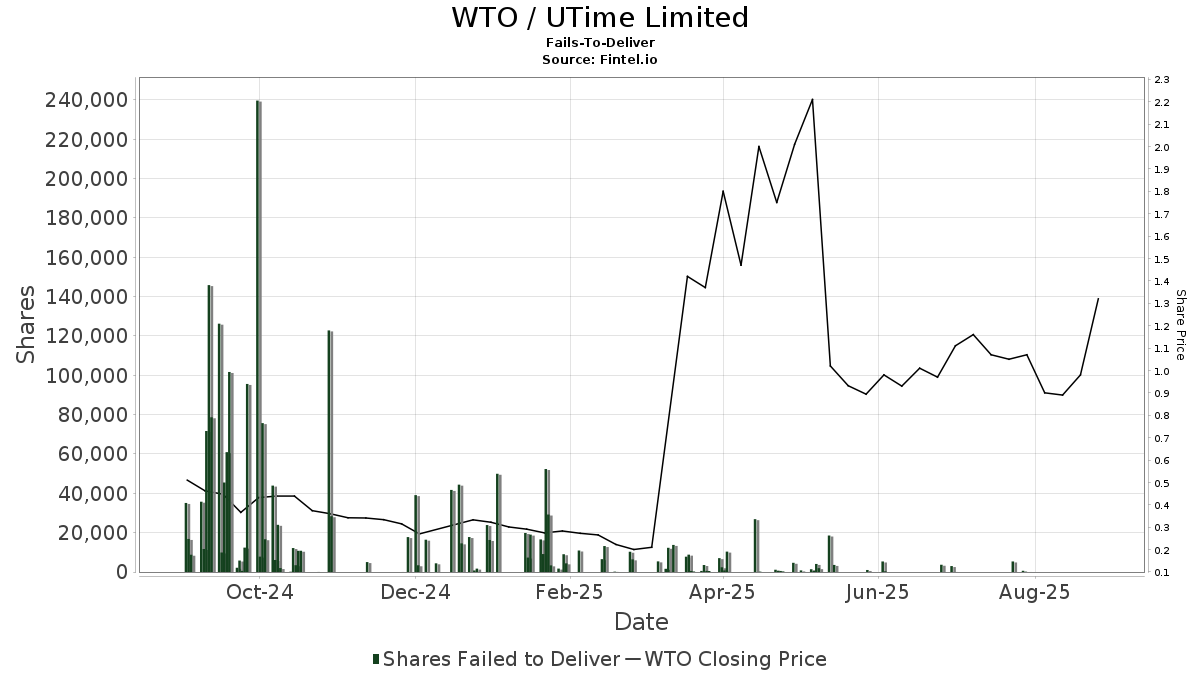

Despite the negative nature of the security breach, WTO stock displayed counterintuitive market behavior. The shares rose 8.49% on September 9th followed by a 17.86% surge on September 10th [0]. This unusual reaction may reflect investor relief at the company’s swift clarification, speculative trading dynamics, or potential short covering activity. However, these movements occurred within the context of catastrophic long-term decline, with the stock having lost 98.71% year-to-date and 98.90% over the past year [0].

The unauthorized filing incident occurred while UTime was already facing severe financial challenges. The company received a Nasdaq notification on August 15, 2025, regarding non-compliance with the minimum $2.5 million stockholders’ equity requirement, with a September 29, 2025 deadline to submit a compliance plan [3]. The current trading price of $0.05 represents a collapse from the 52-week high of $4.40, with market capitalization dwindling to approximately $166,865 [0].

The ability of a former employee to access and misuse EDGAR filing codes suggests systemic failures in UTime’s information security and access management protocols. This incident highlights particular vulnerabilities for international companies with SEC reporting obligations, where proper segregation of duties and access revocation procedures are critical for regulatory compliance.

The company characterized the unauthorized filing as “a deliberate attempt to interfere with the Company’s business operations and stable management” [1], suggesting malicious intent rather than accidental error. The timing during an already critical period of Nasdaq compliance efforts raises questions about potential coordination or opportunistic targeting of the company’s weakened position.

The stock’s positive reaction to negative news challenges conventional market behavior assumptions. This anomaly may reflect: (1) relief that leadership remained stable, (2) speculative trading on unusual events, or (3) algorithmic trading responses to filing activity. The reaction within the context of near-total value destruction suggests complex market dynamics at play.

UTime now faces dual regulatory challenges: the SEC investigation into the unauthorized filing and Nasdaq compliance requirements for minimum equity [1][3]. The compound nature of these regulatory issues creates additional uncertainty and potential for escalated enforcement actions or delisting proceedings.

- Regulatory Enforcement Risk: SEC investigation into the unauthorized filing could result in penalties, increased scrutiny, or mandatory remediation measures [1]

- Nasdaq Delisting Risk: Failure to meet the September 29, 2025 deadline for submitting a compliance plan could trigger delisting proceedings [3]

- Internal Control Deficiencies: The security breach indicates broader governance weaknesses that may affect other operational areas [1]

- Financial Viability Concerns: With the stock trading at $0.05 and market cap under $200,000, the company’s ability to continue operations appears severely compromised [0]

- Reputational Damage: The incident may further erode investor confidence in an already distressed situation [1]

- Governance Remediation: Swift implementation of robust internal controls could demonstrate management’s commitment to proper governance

- Transparency Response: Continued clear communication about remediation efforts may help rebuild some investor confidence

- Strategic Alternatives: The crisis may accelerate consideration of strategic alternatives including mergers, acquisitions, or restructuring

- UTime Limited (NASDAQ: WTO) experienced an unauthorized SEC Form 6-K filing on September 9, 2025, claiming false leadership changes [1]

- Current leadership remains unchanged: Hengcong Qiu (CEO, CFO, Chairman) and Minfei Bao (Director) [1]

- Complete Board of Directors: Minfei Bao, Hengcong Qiu, Xiaoqian Jia, Hailin Xie, and Yanzhi Wang [1]

- Company has notified SEC and engaged proper authorities to investigate the breach [1]

- Stock performance: +8.49% on September 9th, +17.86% on September 10th, but -98.71% YTD [0]

- Nasdaq compliance deadline: September 29, 2025 for equity requirement compliance plan [3]

- Current stock price: $0.05 (down from 52-week high of $4.40) [0]

- Market capitalization: approximately $166,865 [0]

- Year-to-date decline: 98.71% [0]

- Past 12-month decline: 98.90% [0]

UTime Limited is a mobile device manufacturer engaged in design, development, production, sales, and brand operation of mobile devices in China and globally, focusing on cost-effective products for a broad customer base [1].

Investor inquiries: qhengcong@utimemobile.com [1]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.