UTime Limited Corporate Governance Crisis: Unauthorized Press Releases and Market Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the GlobeNewswire report [1] published on September 11, 2025, which detailed UTime Limited’s emergency response to unauthorized press releases published overnight.

The incident represents a severe corporate governance failure with cascading impacts across multiple dimensions. A former employee with previous investor relations responsibilities allegedly accessed company systems and published two unauthorized press releases through legitimate channels, falsely claiming that UTime’s management and board had resigned and been replaced [1][2]. The company’s rapid response included notifying the SEC and proper authorities to investigate the unauthorized filings [2].

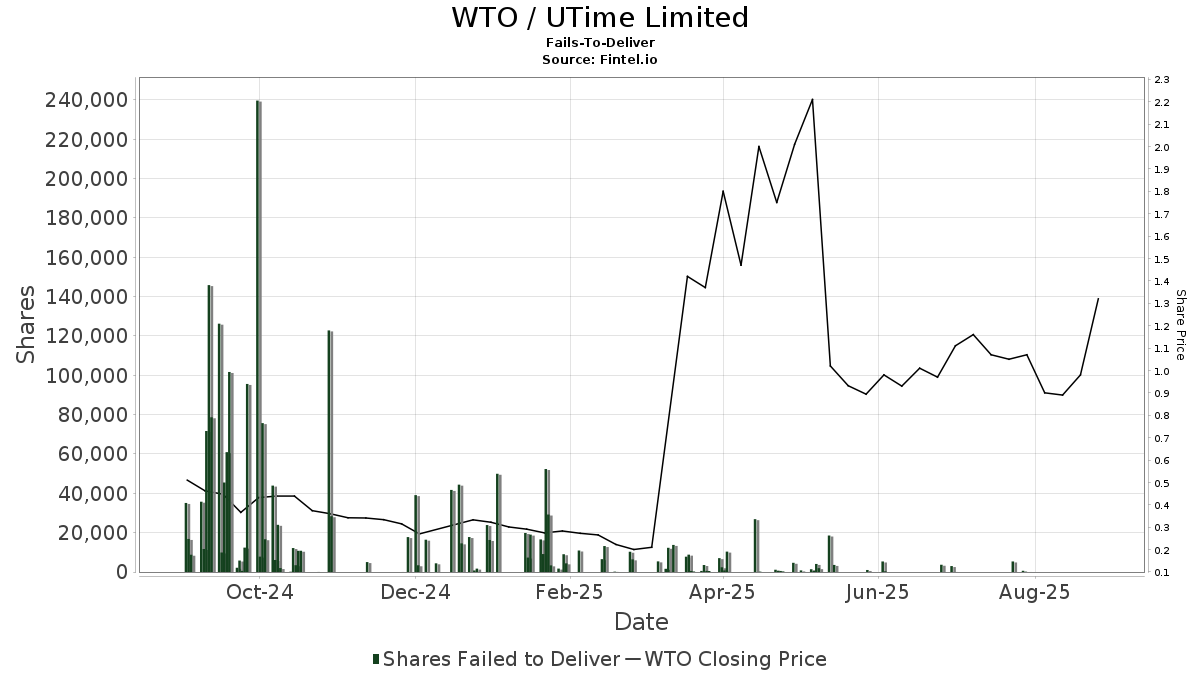

The market reaction was immediate and volatile. Stock data shows a significant +17.86% jump on September 10 (possibly related to the initial unauthorized filing), followed by +0.79% on September 11 when the official clarification was issued, then -1.47% on September 12 and -8.85% on September 15 as the market fully processed the news [0]. The stock is currently trading at $0.05 with extremely high volatility within a 52-week range of $0.04-$4.40 [0].

- Corporate Governance Risk: This breach represents a fundamental failure of disclosure controls that could trigger SEC enforcement actions and shareholder lawsuits [2][3]

- Market Confidence Erosion: Such incidents can permanently damage investor trust, potentially leading to长期估值折价 regardless of operational performance [2]

- Legal Exposure: The company may face liability for inadequate internal controls, while the former employee could face criminal charges for securities fraud [3]

- SEC Investigation Timeline: Investors should monitor for any SEC filings or enforcement actions related to this incident

- Governance Improvements: Watch for company announcements about enhanced internal controls and board oversight measures

- Stock Stabilization: Monitor trading patterns for signs of market recovery or continued volatility as the situation resolves

UTime Limited experienced a serious security breach when a former employee published unauthorized press releases claiming leadership changes. The company confirmed that management and board composition remain unchanged and has notified regulatory authorities [1]. The incident triggered significant stock volatility, with shares currently trading at $0.05 after experiencing sharp declines following the clarification [0]. This event highlights critical vulnerabilities in the company’s internal controls and disclosure systems, potentially exposing the company to regulatory scrutiny and long-term reputational damage [2][3]. The coordinated nature of the unauthorized releases suggests deliberate market manipulation rather than accidental disclosure [2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.