Analysis of the Impact of Kweichow Moutai's Price Hike on the Baijiu Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 1, 2023, Kweichow Moutai issued an announcement to increase the ex-factory price of its 53% vol Kweichow Moutai (Feitian, Wuxing) by approximately 20% from RMB 969/bottle to around RMB 1169/bottle. This price hike does not involve the market guidance price and marks Moutai’s first core product price hike since 2018 [1][2]. From the market reaction perspective, this is a key step for the industry leader after a long period of price “freeze”, forming a strong signal for subsequent industry expectations [1][2].

- After the price hike, the gross profit margin of Moutai liquor remains high. In 2024, the company’s net profit margin is approximately 51.51% and ROE reaches 36.48%, with extremely stable profitability [0][4].

- In Q4 2023, the single-quarter revenue growth rate exceeded 30% for the first time, and the net profit attributable to shareholders increased by approximately 29.37% quarter-on-quarter, indicating that the price hike provided obvious support to the quarter’s performance [4].

- From January 3, 2023 to December 24, 2025, the stock price fell from approximately RMB 1731.2 to RMB 1400.9, with an interval decline of about 19.08%, showing that the stock price weakened shortly after the price hike due to the overall industry headwinds [0].

- Technical Analysis: As of December 24, 2025, the 20/50/200-day moving averages are approximately RMB 1422.94/1440.66/1481.58 respectively. The current price is below the three moving averages, showing a weak trend [0].

- Moutai’s price hike redefines the price ceiling of high-end baijiu, reserving price hike and brand premium space for leading brands like Wuliangye and Luzhou Laojiao, and boosting industry confidence emotionally in the short term [1][2].

- Industry research opinions point out that after Moutai’s price hike, other brands have strategic space for “following price hikes” or “using volume to offset price”, which has a certain stabilizing effect on the price system [1][2].

- Macro and Demand Side: High-end banquets and business consumption tend to be rationalized; the opening rate of baijiu in mass scenarios like weddings has decreased, and real demand has weakened [6][7].

- Supply and Channel Side: In 2025, the industry-wide inventory turnover days reached approximately 900 days, with serious price inversion; channel confidence is insufficient, and dealers prefer “ordering based on sales” [5][6][7].

- Price Inversion: Industry reports show that price inversion is particularly prominent in price bands of 800~1500 yuan, 500~800 yuan, and 300~500 yuan, indicating channel system pressure [7].

- Wuliangye: In recent years, it has focused more on “volume priority”, stabilizing the market through channel subsidies and product structure adjustments (e.g., Wuliangye 1618, low-alcohol Wuliangye) and prioritizing market share preservation [3].

- Luzhou Laojiao: Guojiao 1573 adopted a “price maintenance” strategy in some stages but faced the dilemma of “quantity-price trade-off”, needing to balance market share and profitability [3][6].

- The 2025 Hurun Top 100 Food Industry List shows that the number of baijiu seats decreased from 26 at the peak to 22; brands like Xifengjiu and Jinzhongzijiu fell behind, while the basic market of head brands like Moutai, Wuliangye, Shanxi Fenjiu, and Luzhou Laojiao remains stable, showing the trend of increased industry head concentration [5].

- Shift from “volume expansion + channel stuffing + price hikes” to “terminal sales + de-stocking + value return”. Channel inventory clearing, capital chain pressure, and consumer rationalization jointly promote the industry to evolve towards terminal sales-driven [6][7].

- In terms of product attributes, baijiu is accelerating its return from “investment goods” to “consumer goods”, with prices closer to real drinking scenarios and consumer value [7].

- Inventory and Cash Flow: High inventory (industry average inventory turnover days reach 900 days) coexists with capital turnover pressure, and small and medium-sized enterprises face greater risks [5][6].

- Demand Structure Changes: Shrinkage of high-end and banquet scenarios, generational change (changes in drinking preferences and habits of young people) bring medium and long-term structural pressure [6].

- Price System Pressure: Price inversion and the dilemma of “price maintenance/volume maintenance” force enterprises to balance market share and brand premium艰难ly [6][7].

- Increased Head Concentration: Head distilleries with brand, channel, and capital advantages are expected to gain higher market share after clearing, while small and medium-sized enterprises are under obvious pressure [5][6].

- Competition Logic Transformation: From extensive channel stuffing to refined operations, competing in terminal sales capabilities, consumer insight, and brand value realization [6][7].

- Structural Opportunities: Moutai’s price hike opens a theoretical ceiling for the industry, but actual implementation requires demand recovery and inventory de-stocking as prerequisites; 2025 is more of a stage of “industry clearing and value revaluation” [5][6][7].

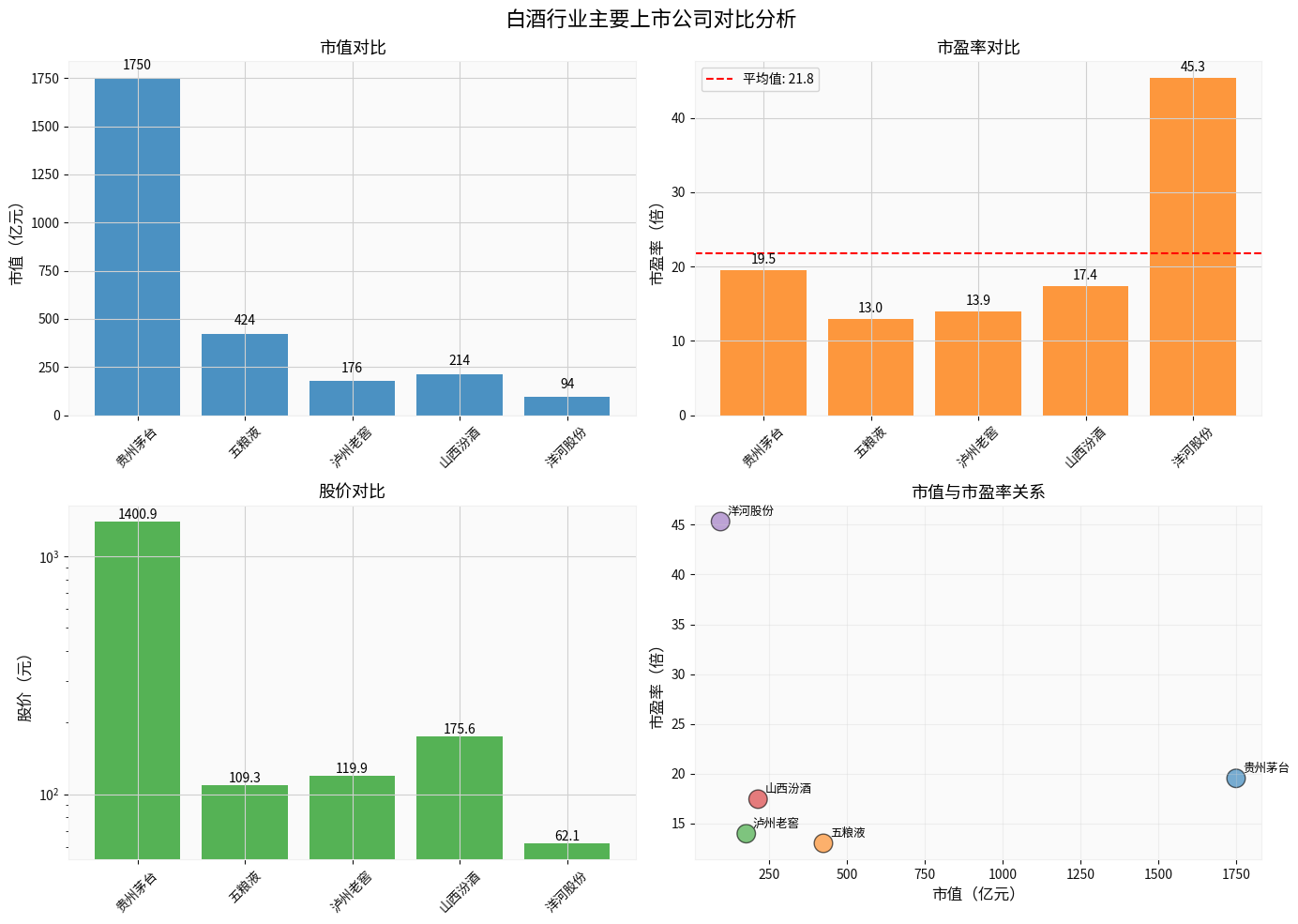

- Kweichow Moutai (600519.SS): Stock price approximately RMB 1400.9, market capitalization about RMB 1.75 trillion, PE around 19.51x [0].

- Wuliangye (000858.SZ): Stock price approximately RMB 109.28, market capitalization about RMB 424.17 billion, PE around 12.98x [0].

- Luzhou Laojiao (000568.SZ): Stock price approximately RMB 119.94, market capitalization about RMB 176.29 billion, PE around 13.95x [0].

- Shanxi Fenjiu (600809.SS): Stock price approximately RMB 175.60, market capitalization about RMB 214.23 billion, PE around 17.42x [0].

- Yanghe Co. (002304.SZ): Stock price approximately RMB 62.10, market capitalization about RMB 93.55 billion, PE around 45.33x [0].

Comparison Chart: Market Capitalization, P/E Ratio, Stock Price of Five Major Baijiu Enterprises and Their Relationship

Chart Description: Drawn based on data as of December 24, 2025, showing the comparison of market capitalization, P/E ratio, stock price of five major baijiu enterprises and the scatter relationship between market capitalization and P/E ratio. (Data Source: Securities Broker API [0], Calculation and Chart Generation: Python Analysis [0])

- This price hike increased from approximately RMB 969/bottle to around RMB 1169/bottle by about 20%, marking Moutai’s first core product price hike since 2018 and re-opening the price ceiling [1][2].

- From the result, the price hike supported Moutai’s profitability and short-term performance, but combined with factors like macroeconomics, weakening demand, and high channel inventory, it failed to reverse the industry’s deep adjustment trend from 2023 to 2025, and the stock price performance was relatively weak [0][5][6][7].

- The industry is undergoing a systematic transformation from “channel stuffing” to “terminal sales” and from “investment goods attribute” to “consumer goods nature”; high inventory, price inversion, and “quantity-price trade-off” together constitute the current main challenges [5][6][7].

- In the medium and long term, Moutai’s price hike provides a theoretical ceiling for the industry, but structural clearing and concentration enhancement will be the main line in the future; head enterprises with brand moats and channel control are more likely to survive the cycle [5][6].

[0] Jinling API Data (Real-time Market, Company Overview, Price Range, Moving Averages, Financial Analysis, Python Chart Generation, etc.)

[1] Debon Securities Research Report. Kweichow Moutai (600519) Price Hike Comment: Price Hike After 6 Years, Leading Baijiu to Open Price Ceiling. 2023-11-02. https://pdf.dfcfw.com/pdf/H3_AP202311031608301448_1.pdf

[2] Wanlian Securities Research Report. Feitian Moutai’s Price Hike Again After Six Years, Demonstrating Leading Strength. 2023-11-02. https://pdf.dfcfw.com/pdf/H3_AP202311031608168765_1.pdf

[3] 21st Century Business Herald. Wuliangye’s “Price Adjustment” Move, Will Guojiao Follow? 2025-12-12. https://www.21jingji.com/article/20251212/herald/be2b1290d00fa73a4238eaad1ada3957.html

[4] Southern Metropolis Daily. How Is the “Quality” of Guizhou Moutai’s Annual Report This Time from Price, Channel to Product? 2024-04-03. https://m.mp.oeeee.com/a/BAAFRD000020240403930210.html

[5] Time Finance/Sina Finance. Baijiu Trapped in 900 Days of Inventory, Still Occupies 22 Seats in Hurun Top 100 List; Jinzhongzi and Xifengjiu Fall Behind. 2025-12-23. https://finance.sina.com.cn/tech/roll/2025-12-23/doc-inhcuyuc6668422.shtml

[6] Huxiu. Baijiu江湖纪事: 2025 Market “逆行” Record. 2025. https://m.huxiu.com/article/4809903.html

[7] The Paper. Baijiu Strides Towards the Era of Inversion. 2025. https://m.thepaper.cn/newsDetail_forward_32165871

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.