2025 Bloomberg Interview: Logan Paul & Ken Goldin on Collectibles Market Growth

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

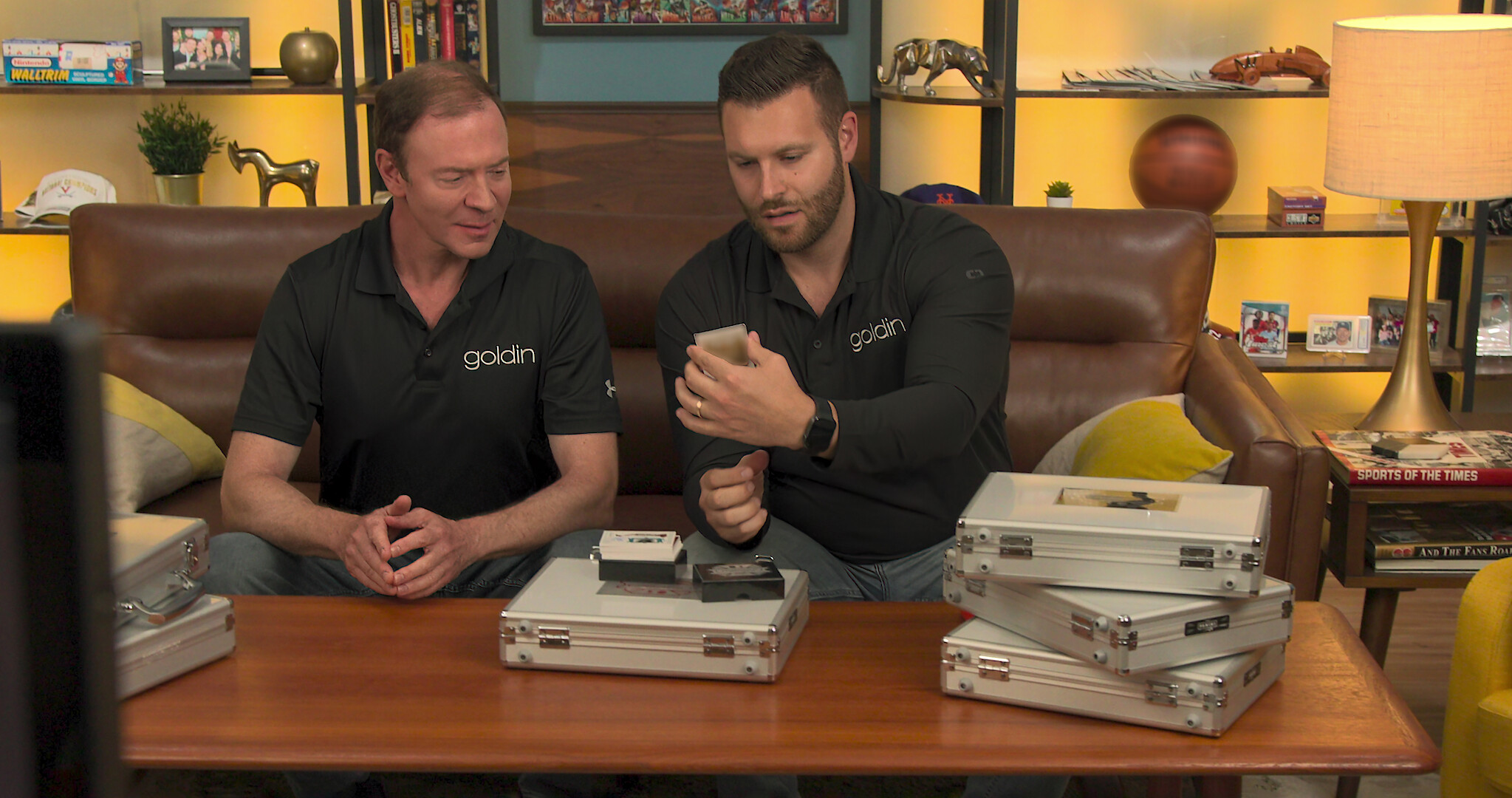

This analysis is based on the 2025-12-24 Bloomberg Television interview [0] featuring Logan Paul and Ken Goldin, conducted alongside the premiere of Netflix’s King of Collectibles: The Goldin Touch Season 3 [1].

The collectibles market, particularly trading cards, has seen explosive growth: Target’s 2025 trading card sales are up ~70%, on track to exceed $1 billion, while Walmart Marketplace recorded 200% sales growth from Feb 2024–Jun 2025, with Pokémon cards up 10x YoY [3]. Card Ladder reported August 2025 as the highest monthly sports card sales volume ($421M) since 2010, with PSA (a leading grading company) on pace to grade 23 million cards in 2025 [4]. eBay’s Q3 2025 data shows Pokémon GMV up triple-digit YoY for three consecutive quarters, with Goldin Auctions (acquired by eBay in 2024) achieving over $39M in sales in September 2025 [5].

Goldin, a leading high-value collectibles auction house, has expanded its reach since eBay’s 2024 acquisition [5]. Season 3 of King of Collectibles features high-profile sales like a 1909 Honus Wagner baseball card and Shohei Ohtani’s $4 million 50/50 home run ball, reinforcing Goldin’s brand as a central player in the professional collectibles market [1].

Paul, a prominent collectibles enthusiast and owner of a $5.3M Pokémon card [2], advised young investors to consider collectibles over stocks, citing Card Ladder’s 3,821% cumulative monthly return for Pokémon cards (2004–2025) [2]. However, he explicitly warned about risks including counterfeiting, lack of income generation, and historical fads like Beanie Babies and NFTs [2].

- Mainstream Adoption: Target and Walmart’s $1B+ 2025 trading card sales signal the hobby’s shift from niche to mainstream [3].

- Authentication’s Role: The rise of grading companies like PSA and eBay’s Goldin integration have reduced fraud risks, increasing collectibles’ investment appeal [4][5].

- Generational Demand: Gen Z/Millennials are driving growth by revisiting 90s/00s collectibles and introducing them to their children [2][6].

- Opportunities: Short-term sales growth is likely due to the Netflix show’s exposure [1], and Goldin’s market dominance may expand further post-eBay integration [5].

- Risks: Historical bubbles (Beanie Babies, NFTs) highlight the potential for value collapse [2]; collectibles lack the income generation and regulatory protections of traditional investments.

This interview, timed with the Netflix show premiere, underscores the collectibles market’s rapid growth, with trading cards leading the surge. Goldin’s brand is strengthened by the show and eBay ownership, while Paul’s dual role as enthusiast and cautionary voice provides mixed signals for investors. The market’s reliance on nostalgia and mainstream retail adoption makes it vulnerable to fad risks, even as authentication improvements enhance investment appeal.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.