Zhejiang Shibao (002703) Trading Halt Due to Price Surge: Drivers and Market Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

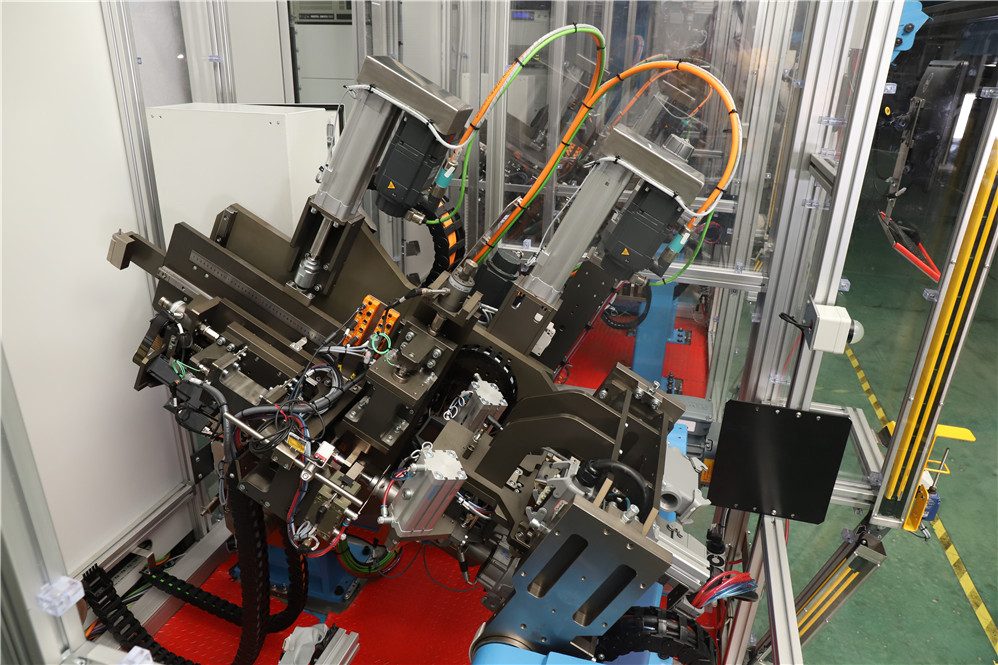

Zhejiang Shibao (002703), a leading Chinese automotive steering system supplier, covers core products including Electric Power Steering (EPS) and intelligent steering systems. It experienced a trading halt due to price surge on December 24, 2025, entering the surge halt list. This surge is mainly driven by two factors: first, the growth dividend from the electric vehicle industry—Chinese electric vehicle sales accounted for 18% of the European market in 2025 [1], and the company’s core products are key components for EVs, directly benefiting from industry expansion; second, recent strong stock price momentum—it rose 71.0% in the past 7 trading days, with a trading volume of 150 million shares on December 24, which is 4 times the average volume [0]. From a technical perspective, the KDJ indicator shows overbought (J:102.8), the current price is close to the resistance level of $20.89, and the support level is approximately $13.82 [0].

- The叠加 effect of industry trends and stock price momentum is significant: Global electric vehicle market expansion drives demand growth for steering systems, and combined with the momentum effect driven by recent market funds, they jointly led to the rapid surge in stock prices.

- Valuation deviates from fundamentals: The current P/E is 89.92x and P/B is 8.22x, significantly higher than the industry average. Moreover, the surge lacks specific company-level catalysts (such as better-than-expected performance or new product launches), mainly driven by market sentiment.

- Technical overbought signals need vigilance: The KDJ indicator has entered the overbought zone. Historical data shows that short-term corrections may occur after such situations, so close attention should be paid to resistance level breakthroughs and volume changes [0].

- Valuation bubble risk: Current valuation is far higher than the industry average, with correction pressure [0].

- Short-term overbought correction risk: Technical indicators show overbought, which may face profit-taking pressure in the short term [0].

- Catalyst absence risk: The current surge lacks specific company-level positive support, and its sustainability is questionable [0].

- Long-term growth of the electric vehicle industry: The company’s core products are key components for EVs and intelligent driving, and industry growth provides long-term demand support [1].

- Technical accumulation advantages: As a leading steering system enterprise, it has electrification and intelligent technology accumulation, and is expected to continue benefiting from industry upgrades [0].

Zhejiang Shibao (002703)'s trading halt due to price surge on December 24 is mainly driven by the growth dividend from the electric vehicle industry and stock price momentum. In the short term, attention should be paid to correction risks brought by technical overbought and high valuation; in the long term, it benefits from the trend of automotive electrification and intelligence. Market participants should pay attention to industry policy changes, company performance disclosures, and technical indicator changes, and rationally evaluate risks and returns [0][1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.