Key Risks and Considerations for Options Trading Amid Misleading Claims

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

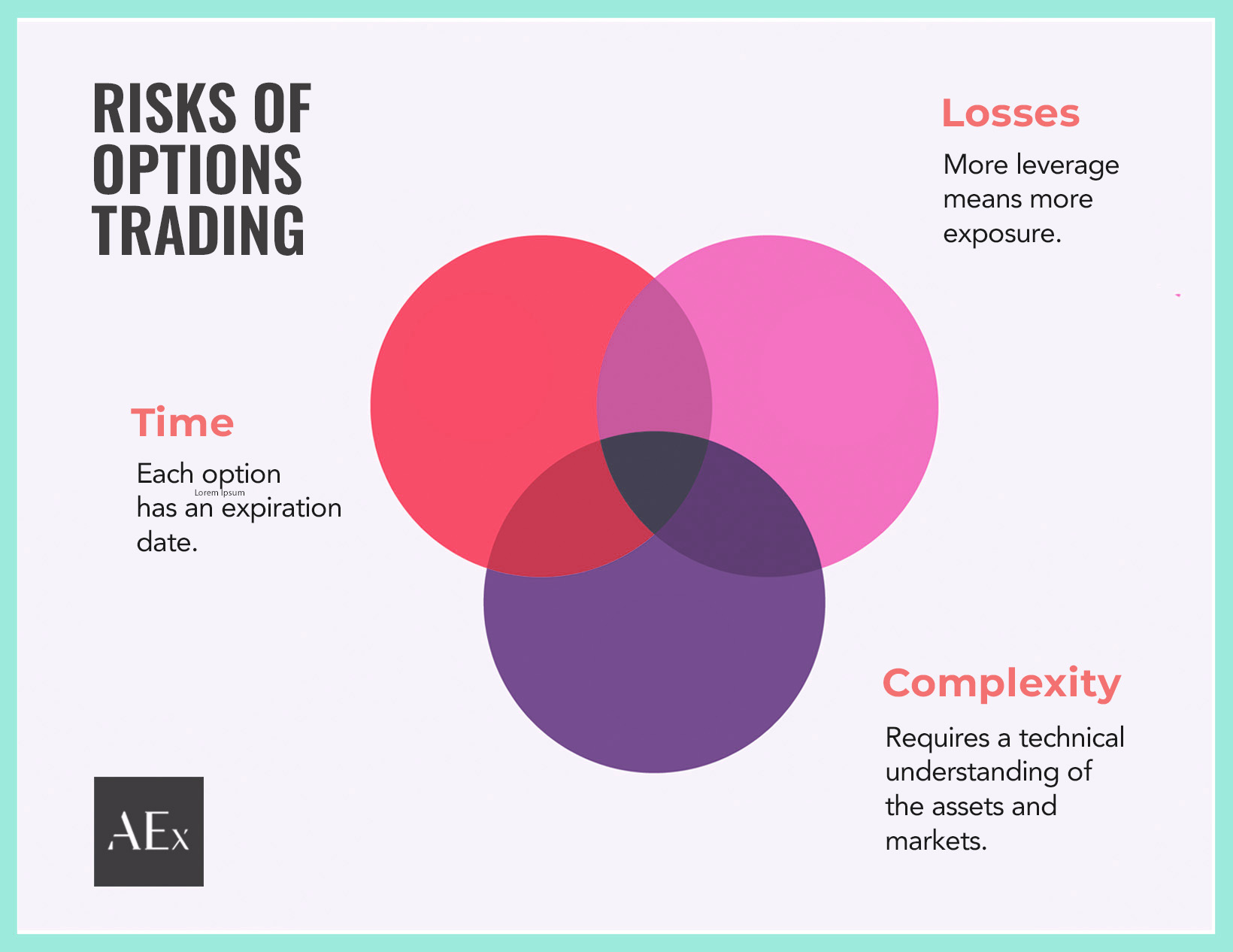

This analysis is prompted by a social media post claiming “options are free money”—a dangerous oversimplification that can mislead inexperienced investors about the significant risks inherent in options trading [0]. Options are complex financial instruments that require specialized knowledge, with unique risk-reward dynamics not present in traditional stock trading. Key risks identified include:

- Unlimited loss potential for sellers (writers): Sellers receive a premium but assume obligations; for example, naked call writers (without owning the underlying stock) face potentially unlimited losses if the stock price rises sharply, as they must buy shares at market price to deliver at the strike price [4][5].

- Time decay (theta): Unlike stocks, options have an expiration date and lose value over time, with decay accelerating in the final weeks of an option’s life. Even if the underlying asset moves in the expected direction, the option may still lose value if the movement is insufficient before expiration [3].

- Volatility sensitivity (vega): Options prices depend on implied volatility, which can change unpredictably. Falling volatility can erode option value even with favorable underlying price movements, while high volatility increases premiums [2][3][4].

- Complexity and knowledge requirement: Options involve specialized terminology (Greeks: delta, gamma, theta, vega, rho) and strategies (covered calls, spreads, straddles) with unique risk profiles, requiring deep understanding to avoid misinterpretation [2][3][5].

- Liquidity risk: Illiquid options have wide bid-ask spreads, eroding potential profits [3].

- Total premium loss for buyers: While buyers’ losses are capped at the initial premium paid, they can lose 100% of their investment if the option expires worthless [4][5].

- Assignment risk: Sellers may be forced to fulfill contracts at unfavorable prices at any time before expiration, even for slightly in-the-money options [2].

- Margin requirements: Brokers impose margin for certain strategies, amplifying potential losses [5].

- Tax complexity: Options transactions have unique tax implications, requiring consultation with a professional advisor [1][5].

Regulatory requirements mandate that all options traders review the “Characteristics and Risks of Standardized Options” (ODD) [1][2][3][5].

- Social media misinformation amplifies risk: The “free money” claim can lead inexperienced investors to ignore critical risks, resulting in emotional decision-making and significant financial loss [2].

- Asymmetric risk between buyers and sellers: Buyers have capped losses (premium), while sellers face unlimited loss potential—a key distinction often overlooked by beginners [4].

- Specialized metrics drive options pricing: The Greeks (delta, theta, vega) are unique to options and require mastery to navigate time decay and volatility risks [3].

- Broker safeguards are reactive, not proactive: Experience-based trading restrictions protect against reckless activity but do not replace proper education [5].

- Risks: Financial loss from underestimated risks (unlimited loss, time decay), emotional stress from unexpected outcomes, and restricted trading access due to inadequate understanding [1][4].

- Opportunities: For educated traders, strategies like covered calls (owning underlying stock) or credit spreads can limit risk while leveraging options’ flexibility [5]. However, these opportunities are only accessible to investors with sufficient knowledge of options mechanics and risk management.

- Options trading is not “free money”; it involves significant, often underappreciated risks.

- The “Characteristics and Risks of Standardized Options” (ODD) is a mandatory resource for all options traders.

- Inexperienced investors should prioritize education and risk management before engaging in options trading.

- Tax professionals should be consulted to address the complex tax implications of options transactions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.