Analysis of Seeking Alpha’s ‘AI Bubble Myth’ Thesis: Market Impact on Memory, Networking, and Cooling Sectors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

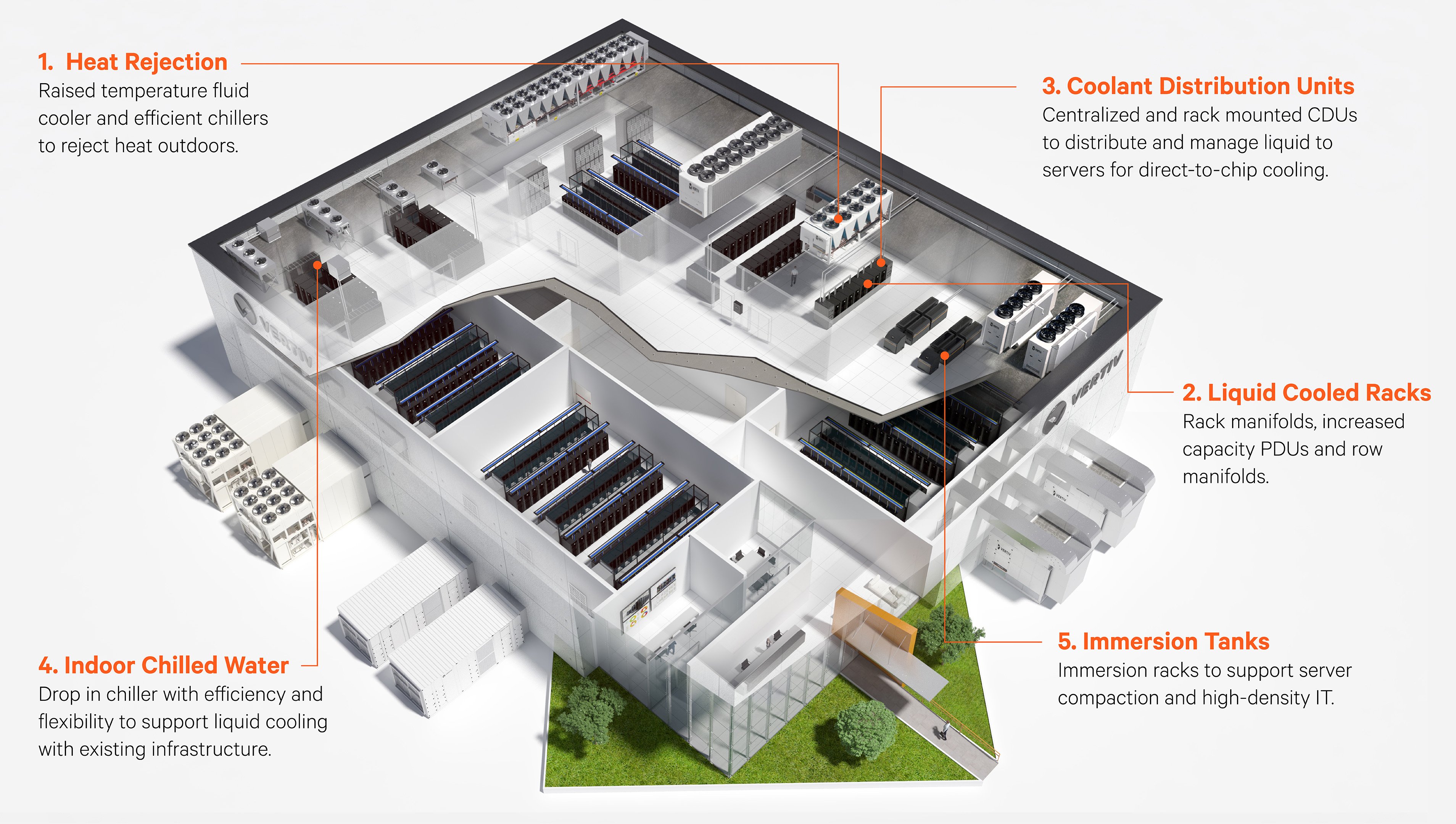

This report integrates market news, performance data, and valuation metrics to evaluate the claims of the Seeking Alpha article [1]. The article’s thesis that AI valuations are not bubbly centers on memory companies (Micron, SK Hynix, Samsung) and AI infrastructure sectors (networking, cooling). Market data shows mixed reactions: Micron (MU) experienced the strongest gain (+2.85% on December 24) [0], possibly reflecting investor attention to the valuation narrative, while SK Hynix (000660.KS) had a marginal +0.17% increase [0]. In contrast, Arista Networks (ANET), a leading AI networking stock, declined by -0.57% [0], indicating no immediate positive response to the article’s networking sector advocacy, and Vertiv (VRT), a data center cooling company, rose by +0.41% [0].

Valuation metrics reveal critical discrepancies. SK Hynix’s 11.37x P/E [0] is close to the article’s 8–10x range, but Micron’s 27.06x P/E [0] is significantly higher, suggesting potential differences in metric definitions (e.g., forward vs. trailing P/E) or regional valuation variations. The article’s projected 40%+ HBM CAGR also conflicts with industry forecasts of 21.35–26.10% (2025–2033) from Yahoo Finance [2], raising questions about the article’s growth assumptions.

- Selective Investor Reaction: Memory stocks, particularly Micron, showed the strongest response to the article’s claims, while networking stocks did not react positively, indicating investors may be prioritizing short-term valuation narratives over broader AI infrastructure themes.

- Metric Definition Importance: The discrepancy between the article’s 8–10x P/E claim for Micron and its actual 27.06x trailing P/E [0] underscores the need to clarify whether forward, non-GAAP, or other adjusted metrics were used.

- Regional Valuation Differences: SK Hynix (a Korean company) has a lower P/E (11.37x) [0] compared to Micron (a U.S. company) (27.06x) [0], highlighting potential regional market dynamics that affect stock valuations in the same sector.

- HBM Growth Realism: Industry forecasts of 21–26% HBM CAGR [2] suggest the article’s 40%+ projection may overstate future growth, which could temper long-term investor expectations.

- Risks:

- Valuation risk: Micron’s 27.06x P/E [0] indicates a higher valuation relative to SK Hynix, which could limit upside if growth slows.

- Growth projection risk: The article’s 40%+ HBM CAGR claim conflicts with industry forecasts [2], potentially misleading investors.

- Market sentiment risk: AI sector valuations are sensitive to rapid shifts in investor sentiment, which could be triggered by missed growth targets.

- Supply chain/regulatory risk: Memory companies face potential disruptions and regulatory challenges (e.g., CHIPS Act compliance, trade tensions) [0].

- Opportunities:

- Long-term growth potential: Memory, networking, and cooling sectors are essential for AI infrastructure, supporting sustained demand if growth aligns with industry forecasts [2].

- Valuation opportunities: SK Hynix’s 11.37x P/E [0], close to the article’s range, suggests potential value for investors focused on Korean memory stocks.

This analysis synthesizes findings from market data and external sources to provide context for decision-making. The Seeking Alpha article’s claims about AI valuations and HBM growth have been partially contradicted by industry data and actual stock metrics. Market reactions were mixed, with memory stocks showing the strongest positive response. Investors should verify metric definitions (e.g., forward vs. trailing P/E) and cross-reference growth projections with industry forecasts. Monitoring supply chain and regulatory developments is also recommended to assess long-term risks and opportunities in AI infrastructure sectors.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.