Xiaomi Transformation: Growth Point Assessment and Investment Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is rooted in an assessment of Xiaomi’s transformation strategy, with three core growth points and financial health evaluation [0, 1, 2]. Market rumors suggesting Xiaomi’s collapse are disproven by three key metrics:

- Financial Position: A market capitalization of approximately 1.017 trillion HKD (as of December 2025) reflects investor confidence [1].

- Asset Quality: Consistent profitability and Q3 2025 record performance, including 199% YoY EV revenue growth, validate sustainable operations [2].

- Order Capability: The Xiaomi 17 series drove the company to 2nd place in China’s smartphone market (17% share, October 2025), demonstrating strong product demand [3].

Breaking down the growth points:

- Overseas Expansion: Xiaomi maintains a significant global presence in India, Southeast Asia, and Europe, with a history of top smartphone market share in India [0].

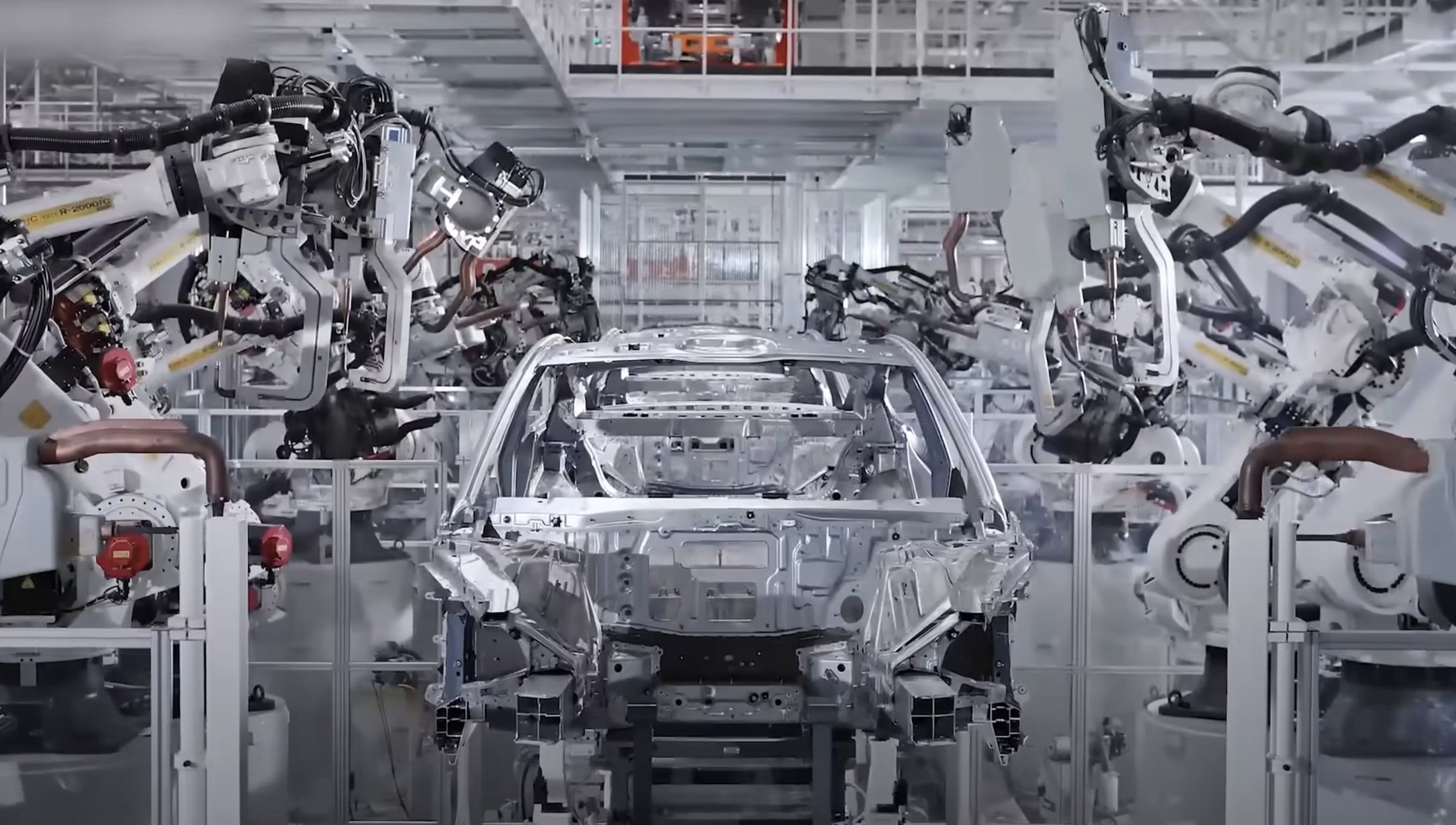

- Human-Vehicle-Home Ecosystem: The EV business (a key ecosystem component) has shown explosive growth, with Q3 2025 revenue surging 199% YoY [2].

- Smartphone Premiumization: The Xiaomi 17 series has accelerated progress, boosting market share in China’s high-end segment [3].

- Ecosystem Synergy: Rapid EV growth enhances user stickiness across Xiaomi’s product ecosystem, creating cross-selling opportunities that support both smartphone premiumization and ecosystem service revenue [0, 2].

- Market Sentiment Stabilization: While Xiaomi’s HK-listed stock (1810.HK) declined 10.37% from November 13 to December 24, 2025, the 20-day moving average of $41.09 indicates short-term volatility rather than a long-term downturn [0]. Founder Lei Jun’s HK$100 million share purchase in November 2025 further signals internal confidence [4].

- Valuation Context: A 2024 base case DCF valuation of $21.00 suggested potential overvaluation, but the Q3 2025 EV and premium phone performance may revise future valuation prospects [0].

- Ecosystem Monetization: The growing EV and smart device user base expands potential for value-added services.

- Premiumization Gains: The Xiaomi 17 series’ success positions the company to capture high-margin smartphone market share.

- Global Reach: Established overseas distribution networks support further international expansion.

- Supply Chain Vulnerabilities: Memory chip shortages and rising component costs may disrupt smartphone production and profitability [5].

- EV Market Competition: Intense competition from Tesla, BYD, and Huawei in the EV sector could slow Xiaomi’s market penetration [6].

- Short-Term Valuation Uncertainty: The 2024 DCF valuation implies potential overvaluation, requiring ongoing performance validation to justify current market price [0].

Xiaomi’s transformation from a hardware manufacturer to an ecosystem service provider is supported by a strong financial foundation, rapid EV growth, and progress in smartphone premiumization. Market rumors of collapse are unsubstantiated by its market cap, profitability, and order capability. While opportunities exist in ecosystem expansion and premiumization, investors should monitor supply chain risks, EV competition, and short-term stock volatility. This analysis presents factual insights for decision support without prescriptive investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.