Analysis: 2026 Industrial Super-Cycle and AI Infrastructure Stock Landscape

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

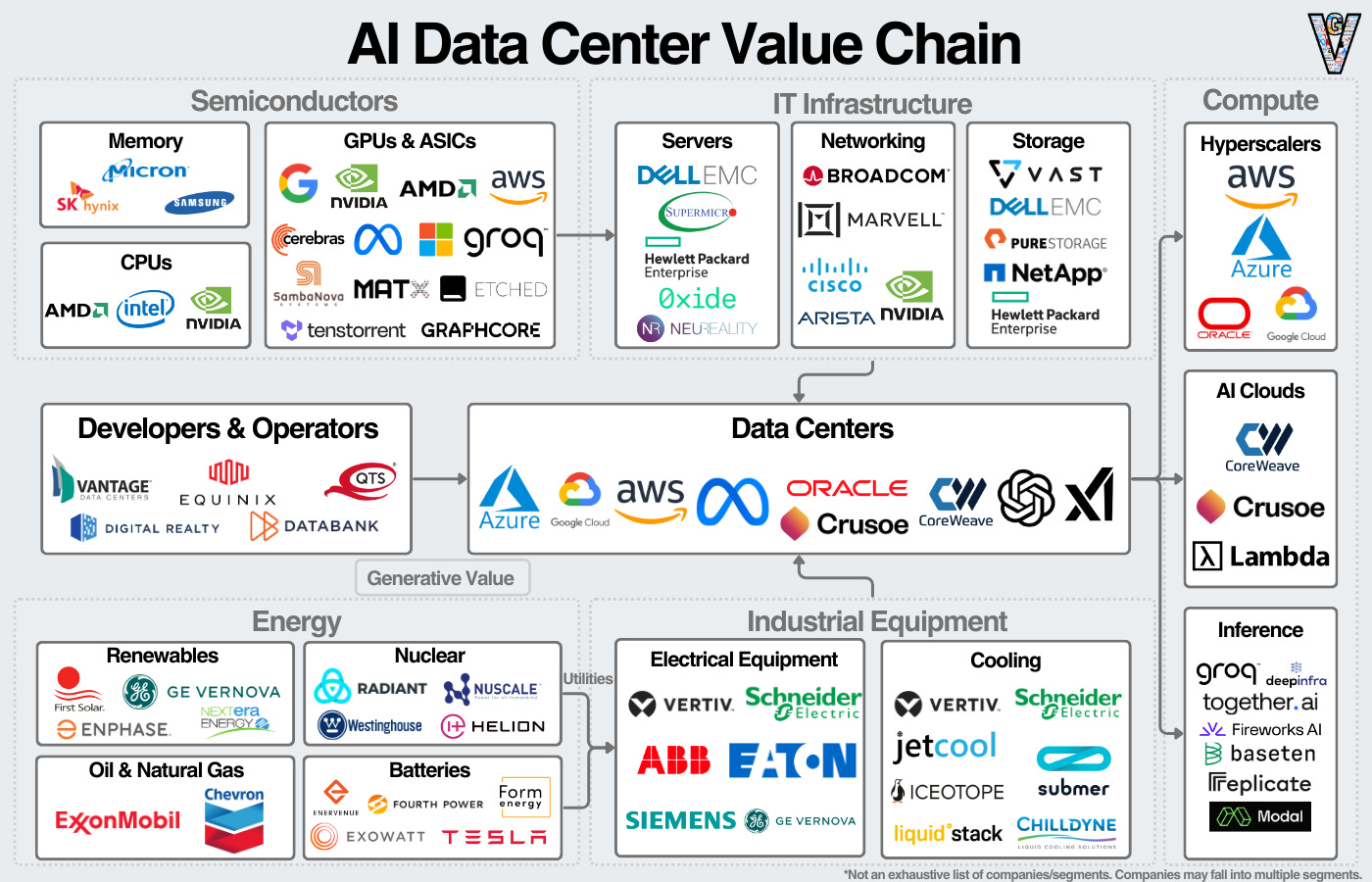

This analysis is based on the Benzinga report [1] published on December 23, 2025, which argues the industrial sector is emerging as a critical driver of AI infrastructure growth in the 2026 super-cycle. The AI infrastructure market is in a 10-year buildout cycle, with 2026 identified as its midpoint by BofA [2], driven by expanding AI use cases and hyperscaler data center investments [0].

Traditionally associated with tech firms, AI infrastructure now includes industrial companies supporting data center construction, power distribution, and cooling. Upstream, semiconductor players like Texas Instruments (TXN) benefit from AI-driven demand for analog and embedded processors [2]. Midstream, firms like Vertiv (VRT) hold a $9.5 billion backlog in AI data center cooling [3], Eaton (ETN) is investing $1 billion in transformer manufacturing [3], and Applied Digital (APLD) has $16 billion in contracted data center power infrastructure backlogs [3].

Component shortages—4-5 year lead times for transformers [3] and Micron HBM supply sold out through 2026 [3]—create significant entry barriers, favoring established industrial players with existing capacity [0].

- Sector Diversification: The industrial sector’s integration into AI infrastructure shifts growth opportunities beyond traditional tech, offering investors and firms new avenues for exposure.

- Structural Shortages: Component supply constraints are long-term, not temporary, providing sustained demand for industrial players with backlogs.

- Systemic Impacts: AI data center energy demands drive grid modernization needs, while onshoring trends influence supply chain strategies for industrial and tech stakeholders alike.

- Risks: Component shortages may delay project timelines; energy supply constraints could limit data center expansion; high capital expenditure requirements favor firms with strong balance sheets, excluding smaller players [0].

- Opportunities: Investors can diversify portfolios into industrial AI infrastructure stocks; industrial firms with record backlogs have predictable revenue streams; governments may increase investments in grid modernization to support AI growth [4].

The 2026 industrial super-cycle is tied to AI infrastructure demand, with industrial players (VRT, ETN, APLD, TXN) emerging as critical value chain participants. The cycle is part of a 10-year AI buildout, with component shortages and entry barriers benefiting established firms. Stakeholders—investors, industrial companies, and governments—must adapt to the sector’s shifting role in AI infrastructure.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.