Brazil’s 2025 Stock Market Bull Run: Dependence on 2026 Political Election Outcomes

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

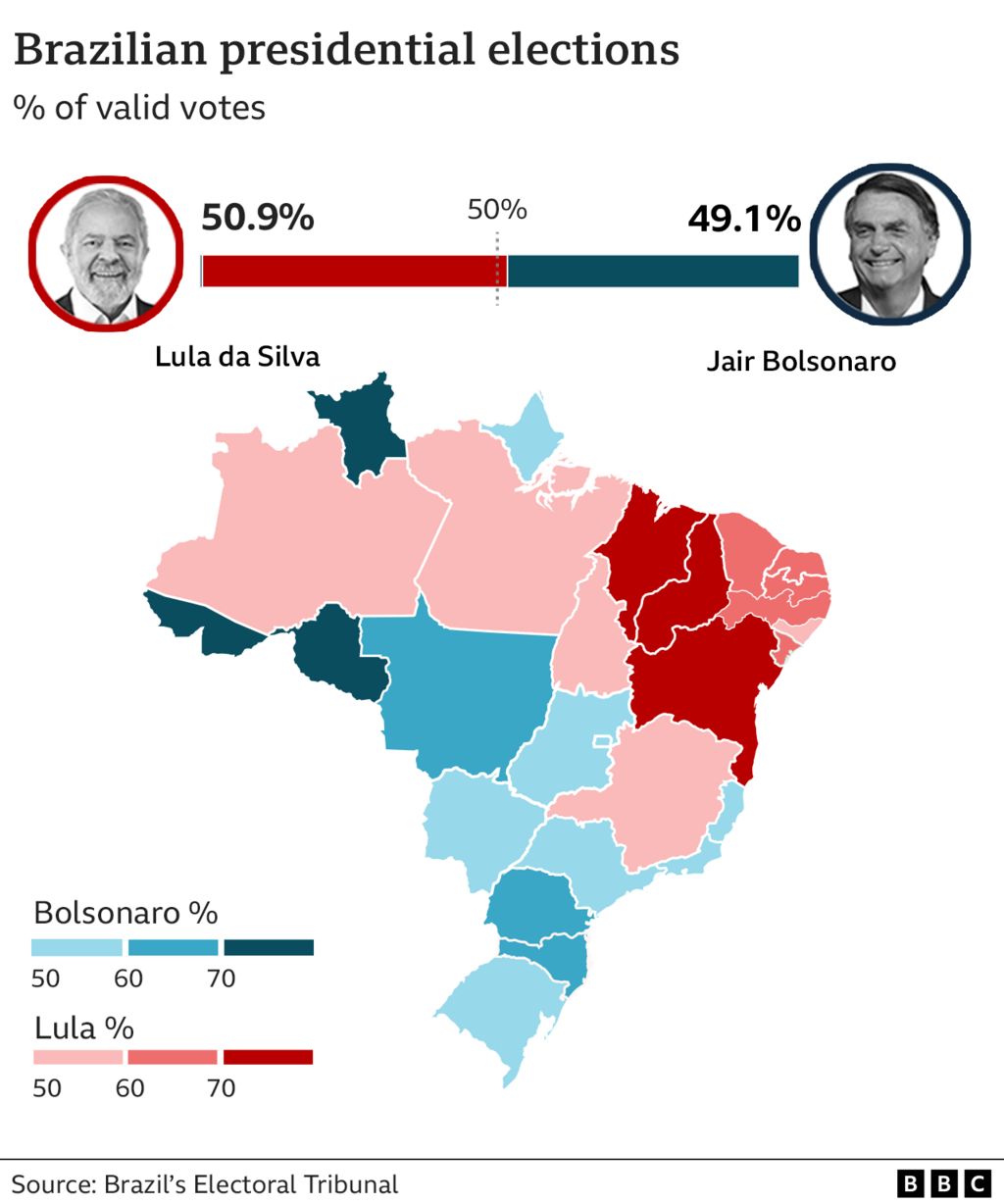

This analysis is based on the Barron’s article [1] published on December 23, 2025, which reports Brazil’s stock market had a strong 2025 with further gains hinging on political change in the 2026 election. Internal market data [0] shows the Bovespa Index is up 33.4% YTD through December 23, 2025, over 247 trading days with an average daily volume of 9.15M shares. Market intelligence indicates two key presidential candidates for 2026: (1) Incumbent President Lula, seeking a fourth non-consecutive term; (2) Flávio Bolsonaro, son of former President Jair Bolsonaro (who is barred from running and incarcerated), backed by the Liberal Party. Investors had previously favored São Paulo Governor Tarcisio de Freitas as a more market-friendly candidate, and Flávio Bolsonaro’s emergence has introduced market volatility. The 2025 bull run is directly tied to investor hopes for policy changes post-2026 election. A conservative victory could signal more market-friendly policies, while Lula’s re-election might continue current policies—scenarios that are already shaping investor sentiment. Affected instruments include Brazilian large caps such as Petrobras, Vale, and Banco Santander Brasil, as well as commodity (iron ore, oil) and financial sectors [0].

- Political polarization in Brazil remains a significant factor influencing market dynamics, with investor sentiment heavily tied to election candidate trajectories.

- The unexpected shift from investor-preferred Tarcisio de Freitas to Flávio Bolsonaro as the Liberal Party candidate has highlighted the volatility of political risk in Brazilian markets.

- Commodity and financial sectors, which are large components of the Bovespa, are particularly sensitive to potential policy changes under a new administration [0].

- Risks: Political polarization could exacerbate short-term market volatility; policy uncertainty post-election may delay investment decisions; unexpected candidate shifts or election outcomes could disrupt market momentum.

- Opportunities: A clear mandate for market-friendly policies following the election could sustain or extend the 2025 bull run; sectors like commodities and financials may benefit from favorable policy changes.

- Time Sensitivity: Volatility is expected to increase as the October 2026 election approaches.

The Bovespa Index has achieved a 33.4% YTD gain in 2025, driven by investor hopes for 2026 political change. Incumbent President Lula and Flávio Bolsonaro are leading candidates, with Flávio’s emergence jolting markets that had favored a more market-friendly candidate. Commodity and financial sectors are most affected by the political uncertainty. This summary provides factual context without prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.