Potential 2026 Market Rotation: Impact on Tech Dominance and Portfolio Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

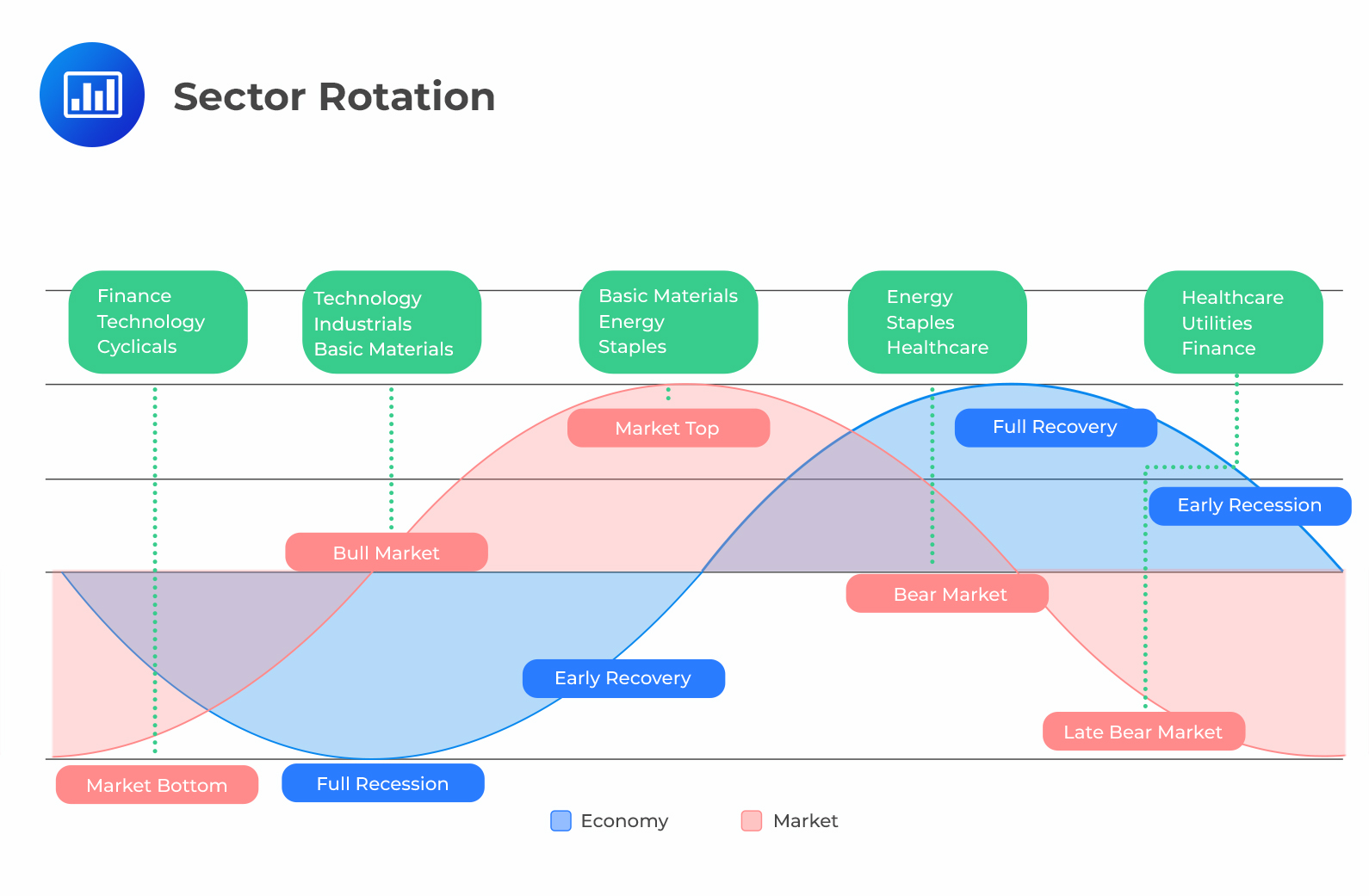

This analysis centers on the December 23, 2025 Seeking Alpha article [1] highlighting a potential 2026 market rotation away from the tech sector, which has dominated recent S&P 500 gains. The author, Samuel Smith, disclosed a long position in Enterprise Products Partners (EPD), a midstream energy company, as part of his portfolio reshuffle. Market data [0] shows the tech sector ETF (XLK) delivered a 19.21% 6-month return, while the small/mid-cap Russell 2000 ETF (IWM) gained 18.18%—a narrowing gap indicating early capital flow toward non-tech segments. Short-term (as of 2025-12-24) sector performance further underscores this shift: utilities (+1.67%) and consumer defensive (+1.01%) led, with tech (+0.21%) ranking mid-table [0]. Valuation disparities are a key driver: NVIDIA (NVDA) has a high P/E ratio of 45.82x, compared to EPD’s 12.13x [0]. Related analyses [3] predict rotation into value/cyclical sectors (financials, utilities) and gold, with tech expected to underperform due to stretched valuations and AI capital expenditure return uncertainties. Small/mid-caps [2] may benefit from better risk-adjusted returns as market breadth expands beyond the “Magnificent 7” tech stocks.

- Early rotation signals in market breadth: Small/mid-cap (IWM) returns have nearly matched tech (XLK) returns over 6 months, indicating growing investor interest in non-tech segments [0].

- Valuation gaps drive shift: High-P/E tech stocks (e.g., NVDA: 45.82x) contrast with low-P/E value stocks (e.g., EPD: 12.13x), creating incentives for portfolio diversification [0][1].

- Maturing tech rally sentiment: The article contributes to growing consensus that the long-dominant tech rally is slowing, prompting investors to seek exposure to underperforming sectors [1][3].

- Mixed outlook for EPD: Despite a buy consensus, recent analyst downgrades (Morgan Stanley, JPMorgan) for EPD require monitoring of its earnings and pipeline projects [0].

-

Risks:

- Tech valuation vulnerability: High P/E ratios (NVDA: 45.82x) increase risk of underperformance amid rotation [0].

- Cyclical sector sensitivity: Energy and financial sectors are exposed to interest rate changes and GDP growth, requiring monitoring of Fed policy and economic forecasts [3].

- Market breadth uncertainty: Sustained rotation depends on continued small/mid-cap outperformance relative to large-cap tech [0][2].

- Company-specific risk for EPD: Analyst downgrades warrant attention to EPD’s operational and financial performance [0].

-

Opportunities:

- Small/mid-cap growth: Expanding market breadth may drive better risk-adjusted returns for the Russell 2000 (IWM) [2][0].

- Value sector appeal: Utilities, financials, and energy (e.g., EPD) offer attractive valuations amid rotation narratives [3].

- Diversification benefits: Shifting exposure from overvalued tech may reduce portfolio concentration risk [1][3].

The potential 2026 market rotation from tech to non-tech sectors is supported by early market breadth trends, valuation disparities, and growing sentiment. Data shows IWM’s 6-month return nearing XLK’s, with short-term momentum shifting to defensive sectors. NVDA’s high valuation (45.82x P/E) contrasts with EPD’s low valuation (12.13x), highlighting opportunities for reallocation. While analyses predict rotation into value/cyclical sectors, conflicting projections of 20% tech upside in 2026 [4] require multi-perspective evaluation. Decision-makers should monitor volume changes between tech and non-tech sectors, economic indicators, and EPD’s performance to confirm rotation signals.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.