Analysis of Institutional Trading Behavior on the Dragon and Tiger List for December 23, 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

December 23 Dragon and Tiger List data shows that institutional investment behavior is divided: 24 stocks received net buying, and 24 were net sold [0]. From the perspective of trading characteristics and track distribution, the top three net bought stocks—DFMC (new energy materials), CNIIC (advanced manufacturing/aerospace), and Kema Technology (memory chips)—represent different logics:

- DFMC: Mainly engaged in core materials for lithium battery electrolytes. On December 23, it hit the daily limit (+9.98%), with trading volume doubling (0.82 billion shares the previous day vs. 1.75 billion shares that day), reflecting institutions’ optimism about the long-term demand for the new energy track [0].

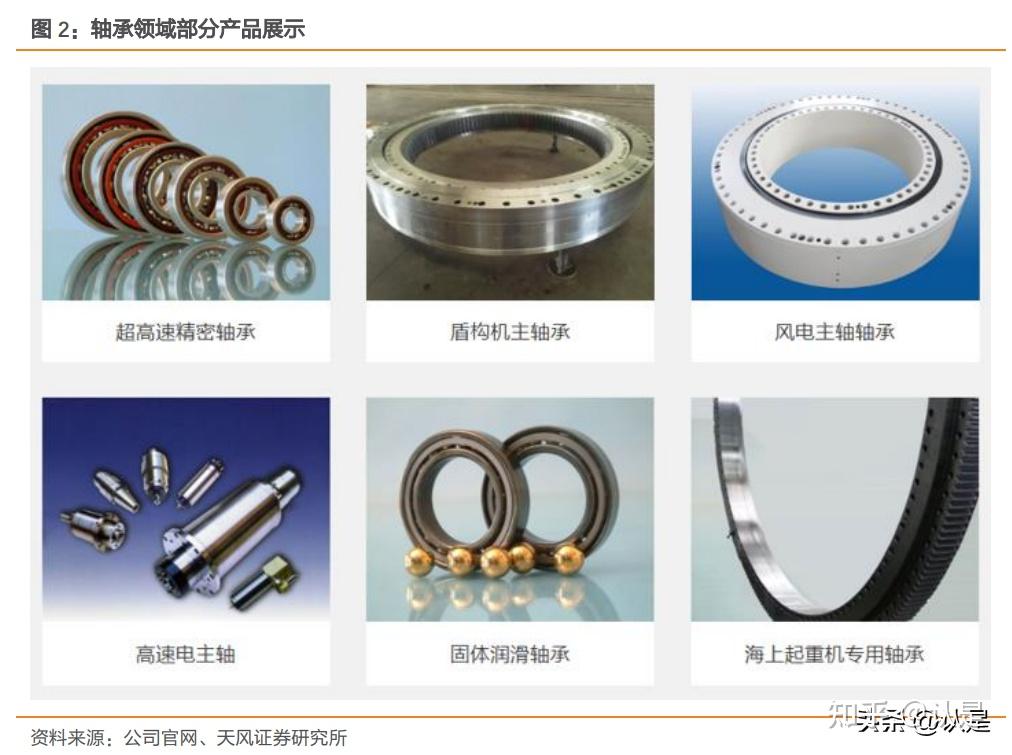

- CNIIC: Mainly engaged in precision bearings and aerospace optical devices. Its stock price fell by 5.40% that day but trading volume increased by 2.5 times, possibly an institutional bottom-fishing behavior to lay out the track supported by the national high-end manufacturing policy [0].

- Kema Technology: Engaged in memory chip business. It hit the daily limit on December 22 and has recently been affected by the news that “China will introduce a $70 billion chip industry incentive policy”. Institutions bought to bet on policy dividends [1,2].

- Institutional layout presents a dual logic of “policy + growth”: New energy materials benefit from global penetration rate improvement, advanced manufacturing/aerospace is supported by national strategies, memory chips are expecting policy incentives—all three tracks have long-term growth potential [0,1,2].

- The “decline + high trading volume” feature of CNIIC reflects institutions’ contrarian layout thinking for high-quality targets, possibly indicating their tolerance for short-term fluctuations and recognition of long-term value [0].

- Opportunity: The three tracks (new energy materials, advanced manufacturing/aerospace, and memory chips) that institutions concentrated on buying have policy or industry demand support and may continue to attract capital attention in the future [0,1,2].

- Risk: Stocks such as Midea Environmental Technology that were net sold may have potential risks such as short-term overvaluation, underperformance, or track policy changes, but the specific reasons need further verification [0].

- Institutional net buying focused on three tracks—new energy materials, advanced manufacturing/aerospace, and memory chips—reflecting long-term strategic layout logic [0].

- The trading characteristics of CNIIC indicate that institutions may adopt a bottom-fishing strategy [0].

- The memory chip track is affected by policy incentive expectations and attracts institutional layout [1,2].

- Institutional net selling behavior needs further analysis of the reasons in combination with the specific situation of individual stocks [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.