港股热股英诺赛科(02577.HK)事件分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

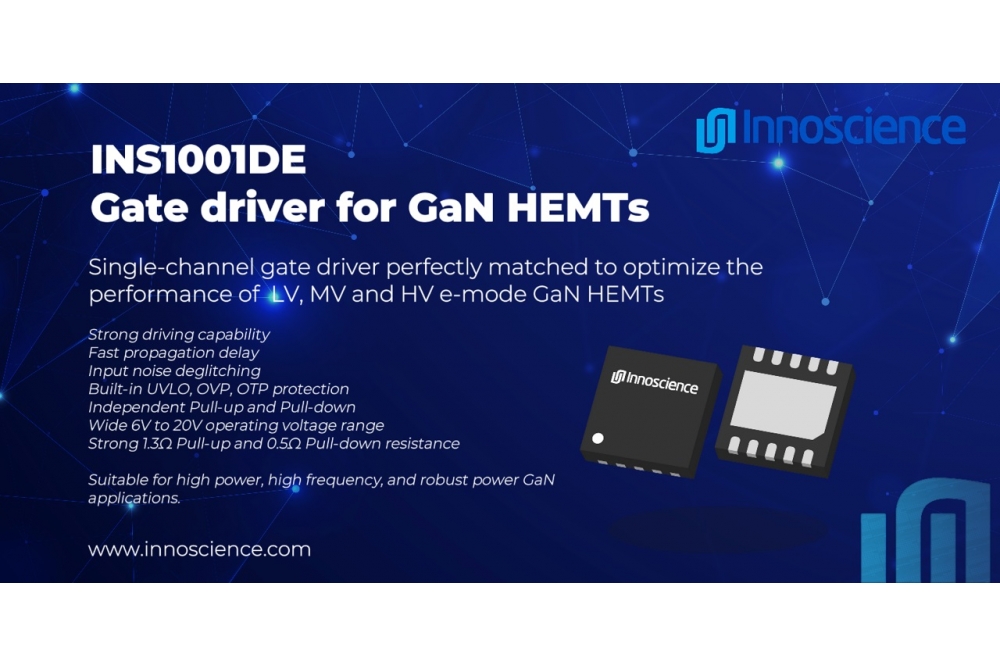

英诺赛科(02577.HK)是一家聚焦氮化镓功率半导体领域的企业[1]。本次成为港股热门的核心催化剂是与安森美半导体(ON.US)的战略合作,双方将采用英诺赛科8英寸硅基氮化镓工艺,加速氮化镓在新能源汽车、AI、数据中心等领域的应用,预计未来几年将带来数亿美元销售收入[4]。

从价格与成交量来看,2025年12月23日该股开盘73.25港元,最高价73.95港元,最低价69.50港元,收盘70.15港元,跌幅3.90%[3]。当日成交量282万股,成交额2.01亿港元,较历史平均显著放大[3]。尽管合作利好吸引市场关注,但股价当日下跌或反映短期获利回吐压力。

- 行业地位与认可:作为氮化镓功率半导体龙头,英诺赛科获得安森美战略合作,彰显其技术实力在行业内的认可度,长期有望提升市场份额与业绩[1][4]。

- 板块联动效应:半导体板块因全球科技需求增长整体走强,对英诺赛科的市场情绪形成正向支撑[3]。

- 风险与估值矛盾:虽然战略合作带来长期发展机遇,但当前市盈率为负(处于亏损状态),叠加行业竞争与技术更新风险,短期估值压力需警惕[3]。

英诺赛科(02577.HK)因与安森美半导体的氮化镓战略合作成为港股热门,尽管当日股价下跌,但长期发展潜力受行业认可。投资者需关注合作进展、技术研发及板块整体走势,同时谨慎评估估值与竞争风险。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.