Historical Comparative Analysis of Gold and Silver Investment Strategies in the Current Stagflation Environment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

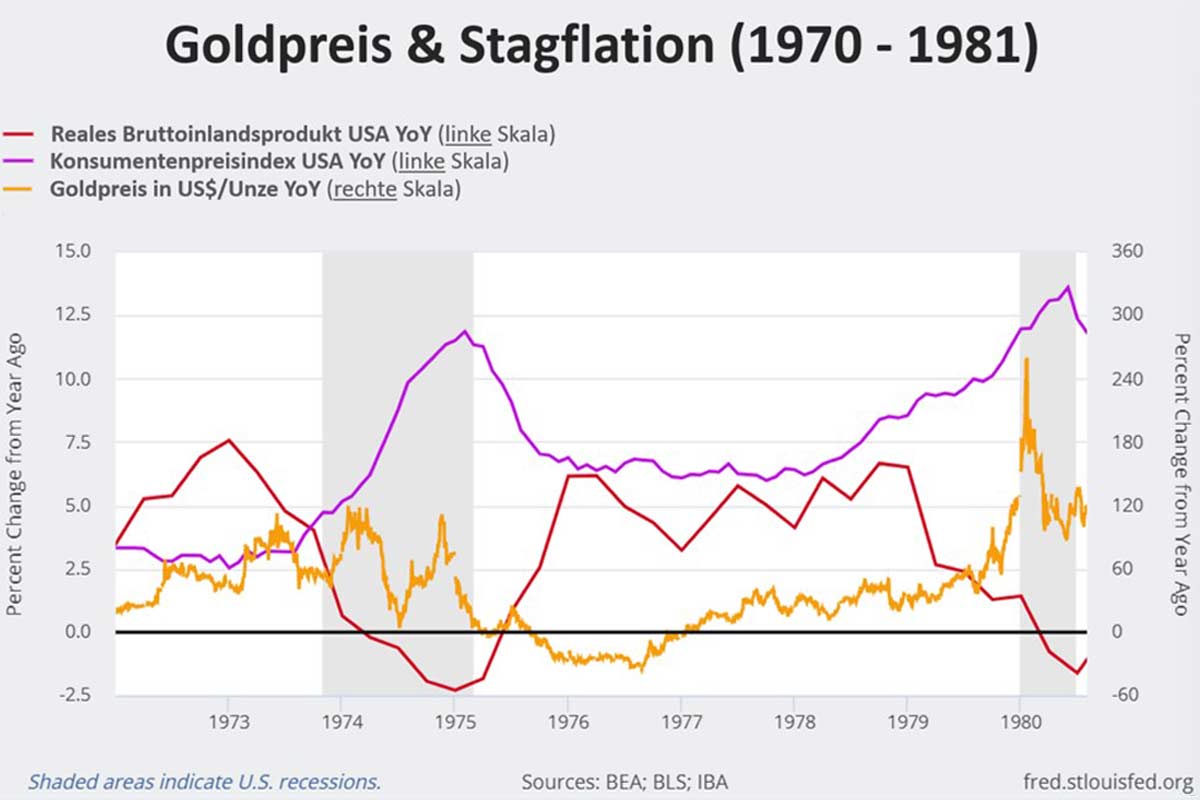

Historical Performance vs. Current Environment Comparison: During the U.S. stagflation period from 1971 to 1980, the price of gold rose from $37.4/oz to $711/oz (an increase of over 1800%), and silver rose from about $2/oz to $49/oz (an increase of 2350%) [2]. The current economic environment has factors similar to the 1970s, such as global excessive monetary issuance and inflationary pressures [2][3], but with a more diversified energy structure and different central bank policy tools—environmental differences need to be noted [2].

-

Price Target Evaluation: The current gold price is approximately $4,300/oz [0]; the $50,000/oz target price lacks historical data support and is a highly optimistic forecast. The current silver price is about $72/oz [4]; the $96-$100/oz target price requires a 33%-39% increase from the current level and falls within the inflation-adjusted range of the 1980 silver price of $49/oz (about $150/oz) [2], but attention should be paid to silver supply rigidity and the development of industrial substitution technologies [5].

-

Market Performance and Correlation: Since 2025, the Gold ETF (GLD) has risen from $244.22 to $399.02 (a 63.39% increase), and the Silver ETF (SLV) has risen from $26.72 to $60.93 (a 128.03% increase). Silver volatility (1.84%) is significantly higher than gold (1.22%) [0]. The rise in gold and silver prices has driven up mining stocks; in 2025, the mining ETF (561330) rose by more than 2.4%, resonating with gold liquidity expectations [5].

-

Silver Investment Has Higher Elasticity Than Gold: Historically, silver has outperformed gold during stagflation due to its smaller market capitalization and industrial属性; this potential still exists in the current environment. Since 2025, the Silver ETF (SLV) has increased by 128.03%, far exceeding the Gold ETF’s 63.39% gain, and its holdings have reached a new high since 2021 [0][4], indicating strong market demand for silver investment.

-

Environmental Differences Bring Uncertainty: Differences between the current environment and the 1970s stagflation, such as energy structure and central bank policy tools, may lead to inconsistent precious metal performance with history. For example, the current energy structure is more diversified, reducing dependence on oil, and the inflation transmission path may be different [2].

-

Mining Stocks Correlate with Precious Metal Prices: The rise in precious metal prices directly drives up mining stocks; in 2025, the mining ETF (561330) resonated with gold liquidity expectations and saw significant gains [5]. Mining stocks can be used as a supplementary way to invest in precious metals.

-

Opportunities:

- Gold and silver have safe-haven and anti-inflation properties and still have allocation value in a stagflation environment [2][3].

- Silver has higher elasticity due to industrial demand and smaller market capitalization, and current market demand is increasing [4][6].

- Mining stocks correlate with precious metal prices and can share in price increase gains [5].

-

Risks:

- Silver has strong industrial属性 and higher price volatility than gold, leading to greater investment risks [1].

- The development of silver substitution technologies in industries like photovoltaics may curb silver price increases [6].

- Changes in Federal Reserve policy and fluctuations in the U.S. dollar index may affect precious metal prices [2].

- The $50,000/oz target price for gold lacks data support and needs to be viewed cautiously [0].

The current economic environment has similarities to the 1970s stagflation period; gold, silver, and related mining stocks have investment potential, but environmental differences and risk factors need to be noted. Silver has performed better due to higher elasticity and increased market demand, but it also has greater volatility. Investors should focus on the safe-haven and anti-inflation properties of precious metals and allocate based on their own risk tolerance. Regarding price targets, the $50,000/oz target for gold needs to be viewed cautiously, and the $96-$100/oz target for silver requires attention to risks like industrial substitution technologies.

Market data shows that since 2025, gold ETFs, silver ETFs, and mining ETFs have all seen significant gains; silver has outperformed gold, and investor demand for precious metals has increased. Institutions generally believe that precious metals are worth allocating in a stagflation environment, but there are also differing opinions—some analysts think gold prices are already high and advise caution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.