AI Bubble Indicators: Reddit vs Institutional Perspectives on Market Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

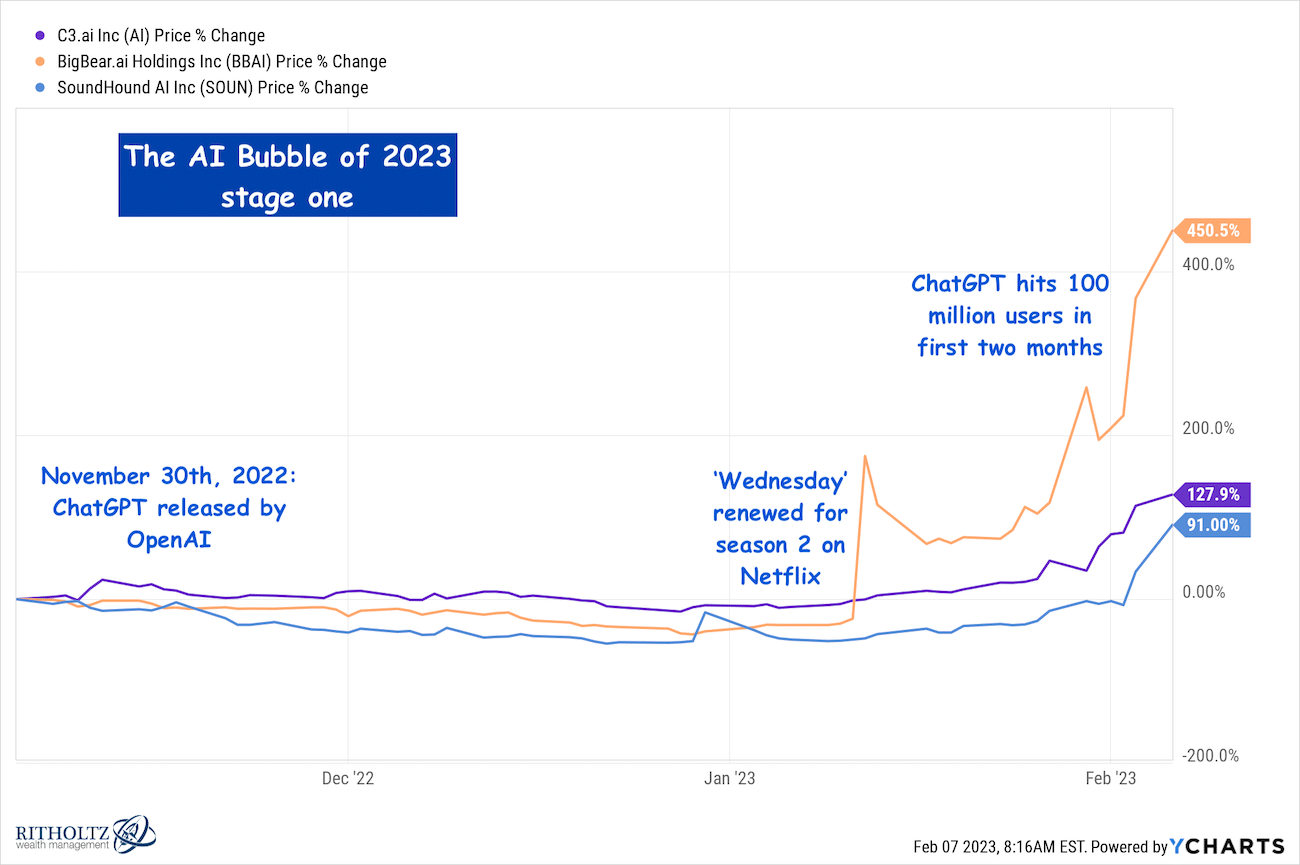

Retail investors on Reddit are actively debating specific quantitative indicators of an AI bubble, with several key metrics emerging from the discussion:

- Valuation Multiples: Users flag S&P 500 P/E ratios above 30 as requiring “astronomical growth to justify” Reddit

- Comprehensive Bubble Indicators: One user listed multiple warning signals including Berkshire cash levels, percentage of companies with P/S ratios above 10, market cap to GDP ratio, Shiller PE near all-time highs, leveraged ETF AUM, and brokerage leverage levels

- Circular Investment Concerns: Reddit users specifically question how much “circular investment between hardware and software firms inflates valuations,” particularly regarding Mag7 capex sustainability

- Contrarian View: Some users argue that “pervasive bubble talk indicates we are not in a bubble; silence would signal one”

- Company Distinctions: Users differentiate between Mag7 companies (diversified revenue, cash-rich) versus pure AI labs (high burn rates, more likely bubble candidates)

Institutional data and market analysis provide concrete evidence supporting bubble concerns:

- Nasdaq 100 P/E ratio at 35.47 significantly exceeds historical averages of 15-16 and the 5-year average of 30.10 Nasdaq 100 Index: current P/E Ratio

- 54% of institutional investors believe AI stocks are in a bubble according to Bank of America’s October 2025 survey

- Individual AI stocks show “extreme valuation multiples compared to traditional tech peers” with “stratospheric” price-to-sales ratios

- The Magnificent Seven collectively spending over $370 billion on AI infrastructure in 2025, representing a 58% increase from $228 billion in 2024

- Nvidia’s $100 billion investment in OpenAIcreates a self-reinforcing loop where OpenAI uses funds to purchase Nvidia chips

- OpenAI’s additional circular deals include $300 billion in computing power from Oracle over five years and chip partnerships with AMD and Broadcom

- Individual capex leaders: Amazon at $125 billion, Alphabet at $91-93 billion, Meta at $71 billion, Microsoft at $64.6 billion

- Nvidia has become the world’s most valuable company, demonstrating “extraordinary” market cap growth NVIDIA (NVDA) Market Cap & Net Worth

The Reddit discussion and institutional research converge on several key points while offering complementary perspectives:

- Both Reddit users and institutional data recognize extreme valuations as primary bubble indicators

- Circular investment patterns between hardware and software companies are viewed with skepticism by both groups

- The sustainability of massive AI capex spending is questioned across both retail and institutional investors

- Reddit users debate whether current valuations reflect justified growth versus bubble dynamics, while institutional data leans more heavily toward bubble concerns

- Some Reddit participants view circular investment as “normal inter-business synergy,” whereas research highlights it as a potential bubble fuel mechanism

- Reddit makes clearer distinctions between established tech giants (Mag7) and pure-play AI companies, suggesting differentiated risk levels

- Valuation Correction Risk: With Nasdaq 100 P/E at 35.47 versus 15-16 historical averages, a mean reversion could trigger significant downside

- Circular Investment Collapse: If one major player reduces AI spending, it could trigger a chain reaction across the ecosystem

- Mag7 Capex Slowdown: A reduction in the $370B collective AI infrastructure spending would disproportionately impact suppliers and partners

- Leverage Amplification: High levels of leveraged ETF and brokerage margin exposure could accelerate declines

- Selective Quality: Well-capitalized Mag7 companies with diversified revenue streams may weather a correction better than pure-play AI firms

- Infrastructure Beneficiaries: Companies providing essential computing power and infrastructure may maintain demand even during valuation adjustments

- Contrarian Positions: As some Reddit users note, widespread bubble talk could create opportunities in overlooked segments

- Nasdaq 100 P/E ratio- Currently 35.47 vs 15-16 historical average

- Magnificent Seven AI capex- $370B in 2025 (+58% YoY)

- Circular investment volumes- Track Nvidia-OpenAI type deals

- Institutional sentiment- Currently 54% see bubble conditions

- Market cap to GDP ratio- Warning indicator mentioned by Reddit users

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.