Analysis of Asset Allocation and Disciplined Investment Strategies to Navigate Bull and Bear Cycles

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

From the Snowball Carnival Fund Investment Roundtable Discussion, 61 (Liuyi Jushi) proposed 15 core strategies to navigate bull and bear cycles [0], covering dimensions such as balanced offense and defense, diversified allocation, and disciplined investment. Combined with external research verification:

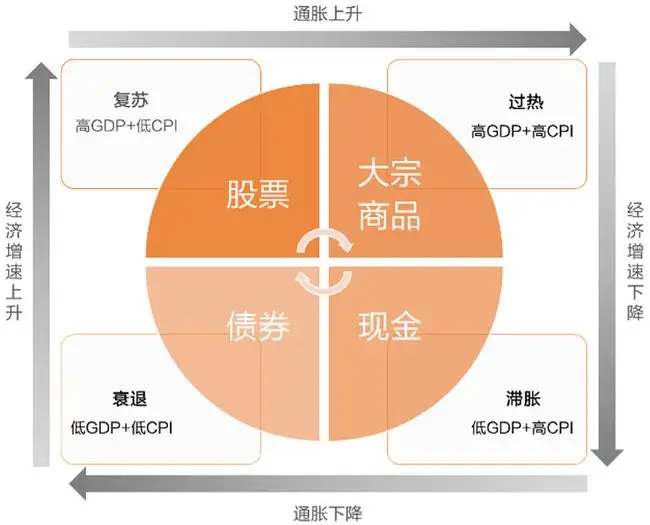

- Research from Sina Finance [1] shows that the All-Weather Strategy (macro factor risk parity) achieved an annualized return of 8.15% during the sample period with a maximum drawdown of only -3.98%, significantly lower than other strategies. This supports views such as “balanced offense and defense is important during bull-bear transition phases” and “asset allocation reduces the probability of loss of control”.

- Research from Taiwan’s Fanggezi [2] points out that a portfolio with annual stock-bond rebalancing achieved an annualized return of approximately 10.4% over 10 years with a maximum drawdown of only -25%, far lower than the -65.9% of full stock exposure. This verifies the effectiveness of the idea that “rebalancing is not market timing; it uses rules to counter emotions”.

- Research from Vocus.cc [3] indicates that the 60/40 stock-bond portfolio had an annualized return of 8.76%, maximum drawdown of -32%, and Sharpe ratio of 0.68; the full stock allocation had an annualized return of 10.96% but a maximum drawdown of over -50% and Sharpe ratio of 0.60. This shows that diversified allocation has better risk-adjusted returns, supporting the views that “diversified allocation essentially pursues a more stable process” and “the goal is to navigate the cycle rather than outperform the index in the short term”.

- During bull and bear cycles, the core reasons for losses among ordinary investors are “losing the margin of safety in bull markets” and “unclear structure and lack of discipline”, rather than the market itself.

- Diversified allocation is not simple dispersion; it is “controlling volatility within an acceptable range”. It needs to be combined with one’s own risk tolerance (the first step is to “admit weakness” and acknowledge the inability to bear extreme drawdowns).

- Rebalancing is the core action of disciplined investment. Through regular, quantitative, or temperature-based rebalancing, it can effectively counter emotional interference and守住 investment boundaries.

Risks:

- Blindly chasing high in bull markets, breaking the margin of safety

- Selling assets due to emotional loss of control in bear markets, missing the window to increase positions

- Insufficient or excessive diversification, leading to reduced effectiveness

Opportunities: - In the bull-bear transition phase, balanced offense and defense strategies can grasp market rhythm

- In a multi-down environment, assets with unchanged fundamentals provide a window to increase positions

- Disciplined rebalancing operations can optimize the return-risk ratio in the cycle

This report integrates the core strategies of the fund investment roundtable discussion and external research verification, presenting an investment framework to navigate bull and bear cycles. The core of the strategy lies in “using rules to counter emotions”. Through balanced offense and defense asset allocation, diversified allocation within acceptable ranges, and disciplined rebalancing operations, long-term investment goals can be achieved. The report does not provide specific investment advice; it only provides objective analysis based on public research and discussion content.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.