Kodiak Sciences Form 13D Query Analysis & Public Offering Context

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The query focused on a potential SEC Form 13D filing for Kodiak Sciences (KOD), which typically discloses when an investor acquires >5% of a company’s equity or makes significant ownership changes [2]. However, multiple searches failed to verify such a filing as of December 24, 2025. Instead, the latest confirmed corporate action is a $184M public offering (Form S-3), a company-issued share sale closed in December 2025 [1].

- Stock Performance: As of December 24, 2025, KOD traded at $27.45 (down 4.05% daily) with a $1.45B market cap [0]. The stock has posted strong recent growth: 6-month gain (660.39%), 1-year gain (178.12%), and YTD gain (218.45%) [0].

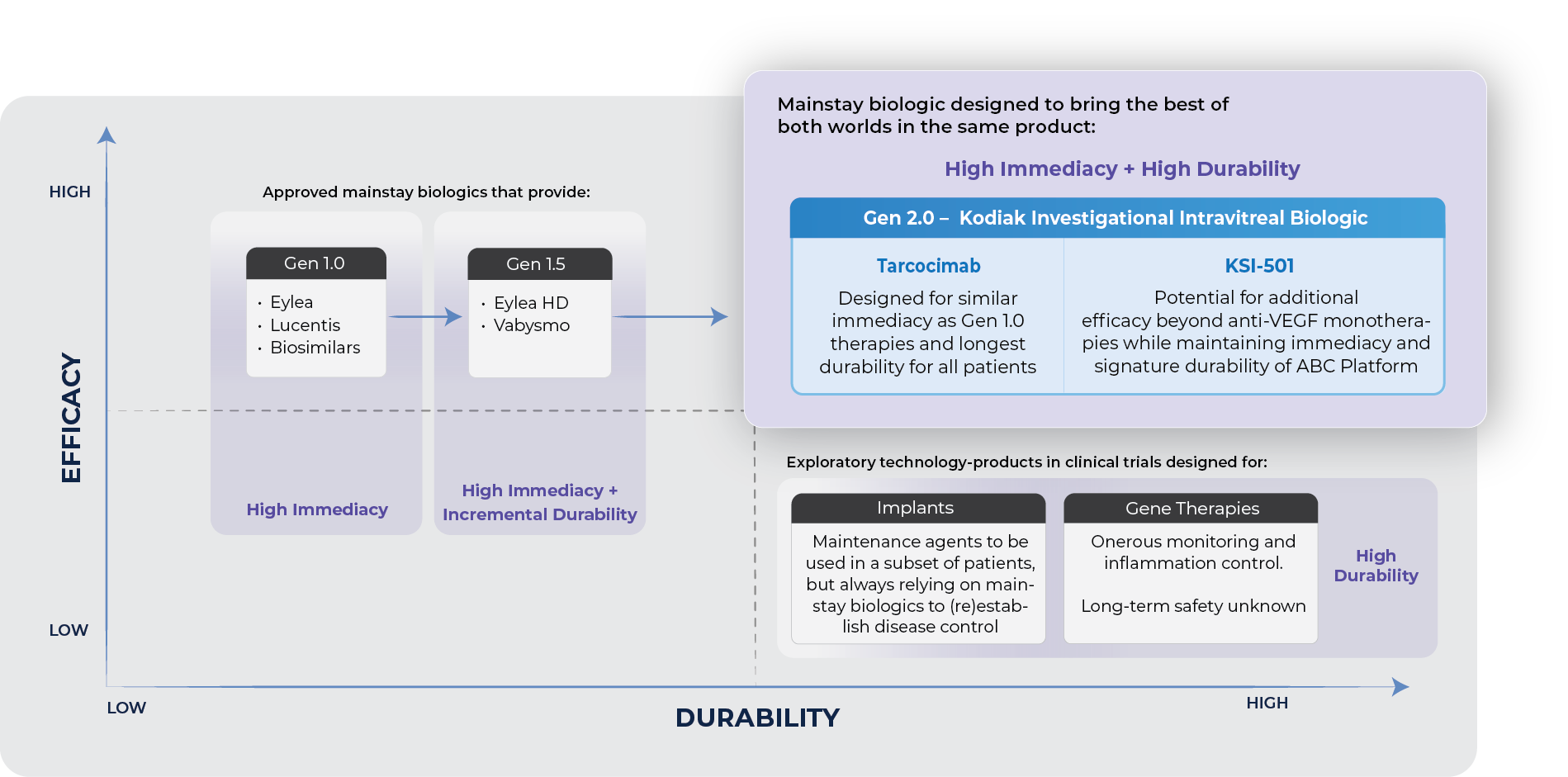

- Company Fundamentals: Kodiak is a clinical-stage biopharmaceutical firm focused on retinal disease treatments. It has negative net profit margins (-584.82%) and EPS (-$4.12) due to its clinical-stage status, but a healthy current ratio (1.78) [0]. Analysts maintain a BUY consensus, though the $17.00 target price is below the current trading price [0].

- Public Offering Details: The $184M offering will dilute existing shareholders but provides funding for Phase 3 trials of retinal medicine candidates KSI-101, KSI-501, and tarcocimab [1].

- Form 13D vs. Form S-3 Distinction: A Form 13D reflects investor-driven equity acquisition (signaling institutional confidence or activist intent), while the confirmed Form S-3 is a company-led share sale (securing funding but diluting shares).

- Lack of Verified Form 13D: The absence of a verifiable Form 13D means there is no evidence of a major investor entering or exiting KOD, so claims of institutional confidence shifts are unsubstantiated.

- Mixed Market Sentiment: KOD’s strong recent growth contrasts with the analyst consensus target price below current levels, indicating market optimism about pipeline progress tempered by valuation concerns.

- Dilution: The $184M public offering will reduce existing shareholders’ ownership percentage [1].

- Clinical Trial Uncertainty: Funding supports critical trials, but failure or delays could impact future success.

- Volatility: The stock’s 6-month price surge indicates high volatility, increasing short-term investment risk [0].

- Unverified Form 13D: If a Form 13D were later confirmed, it could introduce activist investor risks or unexpected ownership changes.

- Pipeline Advancement: The public offering funding enables progress on promising retinal disease treatments, a high-unmet-need area.

- Market Momentum: Strong recent stock growth reflects market interest in Kodiak’s therapeutic pipeline.

As of the event analysis date, no Form 13D filing for Kodiak Sciences could be verified. Investors should focus on the confirmed $184M public offering, which provides funding for clinical trials but dilutes existing shares. KOD’s stock has shown robust recent growth, but it trades above the analyst consensus target, highlighting mixed sentiment. Ongoing monitoring of the SEC’s EDGAR database for any future Form 13D filings is recommended.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.