2026 Market Rotation Outlook: Gold, Financials, and Utilities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

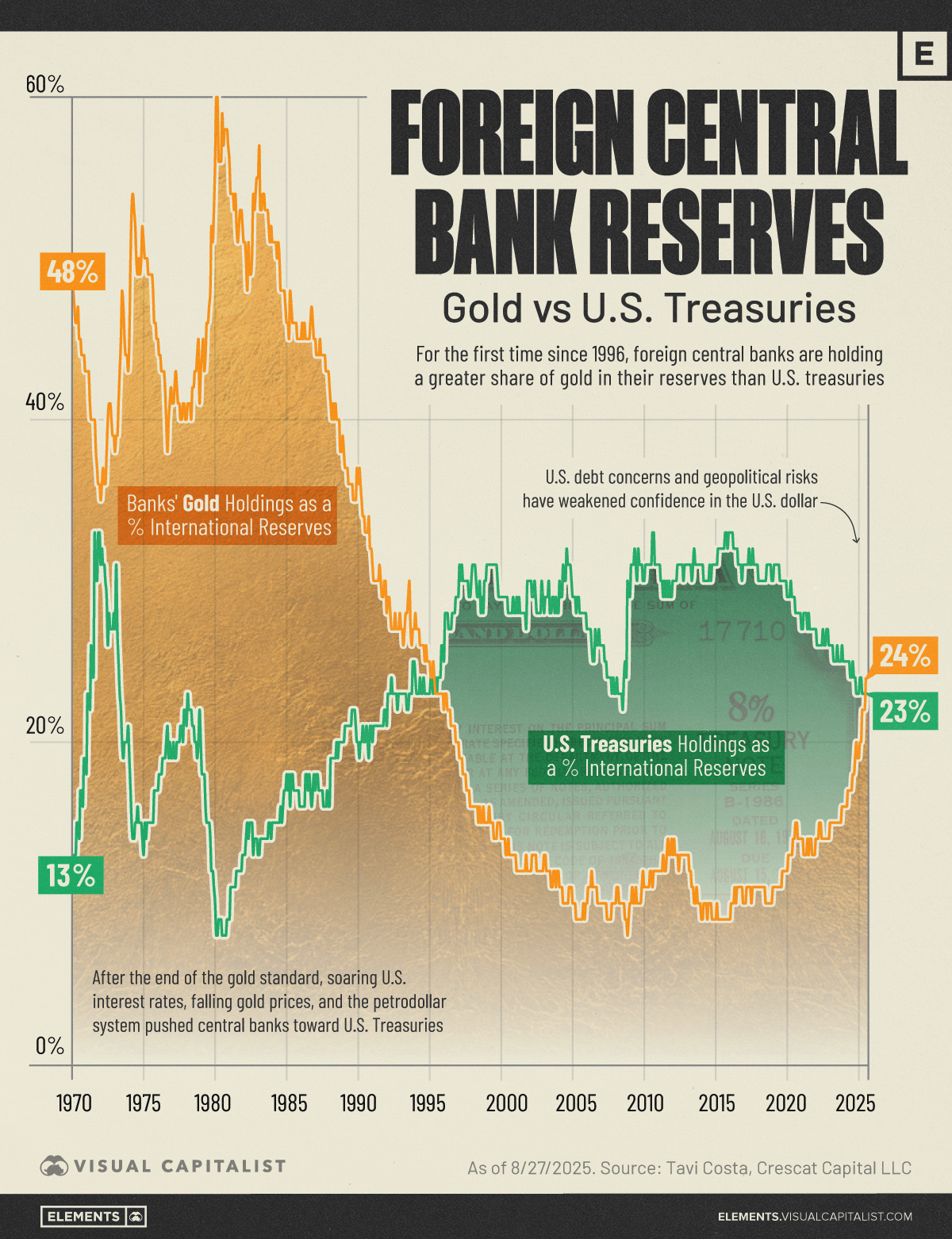

The analysis is anchored in a Seeking Alpha article [1] forecasting outperformance for Gold (GLD), Financials (XLF), and Utilities (XLU) in 2026. Gold’s outlook is underpinned by persistent geopolitical tensions (U.S.-Venezuela, Iran-Israel, Russia-Ukraine), structural de-dollarization trends, and a weak USD environment [1]. Short-term market data shows GLD rose 2.3% from 2025-12-19 to 2025-12-22, closing at $408.23 [0], supported by record central bank gold purchases (1,200 tons in 2025) [2]. Financials (XLF) gained 1.04% on 2025-12-22 (closing at $55.32) following the Federal Reserve’s 25-basis point rate cut, cessation of quantitative tightening, and liquidity injections [0][4]. Utilities (XLU) saw a sector-level gain of 1.49% the same day, driven by rotation out of high-growth tech stocks into defensive value assets with steady dividends [0][3]. The USD Index (UUP) fell 3.7% over the period, reflecting Fed easing policies [0].

- Cross-market dynamics link Fed policy to multiple asset classes: rate cuts and liquidity injections weaken the USD (benefiting gold) while improving financials’ margins and lending demand [0][4].

- Utilities’ defensive appeal amid rotation away from AI hype to tangible earnings aligns with both short-term sector gains and long-term drivers like data center demand and infrastructure upgrades [3][5].

- Record 2025 central bank gold purchases (a core de-dollarization indicator) reinforce gold’s long-term upward momentum beyond short-term geopolitical shocks [2].

- Gold (GLD): Opportunities include ongoing de-dollarization and geopolitical uncertainty [1][2]; risks involve unexpected USD strengthening from Fed policy shifts or geopolitical de-escalation [0][1].

- Financials (XLF): Opportunities stem from easing financial conditions and rising demand for banking services [4]; risks include slowing economic growth reducing loan demand [0].

- Utilities (XLU): Opportunities come from infrastructure spending and defensive investor demand [5]; risks involve regulatory changes or rising energy costs compressing margins [0].

- 2025-12-22 performance: GLD +2.3%, XLF +1.04%, utilities sector +1.49%, UUP -3.7% [0].

- Fed actions (2025-12): 25 bps rate cut, end of quantitative tightening, and liquidity injections [4].

- Central bank gold purchases: 1,200 tons (record 2025) [2].

- Market sentiment: Shift from tech hype to value-oriented, dividend-paying assets [3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.