XPeng-W (09868.HK) Hong Kong Hot Stock Trend Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

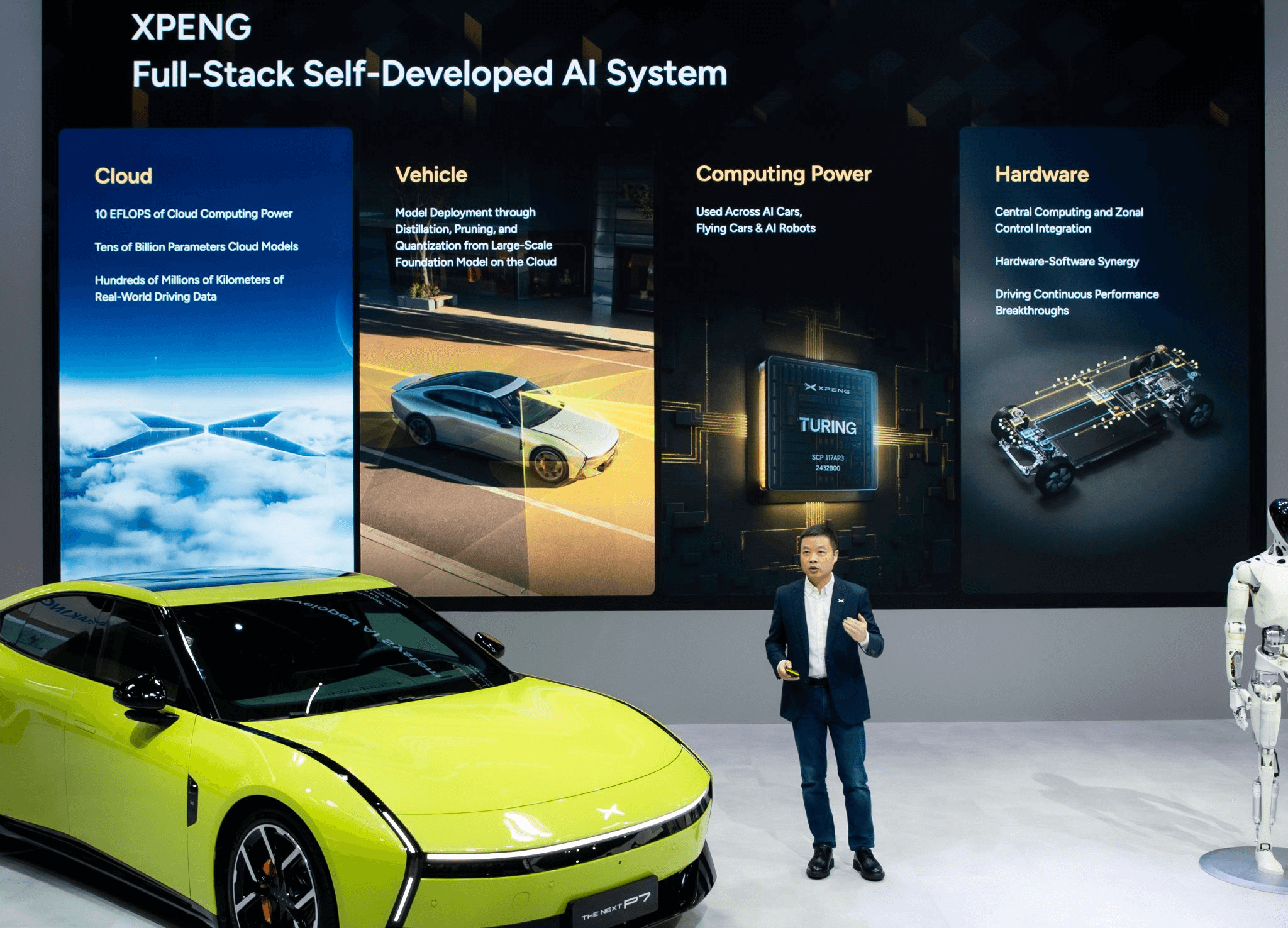

XPeng-W (09868.HK) made it to the Hong Kong Stock Popularity Ranking on East Money App on December 22, 2025 [1]. Although there is no direct price data for the Hong Kong market on that day, its US ADR (XPEV) trading situation can be used as a reference: the trading volume on that day was 4.5 million shares, far lower than the 16-day average of 8.72 million shares, and the price rose slightly by 0.10% [0]. Recently, the company disclosed that November sales increased by 19% year-on-year [3], and at the November AI Day event, it released technical achievements such as VLA 2.0, Robotaxi, and humanoid robots [3], demonstrating its R&D strength in intelligent driving and robotics. However, a report on December 20 pointed out that XPeng is expected to have weak Q4 revenue due to the price war in the electric vehicle market [2].

- The hot stock trend may be driven by positive factors such as recent technological breakthroughs and sales growth, but there is no direct catalyst information for the Hong Kong market on that day, which may be related to overall industry momentum or holiday trading dynamics.

- The combination of low trading volume and stable price of the US ADR reflects the market’s cautious balance between the company’s positives (technological progress, sales growth) and negatives (weak revenue, price war).

- The current price-to-sales ratio of 1.8x [4] indicates a relatively premium valuation; attention needs to be paid to the sustainability of technology implementation and profit improvement.

The hot stock trend of XPeng-W (09868.HK) in Hong Kong reflects the market’s attention to its technological progress and sales growth, but it is necessary to be alert to the pressure from price wars and downward adjustments in revenue expectations. The trading data of the US ADR reflects cautious market sentiment; investors need to further evaluate in combination with the company’s fundamentals and industry dynamics.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.