拼多多“人无我有”独家商品策略的竞争壁垒与估值支撑分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

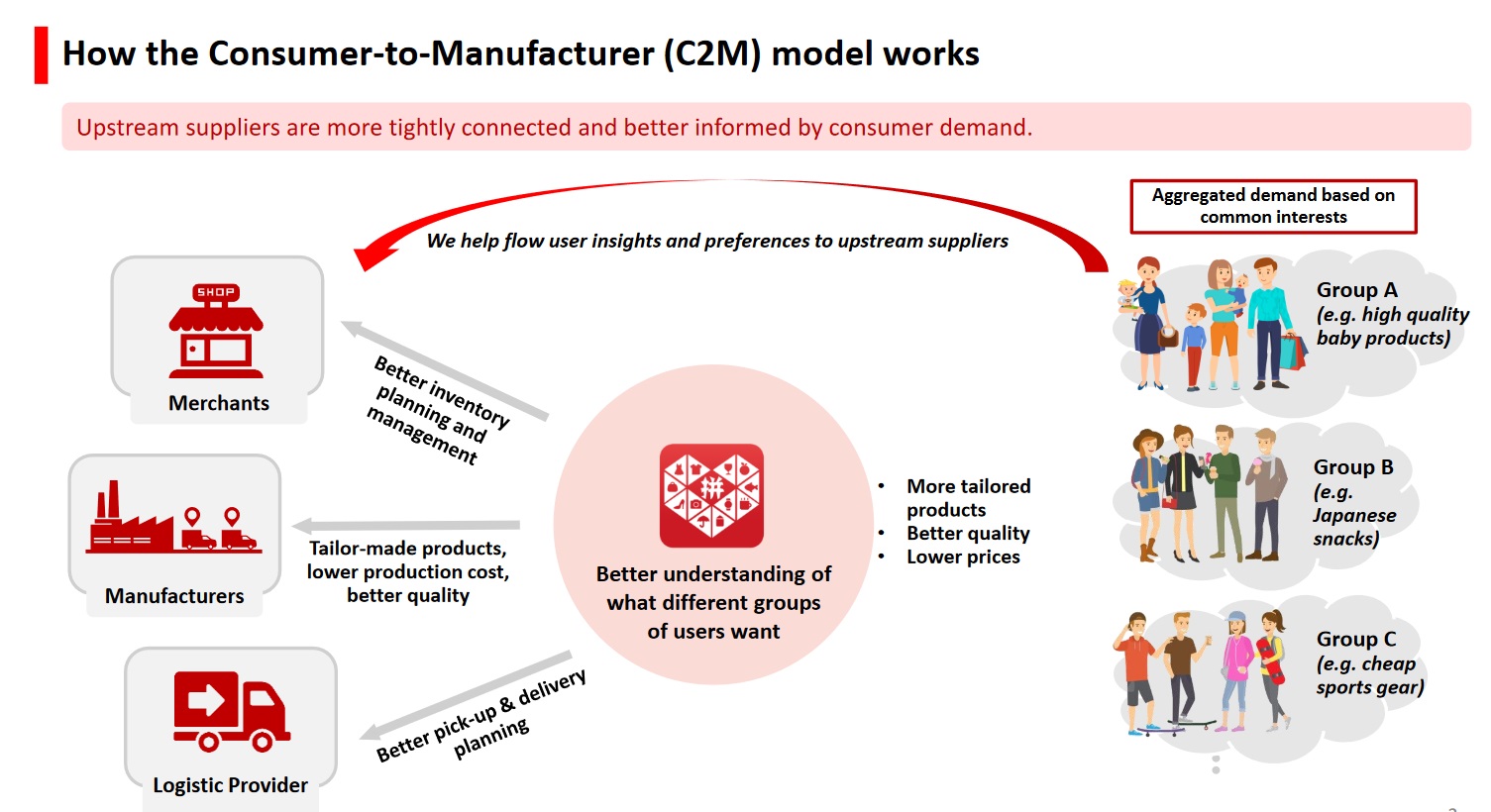

拼多多的成功源于供需撮合的精准理解而非单纯低价,其“人无我有”独家商品策略通过三大支柱构建壁垒:1. 社交网络归集消费需求,结合大数据算法实现精准供需匹配[2];2. C2M模式直连工厂,以销定产缩短供应链,降低成本的同时创造独特供给[2][4];3. 借鉴Costco商品力构建逻辑,通过定制化独家商品建立消费心智[1][4]。

财务数据显示,拼多多当前市值1568.1亿美元,股价112.06美元,ROE达29.30%、净利润率24.43%(行业领先),而P/E仅10.75x(处于较低水平),分析师共识Buy评级占比57.7%,目标价140.50美元(潜在涨幅25.4%)[0]。实践案例如江苏“轻上”养生饮品(4年销售额从200万增长至2.5亿)、天津“乐吧”薯片(订单量半年增10倍)验证了策略有效性[4]。

- 模式差异:拼多多独家商品策略通过C2M定制实现,与Costco自有品牌模式有所不同[4][5],更强调供需端的实时动态匹配。

- 壁垒核心:网经社专家指出,用户长期留存关键在于供给壁垒,而非标品低价[5],独家商品是拼多多从流量驱动转向价值驱动的核心。

- 估值逻辑:当前低估值源于市场对其策略可持续性的认知不足,若独家商品比例与市场份额持续提升,估值有望向行业均值回归。

- 风险:独家商品创新能力持续性、竞品C2M模式跟进压力、供应链品控与管理复杂性[5]。

- 机遇:C2M模式的规模化复制、下沉市场消费升级带来的定制化需求增长、社交电商生态的持续渗透。

拼多多“人无我有”独家商品策略通过供需精准撮合构建了差异化竞争壁垒,支撑其强劲盈利能力。当前低估值与高增长潜力形成错配,若策略持续落地,长期估值有望提升。需关注创新能力与供应链管理风险,同时把握下沉市场升级与模式复制机遇。

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.