Analysis of the Impact of AI Packaging Technology Breakthroughs on the Competitive Landscape and Valuation of China's Semiconductor Packaging and Testing Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

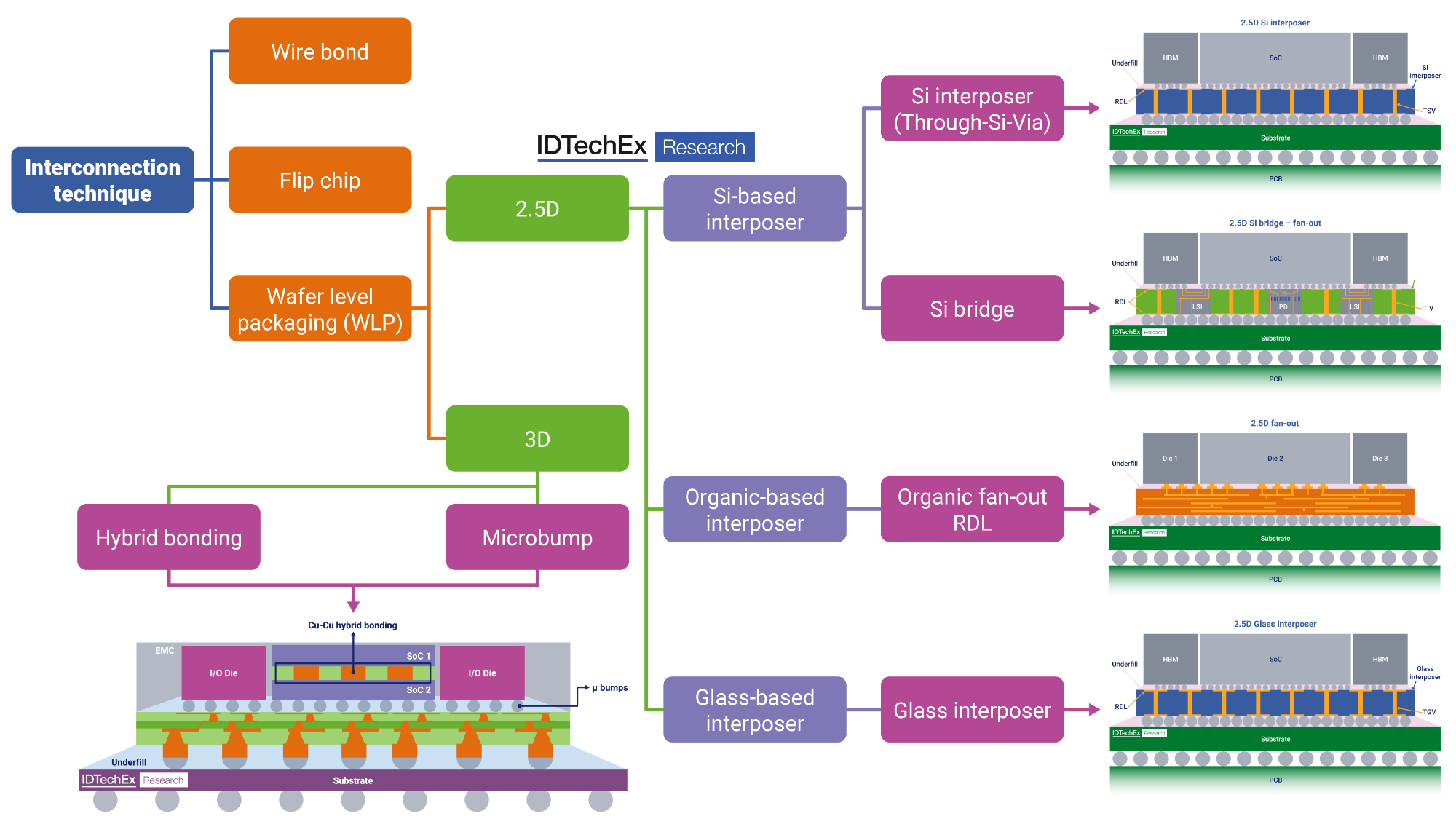

This article discusses the transformation cycle of China’s semiconductor packaging and testing industry from traditional packaging to AI advanced packaging during 2022-2025 [1]. Technologically, the industry is evolving from traditional packaging to 2.5D/3D stereoscopic packaging, and exploring new technical routes such as glass substrates and panel-level packaging [1]. In terms of profit models, the gross margin of AI packaging can reach 30-40%, far higher than the 10-15% of traditional packaging, which has been verified by the 40.3% gross margin of ASMPT’s advanced packaging business [3]. At the market level, DIGITIMES data shows that the compound annual growth rate of the AI data center chip advanced packaging market will reach 45.5% from 2024 to 2030, far higher than the 8.7% of the overall semiconductor industry and the 9.5% of the traditional packaging and testing field [2]. In terms of competitive landscape, Taiwanese enterprises accounted for 77% of the global AI packaging market share in 2024 [2], while domestic enterprises (JCET 600584.SS, Tongfu Microelectronics 002156.SZ) have relative advantages in traditional packaging, but AI packaging is still in its infancy, with current net profit margins of only 3.75% (JCET) and 3.66% (Tongfu Microelectronics) [0], and have not yet fully enjoyed the high-margin dividends of AI packaging.

- Reconstruction of Industry Growth Engine: The high growth rate and high gross margin characteristics of AI packaging will promote the upgrading of the industry’s profit model, shifting from traditional low-margin processing to a high-value-added technology-driven model [1][3].

- Risk of Competitive Landscape Differentiation: The leading position of Taiwanese enterprises may exacerbate competition differentiation in the industry, and domestic enterprises need to narrow the gap through technological breakthroughs [2][0].

- Shift in Valuation Logic: The high growth expectations of AI packaging may change the market’s valuation model for packaging and testing enterprises, shifting from low PE valuation based on traditional packaging to a high valuation logic that balances growth and gross margin [0].

- Rapidly Growing Market Demand: The 45.5% compound annual growth rate of the AI packaging market provides enterprises with broad growth space [2].

- Improvement in Profitability: The high-gross-margin AI packaging business is expected to significantly improve the net profit margins of domestic enterprises [3].

- Valuation Reshaping from Technological Breakthroughs: If domestic enterprises achieve AI packaging technological breakthroughs, both market share and valuation may increase significantly [0][1].

- Technical Barriers and Catching-Up Difficulty: The technological and market leading advantages of Taiwanese enterprises may make domestic enterprises face a long catching-up cycle [2].

- Constraints from Current Profit Levels: The current low net profit margins of domestic enterprises indicate that their AI packaging business has not yet formed scale effects, and short-term performance improvement is limited [0].

- Uncertainty in Technical Routes: The development of new technical routes such as glass substrates has uncertainties, which may affect the long-term pattern of the industry [1].

Based on in-depth research on the transformation of the semiconductor packaging industry [1] and market data [0][2][3], this analysis presents the following key information:

- The AI packaging market will grow at a high compound annual growth rate of 45.5%, becoming a new growth engine for the industry [2].

- The gross margin of AI packaging (30-40%) is far higher than that of traditional packaging (10-15%), which is expected to promote the upgrading of the industry’s profit model [3].

- Taiwanese enterprises currently hold 77% of the global AI packaging market share, while domestic enterprises are in the initial stage [2].

- Major domestic packaging and testing enterprises (JCET 600584.SS, Tongfu Microelectronics 002156.SZ) have seen some stock price growth, but their net profit margins are still low [0].

- AI packaging technological breakthroughs may reshape the industry’s competitive landscape and bring about changes in valuation logic.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.