Analysis of Nebius Group (NBIS) $80,000 Call Position Increase Amid Micron Earnings Context

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

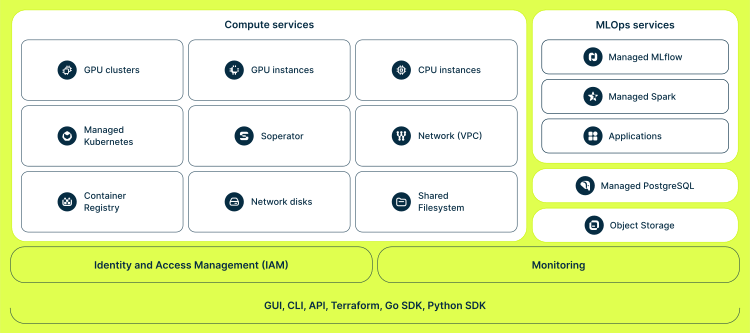

The investor’s call position increase stems from two core, interlinked factors: sector validation via Micron Technology’s (MU) earnings performance and Nebius Group’s (NBIS) compelling business fundamentals. Micron’s record revenue and 57% year-over-year growth, paired with optimistic guidance [0], confirms sustained strong demand for AI infrastructure components. This directly counteracts concerns raised by Oracle’s recent challenges (data center financing, opaque revenue reporting, customer concentration), framing Oracle’s struggles as company-specific rather than indicative of broader industry headwinds. For NBIS, its December 17 announcement of AI Cloud 3.1—powered by NVIDIA Blackwell Ultra compute [0]—strengthens its competitive positioning in the AI infrastructure space by leveraging high-performance, sustainable computing solutions. Additionally, NBIS’s projected revenue run rate growth from ~$1B to $8B annually signals significant expansion potential, while a 21% 30-day price decline may have been viewed by the investor as a market overreaction to sector noise, presenting a cost-effective opportunity to increase exposure.

- Sector Peer Differentiation: Strong performance from sector leaders like Micron can mitigate concerns from underperforming peers (e.g., Oracle), highlighting the critical importance of distinguishing company-specific issues from broader industry trends.

- Competitive Edge via Partnerships: NBIS’s integration of NVIDIA Blackwell Ultra compute in AI Cloud 3.1 positions it to capture a share of the growing AI infrastructure demand validated by Micron’s earnings.

- Entry Point Timing: The 21% short-term price dip, when combined with NBIS’s aggressive growth projections, likely amplified the investor’s conviction in the stock’s upside potential.

- Risks: NBIS faces mixed analyst ratings, with cautious views alongside bullish targets (e.g., Citizens JMP’s $175 target) [0], and inherent volatility in the AI infrastructure sector (evidenced by its 30-day price decline).

- Opportunities: Ongoing sector tailwinds from global AI demand growth, NBIS’s aggressive revenue expansion projections, and the competitive advantage of its NVIDIA-powered AI Cloud platform present favorable long-term prospects.

The investor’s decision to increase the NBIS call position reflects a conviction in both the company’s fundamentals and the broader AI infrastructure sector’s strength, validated by Micron’s earnings. NBIS’s recent product launch and growth projections support a positive long-term outlook, while the short-term price dip may have provided an attractive entry point. Analysts hold mixed views, but some bullish targets indicate potential upside. This context offers objective information for understanding the investor’s decision-making framework without providing specific investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.