Impact of Big Tech Custom AI Chips on AMD and Broadcom: Investment Thesis Analysis with Debt & Valuation Context

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The growing trend of big tech companies developing in-house AI chips (e.g., Google’s TPU) creates divergent impacts on AMD and Broadcom, rooted in their distinct business models, debt profiles, and valuations.

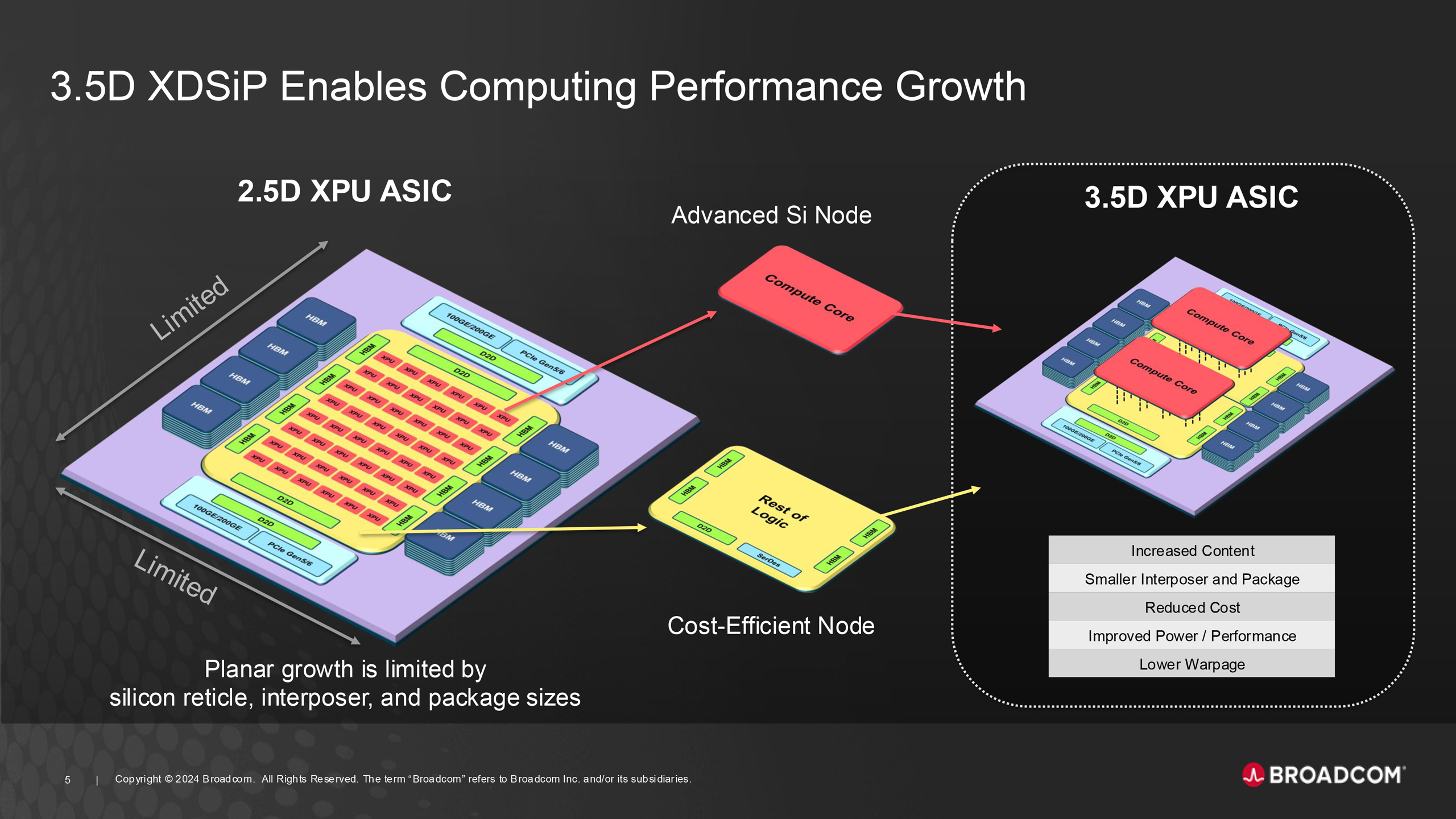

- Broadcom (AVGO)is a leader in designing custom AI ASICs for hyperscalers like Google, Meta, and OpenAI, holding a ~70% share of the 2024 custom AI chip market [1]. This positions it as a direct beneficiary of the trend: Broadcom reported 220% YoY AI-related revenue growth in FY2024 [1], with Q4 2025 AI revenue guided to $6.2 billion [1]. A recent $10 billion custom chip order from OpenAI (September 2025) further validates its strong client relationships [2]. CEO Hock Tan projects a $60–$90 billion AI semiconductor total addressable market (TAM) by FY2027 [4].

- AMD (AMD)competes with Nvidia in supplying GPUs (Instinct series) for AI applications. While it secured a partnership with OpenAI (October 2025) [12], it faces pressure from big tech’s in-house chips, which could reduce demand for third-party GPUs [12]. Susquehanna projects AMD’s AI market share to remain modest (~4% by 2030) [4], though it achieved 57% YoY revenue growth in the data center segment in Q1 2025 [11].

Debt profiles contrast sharply: AMD holds ~$4 billion in net cash (Q3 2025: $7.2 billion in cash/short-term investments, $3.2 billion in total debt) [7][8], while Broadcom carries ~$48.3 billion in net debt (2024) [3]. Valuations reflect growth expectations: AMD trades at ~112.5x TTM P/E, compared to Broadcom’s ~72.9x [0].

- Broadcom’s investment thesis is strengthenedby its alignment with the custom AI chip trend. Its dominant ASIC position drives high-margin revenue growth, mitigating concerns about its significant net debt through robust free cash flow (FY2025 FCF: $26.9 billion) [0].

- AMD’s investment thesis faces mixed risksfrom in-house chip competition, but its net cash position provides financial flexibility. Its high P/E ratio relies on delivering sustained AI GPU market share gains amid competition from both big tech’s internal chips and Nvidia’s ~80% market lead [4].

- Divergent strategies determine exposure: Broadcom’s focus on custom ASICs makes it a direct beneficiary of the trend, while AMD’s GPU-centric model exposes it to potential demand displacement.

- Opportunities:

- Broadcom’s leadership in custom AI chips positions it for continued revenue growth within the expanding AI TAM.

- AMD can leverage partnerships (like OpenAI) to expand its GPU market share in data centers.

- Risks:

- Execution risk (yield issues, design errors) for both companies in delivering high-performance AI chips [1].

- AMD faces regulatory risks from export controls on advanced chips to China [9].

- Broadcom’s high net debt requires stable cash flow to service obligations, though its FCF is currently strong [0].

- Nvidia’s market dominance limits AMD’s AI GPU growth potential [4].

- Market cap: AMD ($348.79 billion), Broadcom ($1.65 trillion) [0]

- Current prices: AMD ($214.90), Broadcom ($349.32) [0]

- Broadcom’s FY2024 AI revenue growth: 220% YoY [1]

- AMD’s Q1 2025 data center revenue growth: 57% YoY [11]

- This analysis provides market context and risk/opportunity assessment without prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.